14 May 2014

4QFY14 Results Update | Sector:

Consumer

Asian Paints

BSE SENSEX

23,815

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,109

APNT IN

959.2

534.2/9.0

560/376

-2/-8/-3

Financials & Valuations (INR b)

Y/E MAR

Net Sales

EBITDA

Adj PAT

Adj.EPS(INR)

Gr. (%)

BV/Sh (INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2014 2015E 2016E

125.8

18.6

12.3

12.8

10.3

40.6

35.1

39.1

43.5

13.7

146.5

22.3

14.9

15.5

21.1

48.0

36.0

40.2

35.9

11.6

172.3

26.6

17.9

18.7

20.3

56.7

36.7

41.2

29.8

9.8

CMP: INR557

TP: INR520

Neutral

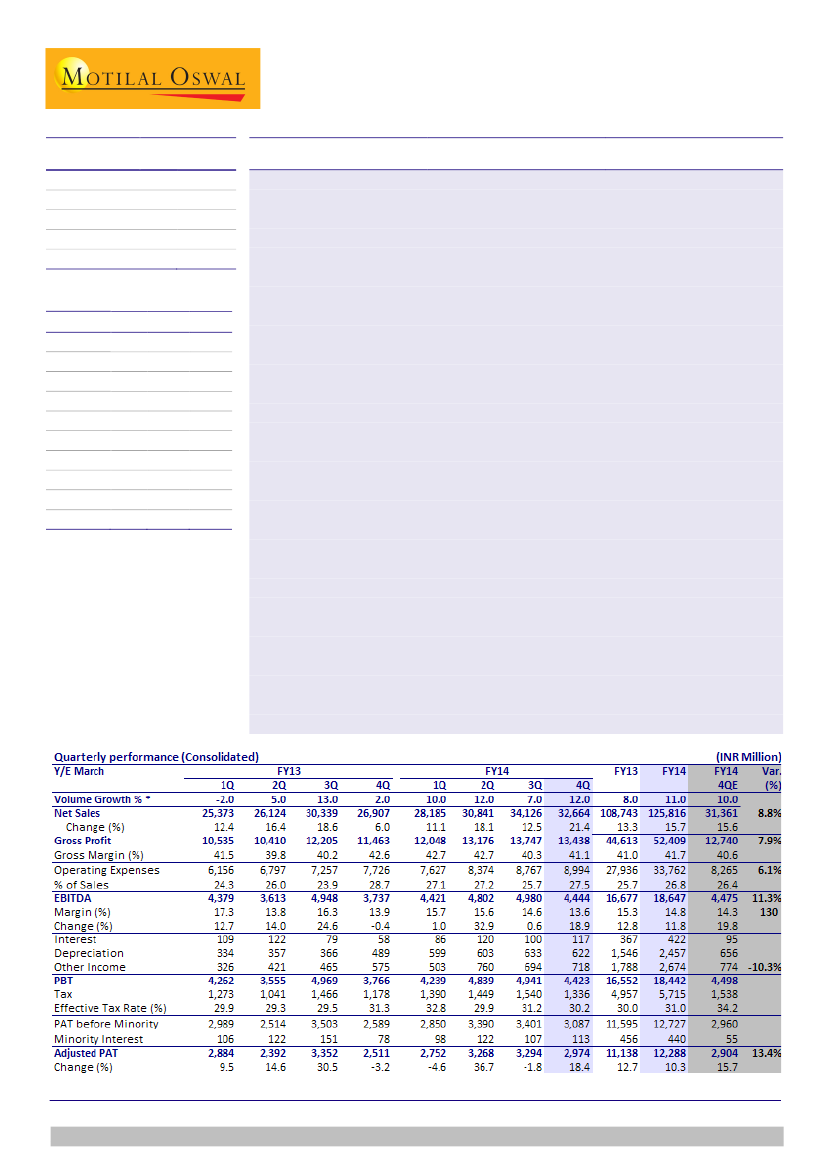

Asian Paints’ (APNT) 4QFY14 results beat our expectations, with consolidated Adj.

PAT at INR3b, up 18.4% YoY (est. INR2.9b). Consolidated net sales grew 21.4%,

9% above estimate, at INR32.6b (est. INR31.3b) led by an estimated 12-13%

domestic paints volume growth (est. 10%). EBITDA margin contracted 30bp at

13.6% (est. 14.3%).

Gross margin declined 150bp YoY but expanded 80bp sequentially. APNT has

announced price hikes of 1% and 1.2% effective May 1 and June 1, 2014

respectively to offset the pressure on gross margin.

EBITDA margin was down 30bp YoY and stood at 13.6%, primarily led by RM

inflation (+150bp YoY), which was partially offset by savings in other expenditure

(-60bp YoY) and employee costs (-60bp YoY).

Commissioning of Khandala plant resulted in higher depreciation costs which

went up 27% YoY. Other income, which grew 24.7% to INR267m, and lower tax

rate (lower by 110bp YoY to 30.2%) aided the 19.2% YoY adjusted PAT growth.

Reported PAT stood at INR2.89b, up 14.5%, impacted by one-off expenses

pertaining to shutdown of Bhandup plant of INR100m.

Net cash nearly doubled to INR11.8b v/s INR6.1b in FY13. FY14 sales, EBITDA and

PAT growth stood at 15.7%, 11.8% and 10.3%, respectively.

APNT has entered into a binding agreement to acquire the front-end sales

business, including brands, network and sales infrastructure of Ess Ess Bathroom

Product Private Ltd, subject to statutory approvals. Deal value is not disclosed.

Valuation and view:

Consistent double digit decorative paints volume growth in

subdued macro environment is a key positive. This was driven by superior

performance of Tier II and III towns, as per management. Acquisition of Ess Ess

indicates management’s intention to diversify the business into allied home décor

categories. At 35.9x FY15E EPS, valuations are expensive given historical

comparison, in our view. We maintain a

Neutral

with a revised target price of

INR520, valuing APNT at 28x FY16E. Spike in RM costs, currency depreciation

constitute key downside risks.

Gautam Duggad

(Gautam.Duggad@MotilalOswal.com); +91 22 3982 5404

Manish Poddar

(Manish.Poddar@MotilalOswal.com); +91 22 3027 8029

Investors are advised to refer through disclosures made at the end of the Research Report.