31 March 2014

Atul Auto

spotlight

The Idea Junction

Stock Info

Bloomberg

CMP (INR)

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

ATA IN

360

11.2

4/0.1

370/145

21/74/124

India's fastest growing three-wheeler company

Drivers: Geographical expansion, widening product portfolio, exports

Financials & Valuation (INR m)

Gujarat-based Atul Auto (ATA) is India's fastest growing three-wheeler (3W) company.

Over FY08-13, its revenue, EBITDA and PAT grew at a CAGR of 35%, 43% and 82%,

respectively, with average RoCE at 26% and consistent dividend payout of over 25%.

The company is plugging gaps in its product portfolio, expanding further geographically

within India and plans to enter export markets to sustain strong growth.

Valuations at 13.4x/11.1x/8.8x FY14E/15E/16E earnings appear interesting, considering

23% EPS CAGR, robust return ratios, healthy dividend payout and debt free status. Key

risks include delay in expected launch of gasoline 3W. Not Rated.

Y/E March

Sales

EBITDA

NP

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

Payout (%)

Valuation

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div. Yield (%)

13.4

4.1

6.9

1.9

11.1

3.2

5.8

2.3

8.8

2.5

5.0

2.8

2014E 2015E 2016E

4,385 5,269 6,386

503.2 616.9 808.8

301.7 363.5 456.1

26.9

16.5

35.1

52.4

25.0

32.5

20.5

32.5

48.5

25.0

40.7

25.4

31.7

47.4

25.0

87.3 112.5 144.1

Introduction of rear-engine diesel 3W in 2009 - key inflection point

Having gained dominance in the front-engine three-wheeler (3W) markets of

Gujarat and Rajasthan, ATA expanded its geographical presence, with the

introduction of its rear-engine diesel 3W (Atul Gem series) in 2009. New products

coupled with geographical expansion helped ATA to register a volume CAGR of

29.3% over FY08-13. Its market share has improved significantly from 2.4% in FY08

to 7.7% in FY14 YTD.

Shareholding pattern (%)

As on

Dec-13 Sep-13 Dec-12

Promoter

55.1

56.6

56.6

Dom. Inst.

0.0

0.0

0.0

Foreign

6.1

4.6

4.6

Others

38.8

38.8

38.8

Gasoline/alternate fuel 3W launch to triple addressable market

Over the near term, ATA plans to enter the gasoline/alternate fuel segment,

which constitutes 1/3rd of the domestic 3W industry. Moreover, this will help to

enter a large export market (almost equal to the domestic market size). The 3W

markets in Africa, Latin America and neighboring countries are predominantly

gasoline-based.

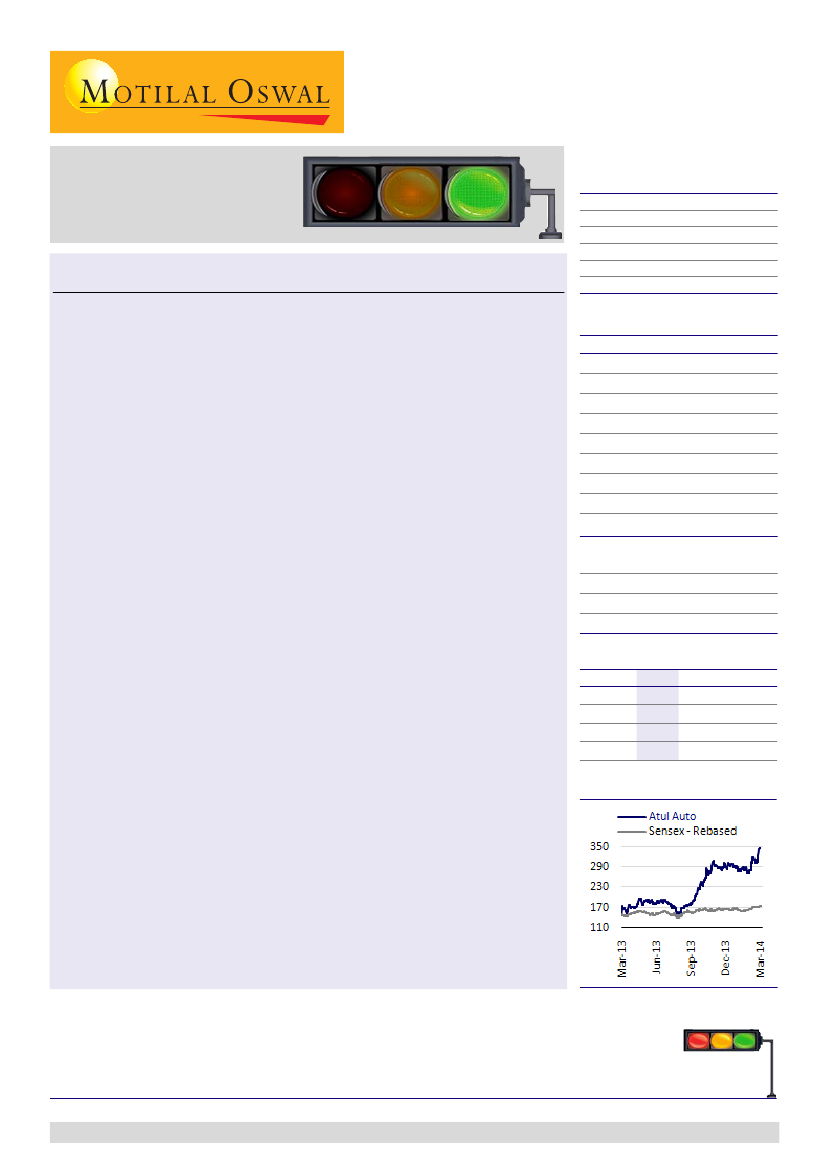

Stock performance (1 year)

Plans to significantly increase capacity, largely through internal accruals

ATA plans to significantly increase capacity from current 48,000 units to 120,000

units per year in phases, largely through internal accruals . Recently, it doubled

capacity at its existing Rajkot plant to 48k units through brownfield expansion,

which can be scaled up further to 60k units at minimal capex. To add capacity of

another 60k units, ATA is evaluating options near Ahmedabad (Gujarat). Capex

for the new plant is likely to be INR1b-1.5b, largely funded by internal accruals.

Spotlight

is a new offering from the Research team at Motilal Oswal. While our Coverage Universe

is a wide representation of investment opportunities in India, there are many emerging names in the

Mid Cap Universe that are not under coverage. Spotlight is an attempt to feature such mid cap stocks

by visiting such companies. We are not including these stocks under our active coverage at this point

in time. Motilal Oswal Research may or may not follow up on stocks under Spotlight.

Chirag Jain

(Chirag.Jain@MotilalOswal.com) + 91 22 3982 5418

Jinesh Gandhi

(Jinesh@MotilalOswal.com) + 91 22 3982 5416

Investors are advised to refer through disclosures made at the end of the Research Report.

RED: Caution

AMBER: In transition

GREEN: Interesting

1