29 Nov 2012

Technology

TECHNOLOGY: Takeaways from management meetings; Expect

3Q to remain soft; Decision making continues to be slow

We met with managements of IT companies to get a sense on CY13 client budgets

and their expectations for the current quarter. Key Takeaways:

−

While it is still early to ascertain clients’ budgets for CY13, companies are not

worried about the same. Deal pipeline is not shrinking, suggesting continued

growth. However, discretionary spending remains weak and decision making

continues to be slow.

−

3QFY13 is expected to be a weak quarter. Furloughs are likely to impact onsite

volumes at some companies as much as 4 working days (6% of onsite volumes

assuming a 65 working day quarter). Given anticipated drop in utilization,

margins too are likely to soften.

−

Pricing discipline has been maintained by competition at large and companies

do not expect any pressures on that front. Outlook remains for stable pricing.

1. HCL TECH: Expect strong deal signings led by higher win rates,

healthy pipeline; margins to remain above 16.5%

‐

‐

‐

‐

‐

Deal pipeline of HCL Tech (HCLT IN, CMP INR643, Mkt cap USD8.1b, Buy) in ITO

remains healthy with USD61b worth of deals in the market expected in 2HCY12.

Total deals in CY13 is expected to increase to USD120b from USD102b in CY12.

HCL’s win ratios in the past have been 25‐30% and have improved now. The

company would be disappointed with win ratios of less than 40%.

ITO and IMS market remain lucrative. Of the total USD273b worth of churn deals

expected between Oct 2012 – Dec 2014, two‐thirds fall in these two segments.

Healthy deal pipeline coupled with improved win ratios indicate likelihood of

strong TCV of deal signings in the next two quarters.

While the opportunity in ITO / IMS have made other players focus on these

segments as well, HCL expects its early mover advantage and higher end

capabilities in full ITO deals to hold it in good stead.

Margins are expected to be stable. Residual impact of wage hikes and increased

investments in hunting are headwinds to the margins, but the company expects

gradual improvement in the pyramid and maturation of large deals to help

offset the same.

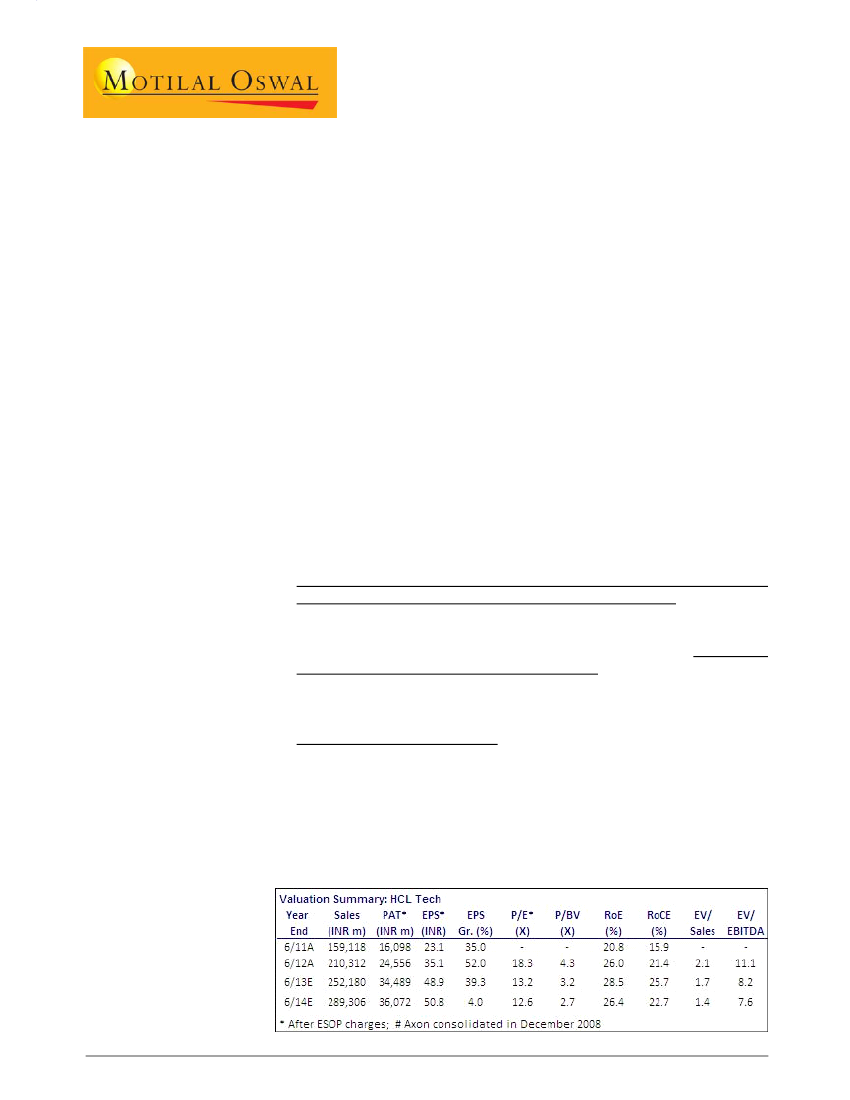

The stock trades 13.2x FY13x and 12.6x FY14E. Higher revenue growth visibility

at HCL compared to peers coupled with healthy margin performance make a

case for higher multiples. Maintain Buy with TP of INR712 (14x FY14 EPS), 11%

upside.

1