22 April 2014

4QFY14 Results Update | Sector:

Financials

HDFC Bank

BSE SENSEX

22,758

Bloomberg

Equity Shares (m)

M.Cap.(INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,815

HDFCB IN

2,399.1

1,743/28.6

761/528

-5/0/-15

CMP: INR726

TP: INR825

Buy

Financials & Valuation (INR Billion)

Y/E March

NII

OP

NP

EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

P/E (x)

P/BV (x)

RoE (%)

RoA (%)

2014 2015E 2016E

184.8

143.6

84.8

35.3

25.0

181.1

20.6

4.0

21.3

1.9

221.6

183.9

106.0

44.2

25.1

215.0

16.4

3.4

22.3

2.0

272.2

229.7

132.4

55.2

24.9

257.4

13.2

2.8

23.4

2.0

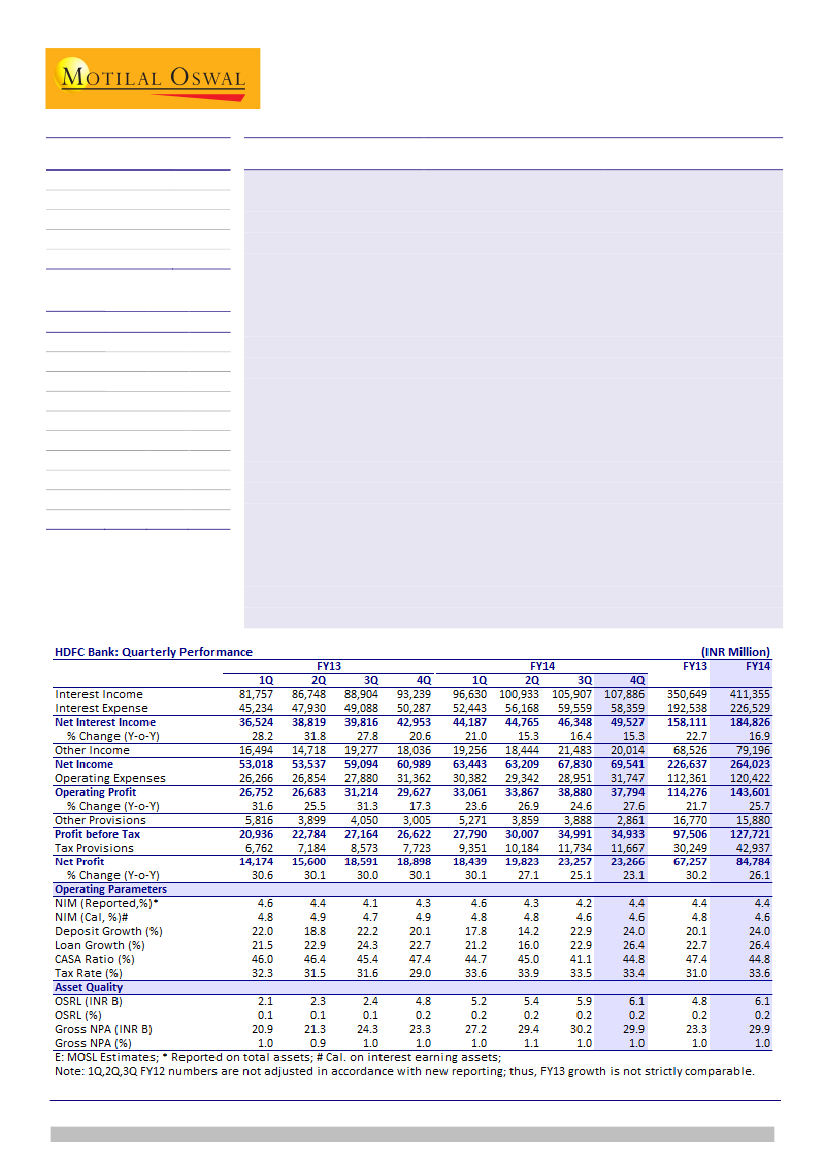

HDFC Bank's (HDFCB) 4QFY14 PAT grew 23% YoY to INR23.3b (in-line). NII was in

line with estimate at INR49.5b (+15% YoY and 7% QoQ) led by 15bp+ QoQ

improvement in NIM to 4.4% and in-line loan growth (26% YoY).

Lower non-core income (including forex) of INR4.8b (estimate of INR7.8b)

impacted revenue. Fees were marginally (4%) below estimate. Continued

operating leverage (opex flat YoY, 4% below estimate) and lower-than-expected

provisions (INR2.9b v/s INR5b) led by strong asset quality helped earnings.

PBT growth remains healthy at 30% YoY though high tax rate YoY (34% v/s 29% a

year ago) led to 23% YoY growth in PAT. Even for FY14, PBT growth remained at

30%+ YoY; however, high tax rate at 34% (31% in FY13) led to PAT growth of 26%.

Other highlights:

1) Strong SA deposits growth of 9% QoQ (+17% YoY) and CA

float (+26% QoQ, 17.6% YoY) led to an increase in CASA ratio to 44.8% v/s 41%

(43.7% ex-FCNR (B) deposits) in 3QFY14, 2) net stress loans were at 50bp (40bp in

FY13), 3) loan mix shifted in favor of non-retail loans driven by strong growth in

overseas loans (23% of incremental loans in FY14) and corporate loans (+38% YoY)

and 4) RWA to total assets declined to 70% v/s 76% in FY13.

Maintain Buy:

HDFCB is best-placed in the current environment, with a CASA ratio of

~45%, growth outlook of at least 1.3x of industry, least asset quality risk and healthy

CET1 of 11.8%. While FIPB approval and reduction in weights in MSCI index can impact

stock’s performance in the near term, we believe valuations are at an attractive level,

with one-year forward P/BV of 3.4x (near its LPA). Comfort on earnings (25%+ CAGR)

remains high and RoE is expected to be at decadal best of 22%+.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Sohail Halai

(Sohail.Halai@MotilalOswal.com); +91 22 39825430

Investors are advised to refer through disclosures made at the end of the Research Report.