Wednesday, February 19, 2014

Market Overview

Resurgent BMD palm oil market and buoyancy in

cbt soy complex is leading broader rally in

oilseeds complex. Soy meal remains secular bull

market and a zigzag rally in CPO looks secular in

nature and may attain much more peaks.

Among edible complex, soyoil moved into

positive carry after a prolong inversion. Seed

prices still remain inverted. However present

contango in soyoil may be elusive and we need

to watch carry for next few days. Soyseed retain

upside momentum. Mustard complex ruled

steady. Castor complex ruled steady to

marginally firm amid slow arrivals. Overall bias

is bearish in both markets.

Coriander futures recovered on fresh bulls

buying. Jeera market lost gains and resume its

southward journey. New crop arrivals have

started. Quality, quality and yield are excellent

in Gujarat and Rajasthan Bias is to sell on rally.

Exotic spices are stealing the show. Grabbing

some actions as volatility has returned after long

hibernation. Cardamom ended lower on fresh

bouts of selling. Mentha futures continued its

downwards journey. Inventory is still seen

comfortable.

Cotton market ruled mix amid two way buying

and selling. Kapas futures are reeling under

selling pressure as underlying ready kalian

cotton is in a free fall. Sanker cotton traded at

MCX ruled firm. MCX cotton-NCDEX spread has

generated return on around 40% on annualize

basis in last 3 month and we think it is still a

juicy trade. Cottonseed cake and cotton cake

market is mild bearish. We are seeing sharp

selloff in cottonseed during coming days. We

have been telling that Kapas fundamentals look

very weak relative to cotton.

Chana future ruled steady. Market seen

lackluster. Demand in chana dal is still poor.

Market is well supplied. Guar and gum futures

settled mild weak. Short term trend is bearish.

Commodity

Chana

Turmeric

Jeera

Soyabean

Soyoil

R M Seed

CPO

Sugar

Wheat

Mentha Oil

Castor Seed

Potato

Exchange

NCDEX

NCDEX

NCDEX

NCDEX

NCDEX

NCDEX

MCX

NCDEX

NCDEX

MCX

NCDEX

MCX

Expiry

Feb

Apr

Mar

Feb

Feb

Feb

Feb

Feb

Feb

Feb

Feb

Mar

Price

2968

7346

11630

3970

691.6

3355

559.8

2750

1676

767.6

4222

1129.2

%

Change

-0.47%

-0.65%

-1.08%

0.14%

-0.35%

-0.83%

0.16%

0.00%

0.06%

-4.30%

-0.52%

1.01%

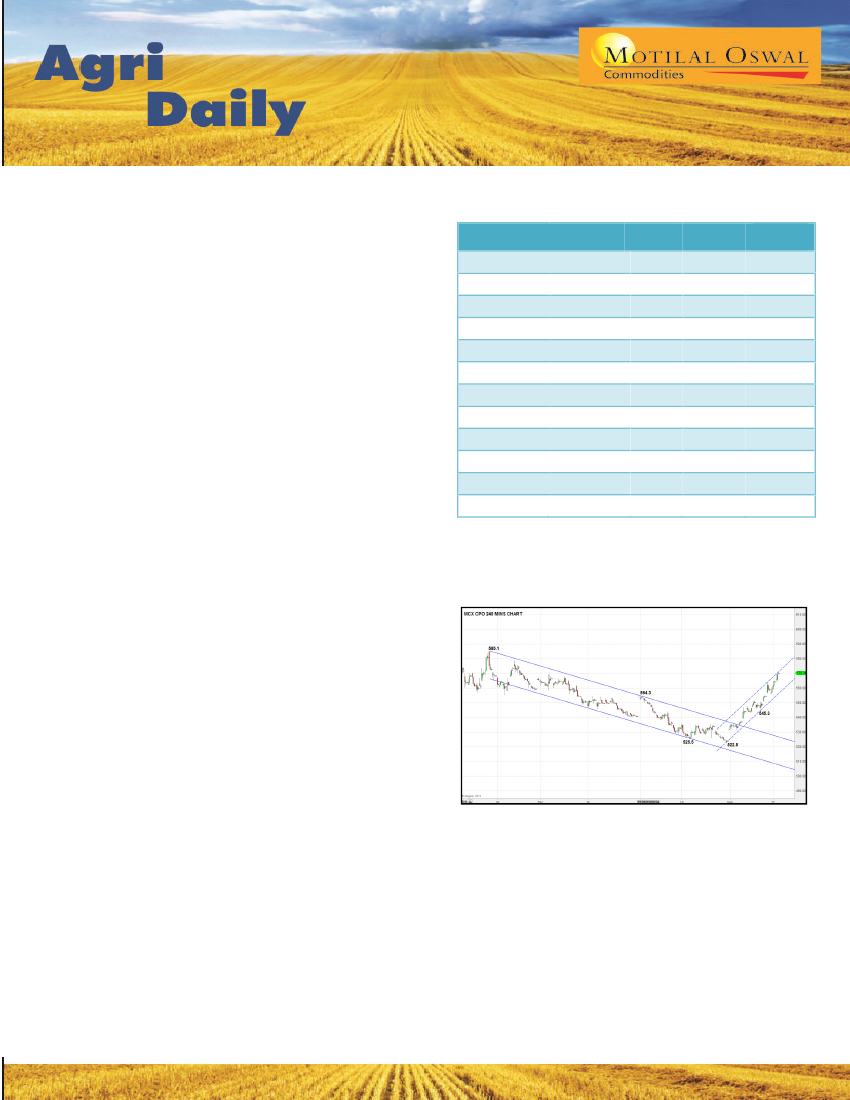

Chart of the Day: CPO

As shown on the 240-minutes chart, MCX CPO has

been in an uptrend since the past three weeks

forming higher lows and highs after breaking out of

a downward-sloping channel. The price currently

faces trend line resistance near 572 level and hence

a small corrective dip could be possible.

1

Please refer to disclaimer at the end of the report.