17 April 2014

3QFY14 Results Update | Sector:

Technology

HCL Technologies

BSE SENSEX

22,629

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,779

HCLT IN

699.5

1,589/674

-3/21/69

CMP: INR1,424

TP: INR1,700

Buy

M.Cap. (INR b) / (USD b) 985.9/16.3

Financials & Valuation (INR Billion)

Y/E June

Sales

EBITDA

PAT

EPS (INR)

EPS Gr. (%)

2014E 2015E 2016E

330.1

86.6

61.2

86.4

51.6

371.4

91.4

71.0

99.7

15.3

360.9

36.1

30.8

14.3

9.5

426.8

102.0

80.1

111.7

12.0

446.6

30.8

27.7

12.8

9.8

BV/Sh.(INR) 279.1

41.2

RoE (%)

RoCE (%)

P/E (x)

EV/EBITDA

( )

34.7

16.5

10.5

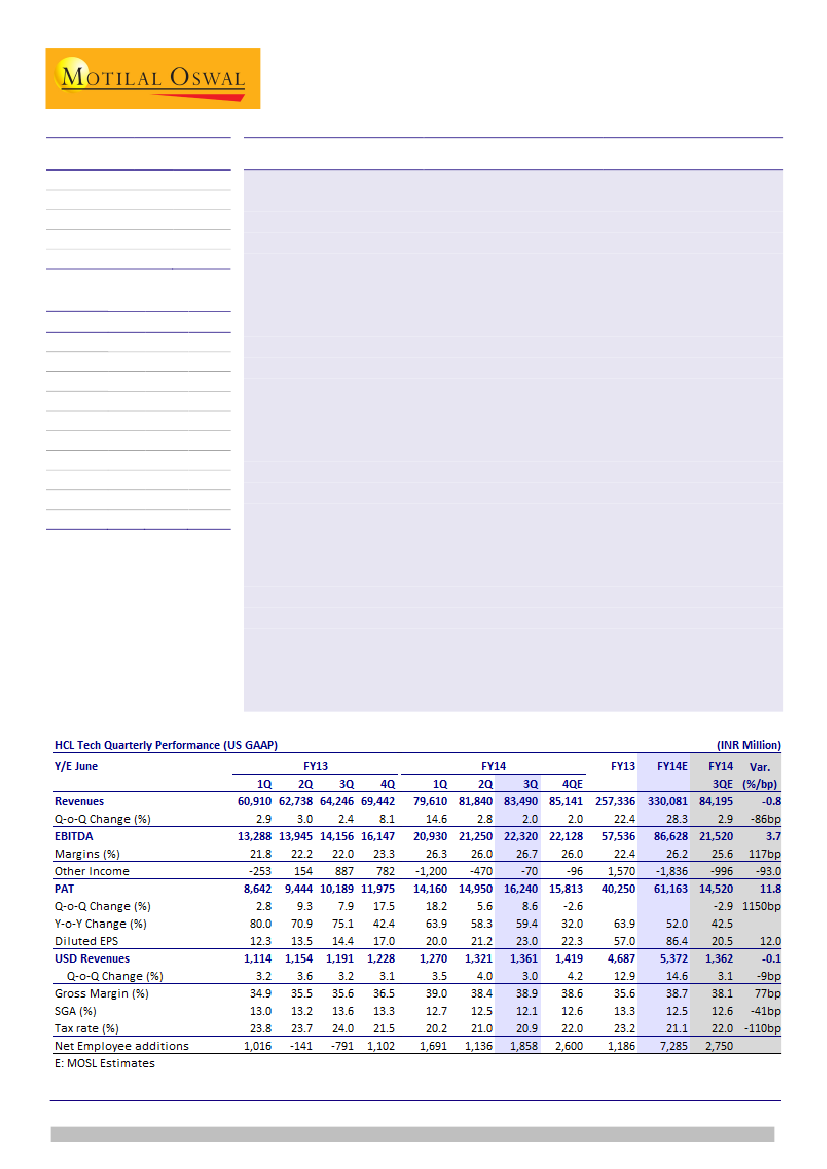

Higher OPM, lower forex loss results in higher than expected PAT:

HCLT’s USD

revenue for 3QFY14 grew 3% QoQ to USD1,361m, in line with our estimate of

USD1,362m. EBITDA margin expanded 70bp QoQ to 26.7%, higher than our

estimate of 25.6%. PAT grew 8.5% QoQ to INR16.2b, well above our estimate of

INR14.5b, led by higher operating income and lower forex losses (INR1.42b v/s our

estimate of INR2.4b).

Software Services gaining traction:

Software Services revenue grew 2% QoQ to

USD831m v/s our estimate of USD826m. IMS grew 5% QoQ v/s our estimate of

6.3% QoQ growth. BPO business declined 1.3% QoQ v/s our estimate of 2.2% QoQ

growth.

Deal wins remain healthy:

For the sixth quarter in a row, HCLT signed deals with a

TCV of over USD1b, taking total 9MFY14 TCV to USD3b+. HCLT has already signed

as many deals as it had announced in the full year FY13. It remains on track to sign

USD4b+ deals in FY14, which would translate into more than 30% growth

compared to the TCV announcements in FY13.

Efficiencies driving margin surprise:

Margin expansion was aided by 30bp QoQ

decline in SGA to 12.15% (our estimate: 12.6%). The company has been on course

for G&A rationalization for some time now, and had extracted 130bp from G&A

efficiencies over 2QFY13-2QFY14.

Visibility of growth acceleration; Buy:

Continued order closures keep revenue

growth prospects sanguine. While profitability may cool off, HCLT could continue

to surprise positively on efficiency gains. We expect HCLT to grow its USD revenue

at a CAGR of 15% and EPS at a CAGR of 14% over FY14-16. Improvement in

Software Services growth makes a case for stock re-rating. Our target price of

INR1,700 discounts FY16E EPS by 15x.

Buy.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Siddharth Vora

(Siddharth.Vora@MotilalOswal.com); +91 22 3982 5585

Investors are advised to refer through disclosures made at the end of the Research Report.