6 March 2014

Blue Dart

spotlight

The Idea Junction

Stock Info

Bloomberg

BDE IN

CMP (INR)

3,358

Equity Shares (m)

23.8

M.Cap. (INR b)/(USD b)

79.8/1.3

52-Week Range (INR) 4,040/2,140

1,6,12 Rel. Perf. (%)

-2/36/35

India's largest package distribution company

Key beneficiary of explosive growth in e-commerce business

Blue Dart (BDE) is India's largest package distribution company, with a presence in over

33,739 locations domestically and 220 countries worldwide. It has a market share of

49% in the organized air express business and 13% in the organized surface express

business.

Acquiring a new license for operating a cargo airline is a significant entry barrier. Blue

Dart Aviation is India's first and only scheduled cargo airline.

E-commerce which contributes 10% of consolidated revenues is the fastest growing

segment for the company.

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

NP

EPS (INR)

EPS Gr (%)

BV/Sh (INR)

RoE (%)

RoCE (%)

Payout (%)

Valuation

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yld (%)

63.5

10.5

47.1

0.4

50.5

9.0

35.8

0.4

41.5

7.7

28.8

0.4

2014E 2015E 2016E

19.3

1.6

1.3

52.9

-34.1

18.1

26.4

22.1

21.3

2.1

1.6

66.5

25.8

19.5

29.1

21.1

23.7

2.6

1.9

80.9

21.7

20.2

30.2

21.7

320.0 373.5 438.0

Undisputed leader in organized air express business

BDE is the undisputed leader in the organized air express business, with 49%

market share. It benefits from strong first mover advantage, coupled with an

owned fleet of aircraft, high service standards, pan-India presence and long-

term tie-ups with major corporates across business segments. BDE's fleet of seven

aircraft covers 33,739 locations via 20 ground hubs and 166 network routes, a

competitive edge over existing domestic players and new entrants including

MNCs.

Shareholding pattern (%)

As on

Dec-13 Sep-13 Dec-12

Promoter

75.0

75.0

75.0

Dom. Inst

7.1

8.1

9.7

Foreign

6.5

5.6

3.3

Others

11.4

11.3

12.0

Blue Dart Aviation the only licensee for cargo aviation in India

Blue Dart Aviation is India's first and only scheduled cargo airline. Acquiring a

new license for operating a cargo airline is a significant entry barrier. Flying its

own aircraft gives BDE a competitive edge over its peers since it is in a better

position to deliver consignments on time, given secured cargo space (16 tonnes/

aircraft) and discipline in schedules (load/unload time rigid at 30 minutes). Other

air express players have to rely on space availability of passenger airlines, where

passenger luggage has priority over cargo. This results in space constraints (usually

two tonnes cargo capacity is available per passenger airline as against a dedicated

16-tonne capacity of a BDE aircraft) and time delays.

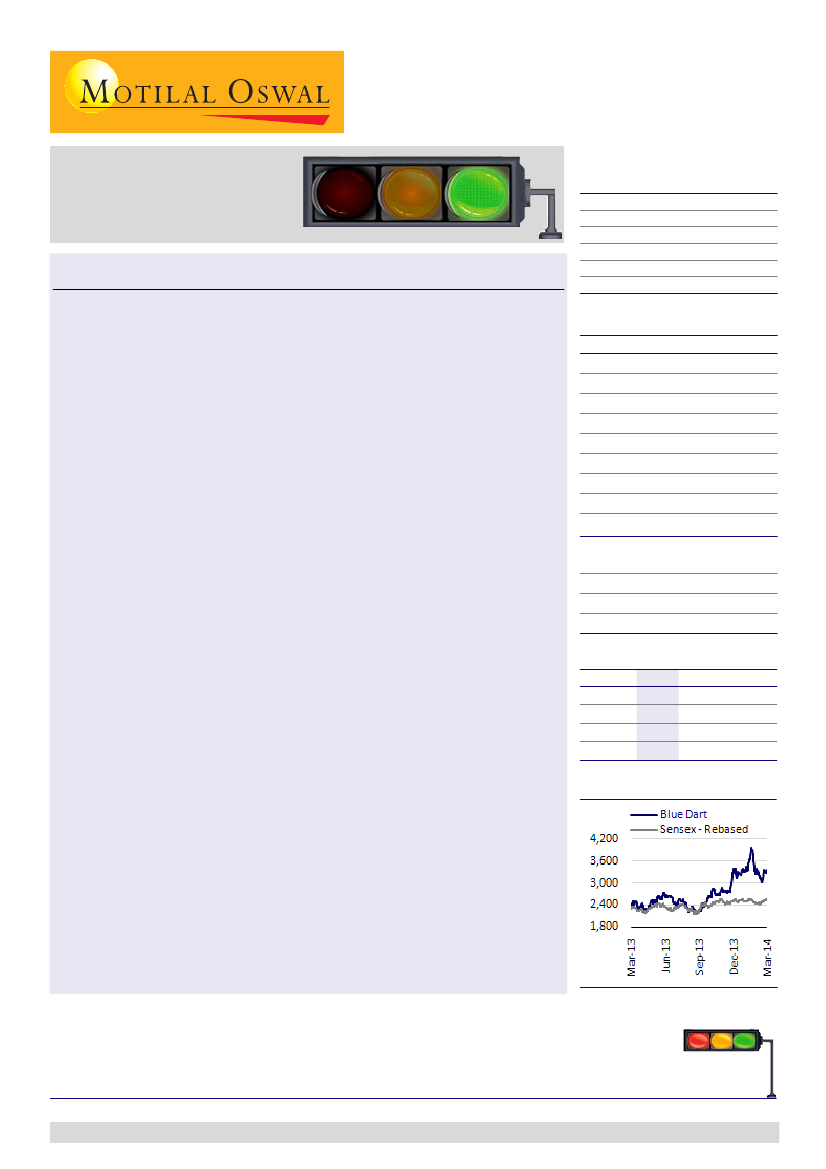

Stock performance (1 year)

Surface express: Expanding footprint quickly

BDE has aggressively scaled up the surface express business since 2007 and it

now contributes 20% of overall revenue. It has a market share of ~13% in this

business. Its ground fleet of 7,460 vehicles is mostly on hire basis. Because of its

Spotlight

is a new offering from the Research team at Motilal Oswal. While our Coverage Universe

is a wide representation of investment opportunities in India, there are many emerging names in the

Mid Cap Universe that are not under coverage. Spotlight is an attempt to feature such mid cap stocks

by visiting such companies. We are not including these stocks under our active coverage at this point

in time. Motilal Oswal Research may or may not follow up on stocks under Spotlight.

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Atul Mehra

(Atul.Mehra@MotilalOswal.com); +91 22 3982 5417

Investors are advised to refer through disclosures made at the end of the Research Report.

RED: Caution

AMBER: In transition

GREEN: Interesting

1