28 April 2014

4QFY14 Results Update | Sector:

Technology

KPIT Technologies

BSE SENSEX

22,632

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

6,761

KPIT IN

194.1

33.3/0.5

189/95

3/9/64

Financials & Valuation (INR Million)

Y/E Mar

Sales

EBITDA

PAT

EPS (INR)

EPS Gr. (%)

BV/Sh.

RoE (%)

RoCE (%)

P/E (x)

EV/EBITDA

2014E 2015E 2016E

26.9

4.2

2.4

12.6

19.0

64.1

20.5

27.7

13.7

7.4

30.9

5.0

3.1

15.4

22.4

79.5

21.4

27.9

11.2

5.9

35.8

6.0

3.8

19.2

24.9

98.7

21.5

28.0

8.9

4.3

CMP: INR172

TP: INR210

Buy

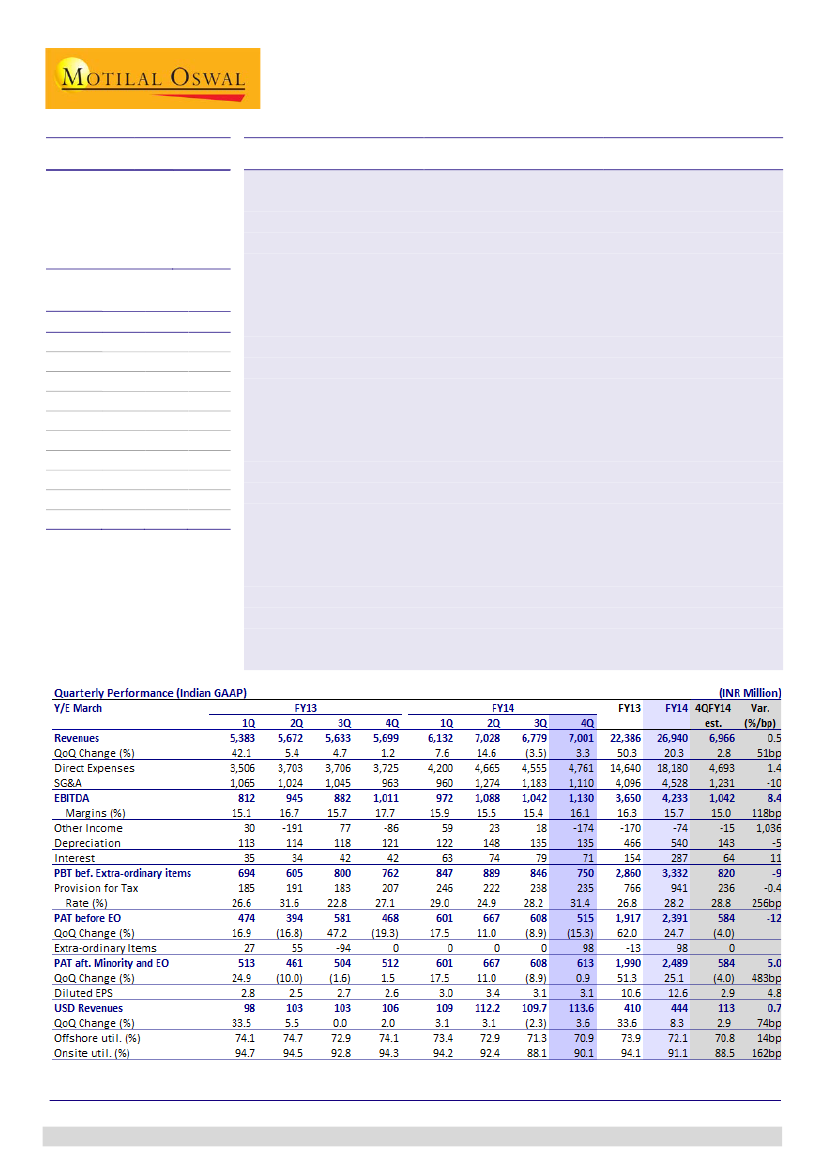

4QFY14 margin above estimate:

KPIT’s 4QFY14 revenues grew 3.6% QoQ to

USD113.6m, marginally ahead of our estimate of USD112.8m. EBITDA margin for

the quarter was 16.1%, +70bp QoQ, above our estimate of 15% (-40bp QoQ). PAT

(excluding exceptional item) was INR515m, below our estimate of INR583m, on

the back of higher forex loss (INR239m loss v/s est. of INR40m loss).

USD revenue guidance implies sustained 4Q traction:

For FY15, KPIT guided for

revenues between USD498-506m, implying growth of 12.1-13.9% YoY (v/s our

organic growth estimate was 13.7%). Guidance is for organic growth and excludes

revenues from purchase agreement with I-Cubed, which is yet to close, and adds

~USD10m in annual revenues. I-Cubed is a US based PLM focused company with

70+ employees and 13% EBITDA margin.

PAT guidance implies margin expansion:

PAT guidance for FY15 is INR2.94-3.00b,

implying growth of 18-21%. This compares with our organic PAT estimate of

INR3.01b. Guidance implies EBITDA margin of ~17%, compared to 15.7% in FY14.

Change in estimates:

Our USD revenue estimates for FY15/16 are up by 2%/2.2%,

as we factor numbers from I-Cubed acquisition from 2QFY15. Our margin

estimates are unchanged, and EPS estimates are changed by 1.3%/-0.9%, after

factoring lower other income owing to purchase consideration

Valuation View:

KPIT remains focused on select verticals, evidenced as the

company added strong ERP capabilities to its Engineering prowess by acquisitions.

We expect the company to grow its USD revenues at a CAGR of 16% over FY14-

16E and EPS at a CAGR of 24% during this period. Also, given limited likelihood of

any big ticket acquisition going forward, we expect Free cash flow generation to

improve going forward. Maintain

Buy.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Siddharth Vora

(Siddharth.Vora@MotilalOswal.com); +91 22 3982 5585

Investors are advised to refer through disclosures made at the end of the Research Report.