21 April 2014

4QFY14 Results Update | Sector:

Metals

Hindustan Zinc

BSE SENSEX

22,765

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,818

HZ IN

4,225.3

142/94

4/-10/0

CMP: INR132

TP: INR161

Buy

EBITDA in line; negative operating leverage affected costs

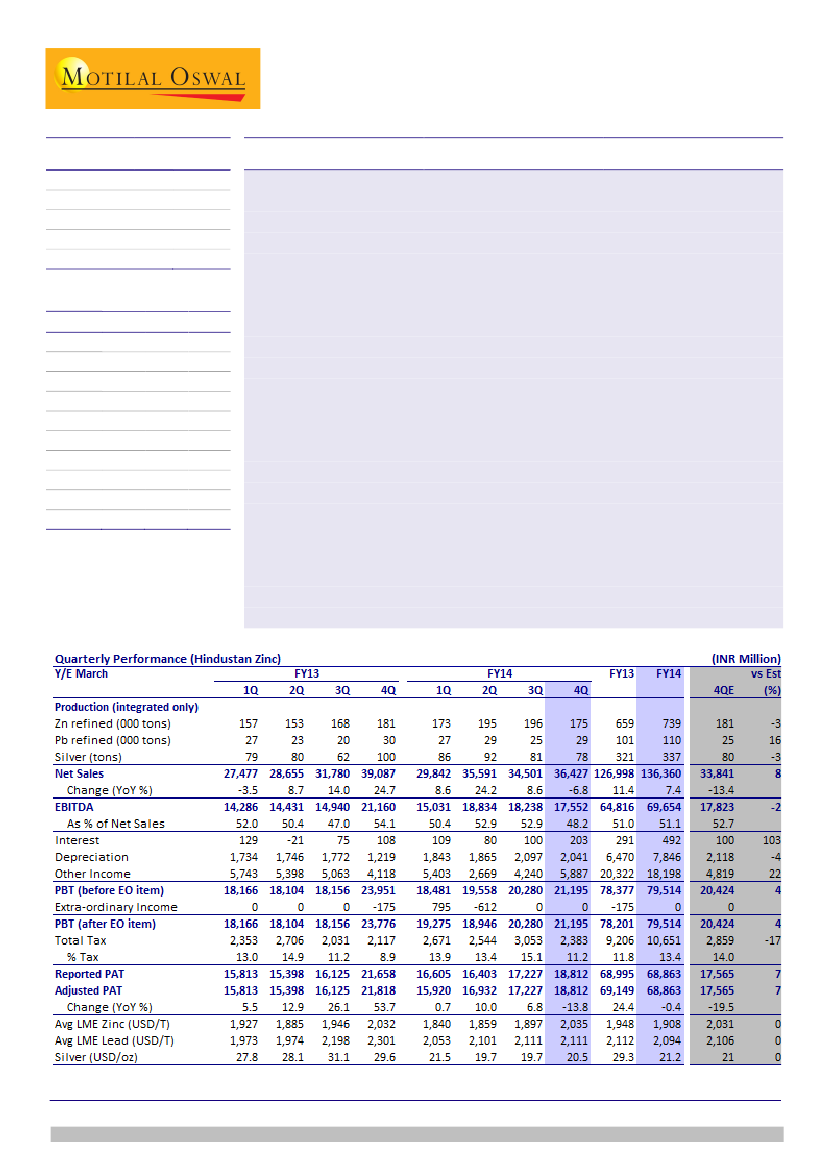

Hindustan Zinc (HZ) 4QFY14 adjusted PAT increased 9% QoQ to INR18.8b, above

estimates, due to higher other income. EBITDA declined 4% QoQ on lower volumes

and negative impact of operating leverage on costs.

Net sales increased 6% QoQ driven by realization. The premiums over LME were

stronger than estimate. Although integrated lead production increased 16% QoQ,

zinc and silver integrated production declined 3% and 22% respectively.

EBITDA declined 4% QoQ to INR17.5b due to 7% jump in cost of production (CoP)

to INR55,467/t. Inflation in mining costs due to diesel prices, mine development

and lower production are key reasons behind the increase in costs. Higher-than-

expected costs were mostly offset by higher-than-expected revenue premiums.

Other income was boosted by MTM gains. Total dividend is up 13% YoY to

INR3.5/share for FY14. Cash and equivalent increased by INR40b YoY to

INR255.4b.

HZ has issued FY15 guidance of USD250m capex on expected lines but volumes are

expected to increase only marginally. We are expecting mine production to

increase by 2.5% YoY to 899kt in FY15, which remains unchanged.

Although mine production did not ramp up as per initial plan during FY14, the

production will ramp up during FY15 and full benefit will be seen in FY16.

Earnings are expected to grow 7% to INR17.5/share helped by better prices and

higher volumes. Stock trades at FY15E EV/EBITDA of 3.4x and P/BV of 1.3x. In view

of positive price outlook, valuations are attractive. Maintain

Buy.

M.Cap. (INR b) / (USD b) 558.6/9.2

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

EV/EBITDA

( )

2014 2015E 2016E

136.4

69.7

68.9

16.3

-0.4

19.7

22.0

8.1

1.5

4.3

140.8

73.8

73.8

17.5

7.2

18.2

20.6

7.6

1.3

3.4

147.8

75.9

72.3

17.1

-2.1

15.7

19.0

7.7

1.1

2.6

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Investors are advised to refer through disclosures made at the end of the Research Report.