5 April 2014

4QFY14 Results Update | Sector:

Capital Goods

BHEL

BSE SENSEX

22,360

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,694

BHEL IN

2,447.6

450.2/7.5

208/100

5/16/-18

Financials & Valuation (INR Million)

Y/E MAR

Net Sales

EBITDA

Adj PAT

Adj.EPS(INR)

Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2014 2015E 2016E

387,725 317,823 350,020

47,216 33,706 47,570

33,789 23,557 36,659

14.4

-46

133

10.7

12.0

12.8

1.4

9.6

-33

140

7.1

6.9

19.1

1.3

15.0

56

149

10.4

10.1

12.3

1.2

CMP: INR184

TP: INR240

Buy

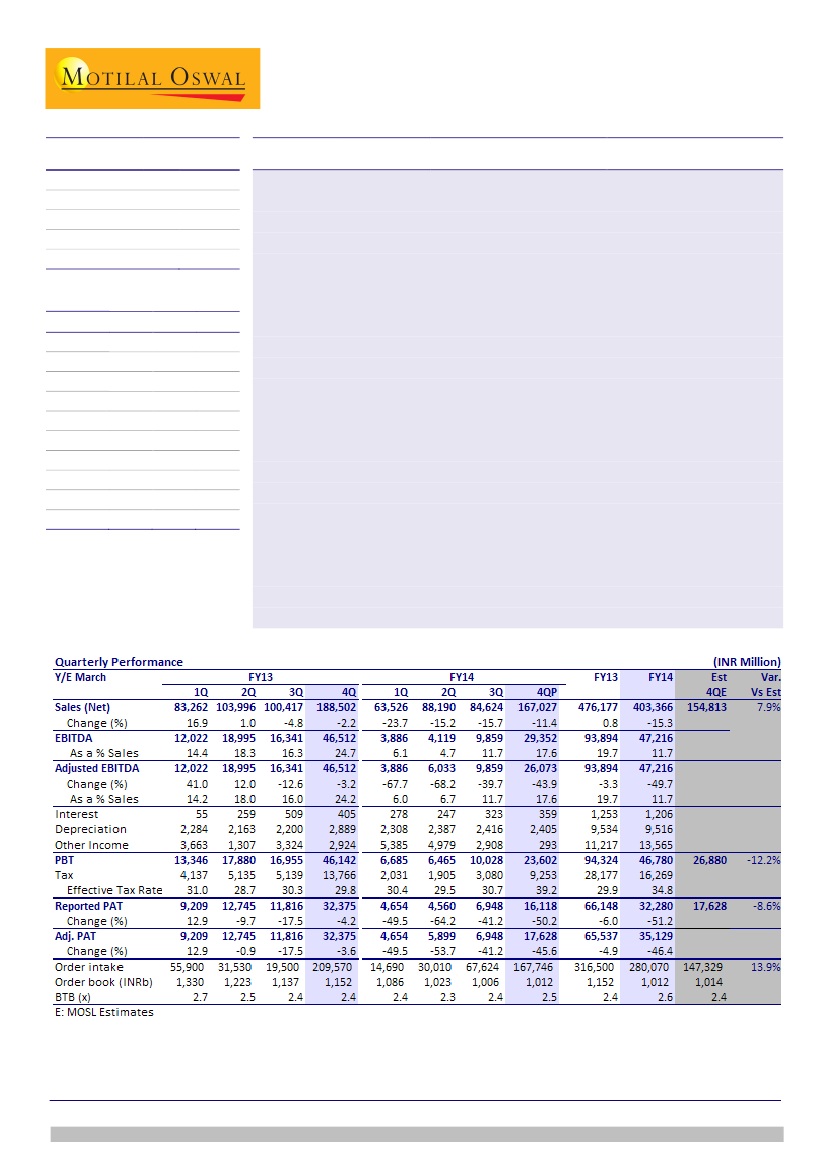

BHEL provisional numbers in-line with estimates:

margins possibly at

normative levels BHEL reported provisional FY14 earnings, with Revenues at

INR404b (down 19.5% YoY), PBT at INR46.8b (down 50% YoY) and PAT at

INR32.3b (down 51% YoY). The numbers are largely in-line with our estimates,

with Revenues at INR404b and PAT at INR33.8b (variance of 4.7%).

Order intake at INR280b in FY14 (vs INR317b in FY13), entails 4QFY14

intake at INR163b:

During 4QFY14, BHEL’s order intake stands at INR168b vs

INR112b in 9mFY14. Key orders received in 4Q includes: i) 1980MW NTPC North

Karanpura (EPC, INR80b), ii) 1600MW NTPC Darlipalli (Boilers, INR30b), iii) hydro

power projects in Punjab / J&K (INR13b), etc. In addition, we understand that

BHEL has emerged as L1 in i) 1320MW Ennore SEZ (EPC, INR78b) ii) 6X196MW

Pranhita Lift Irrigation (~INR25-30b) etc.

Maintain Buy, BHEL is strongly exposed to cyclical factors:

BHEL is strongly

exposed to cyclical factors: i) Contribution margins at ~40-41% vs expected

EBIDTA margin of 12.4% in FY14, leading to a meaningful operating leverage, ii)

Core NWC stable at ~200 days; cyclical factors of retention money (at ~200 days

in FY14E vs 55-60 days in FY07-09) and customer advances (deteriorated from

63% of revenues in FY09 to 34% in FY13) that impacted reported NWC are

expected to normalize, as we expect BTB to increase from 2.2x currently to 3x in

FY15/16E. We maintain

Buy

with a revised Price target of INR240/sh (16x FY16E),

30% upside.

Satyam Agarwal

(AgarwalS@MotilalOswal.com); +91 22 3982 5410

Nirav Vasa

(Nirav.Vasa@MotilalOswal.com); +91 22 3982 5422

Investors are advised to refer through disclosures made at the end of the Research Report.