22 April 2014

4QFY14 Results Update | Sector:

Real Estate

Mahindra Lifespaces

BSE SENSEX

22,758

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,815

MLIFE IN

40.8

15.6/0.3

472/327

1/-19/-18

CMP: INR381

TP: INR430

Buy

Financials & Valuation (INR Million)

Y/E March

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2014 2015E 2016E

7,053

1,702

1,006

24.6

-28.9

308.9

7.9

8.2

15.5

1.2

7,754

2,056

1,031

25.3

2.5

329.9

7.9

8.6

15.1

1.2

9,411

2,586

1,229

30.1

19.1

356.8

8.8

10.2

12.7

1.1

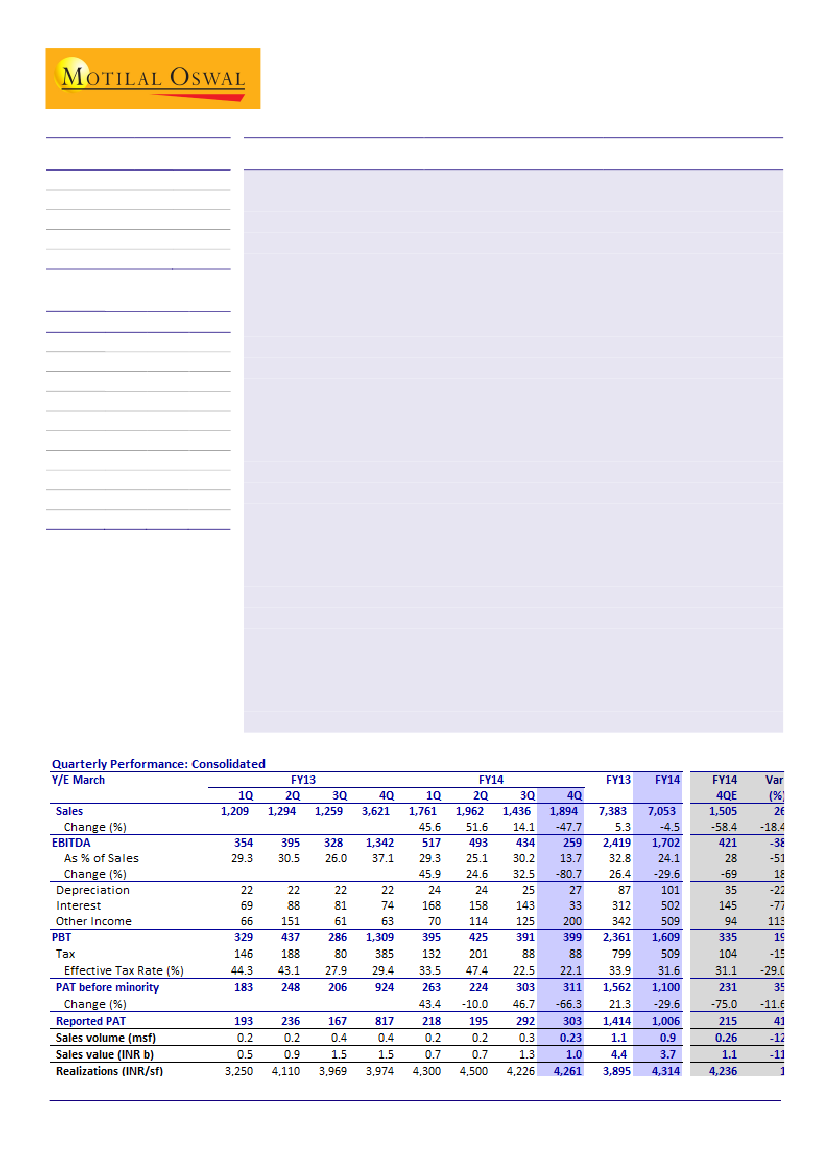

P&L weak as margin pressure persists:

MLIFE’s consolidated revenue stood at

INR1.9b, -48% YoY (v/s est. of INR1.5b). EBITDA de-grew 81% YoY to INR259m (v/s

est. of INR421m) as margins plunged sharply due to (1) weakness in ongoing

residential projects (standalone margins at 5.7%), (2) cost escalations in Chennai

projects and (3) lower revenue from processing area. Higher other income and lower

interest cost kept PAT ahead of estimate at INR303m.

Approval cycle still elusive, pre-sales remain weak:

Approval cycle remains elusive

with no new launches in 4QFY14. Hence, pre-sales continue to remain weak at INR1b

in 4QFY14 (v/s est. of INR1.1b). FY14 annual sales stood at 0.9msf (INR3.7b), down

16% YoY. Antheia (Pune) accounted for 32% of pre-sales, while

Chennai/Nagpur/Hyderabad projects contributed 26%/20%/14%. In MWC Jaipur, it

sold 2.36 acres of DTA area to existing customer, while monetization of balance 40

acres of industrial area in MWC Chennai continue to hinge on government approval.

Other 4QFY14 updates:

Acquired 6% stake of Mahindra group in MWCDL (Chennai

township) at ~INR163m. Also paid ~INR471m for acquiring another 0.48msf of area

across Bangalore and Gurgaon Sector 59 projects.

Focus on launch and monetization but…:

Management highlighted a strong focus on

monetization of recently-acquired projects, which have considerably increased

gearing and deteriorated working capital and undergoing elongated approvals cycle

and regulatory uncertainties. In MWC Chennai, it hopes to monetize the balance 40

acres (~INR1.4b) in FY15-16.

…recovery cycle could be a year away:

With most of its planned launches likely to

take place from 2HFY15, we expect benefits of operating cash flow, improvement in

capital efficiencies and gearing only in FY16. The stock trades at 1.1x FY16E BV, 12.7x

FY16E EPS. We maintain a

Buy

with a target price of INR430, albeit with a view of

delayed recovery cycle. Any clarity on monetization of Byculla land (which has

reached an advanced stage) offers near term trigger.

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Investors are advised to refer through disclosures made at the end of the Research Report.