22 May 2014

4QFY14 Results Update | Sector:

Automobiles

Ashok Leyland

BSE SENSEX

24,374

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,276

AL IN

2,660.7

76.9/1.3

30/12

15/67/4

Financials & Valuation (INR Billion)

Y/E Mar

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2014 2015E 2016E

99.4 116.5 147.3

1.7

-4.8

-1.8

NA

16.7

-10.7

-1.6

1.7

6.5

-0.5

-0.2

NA

16.3

-1.1

3.9

1.8

10.4

2.5

1.0

NA

16.7

5.8

8.2

30.3

1.7

CMP: INR29

TP: INR34

Buy

Margins rebound strongly, guides market revival 2Q onwards

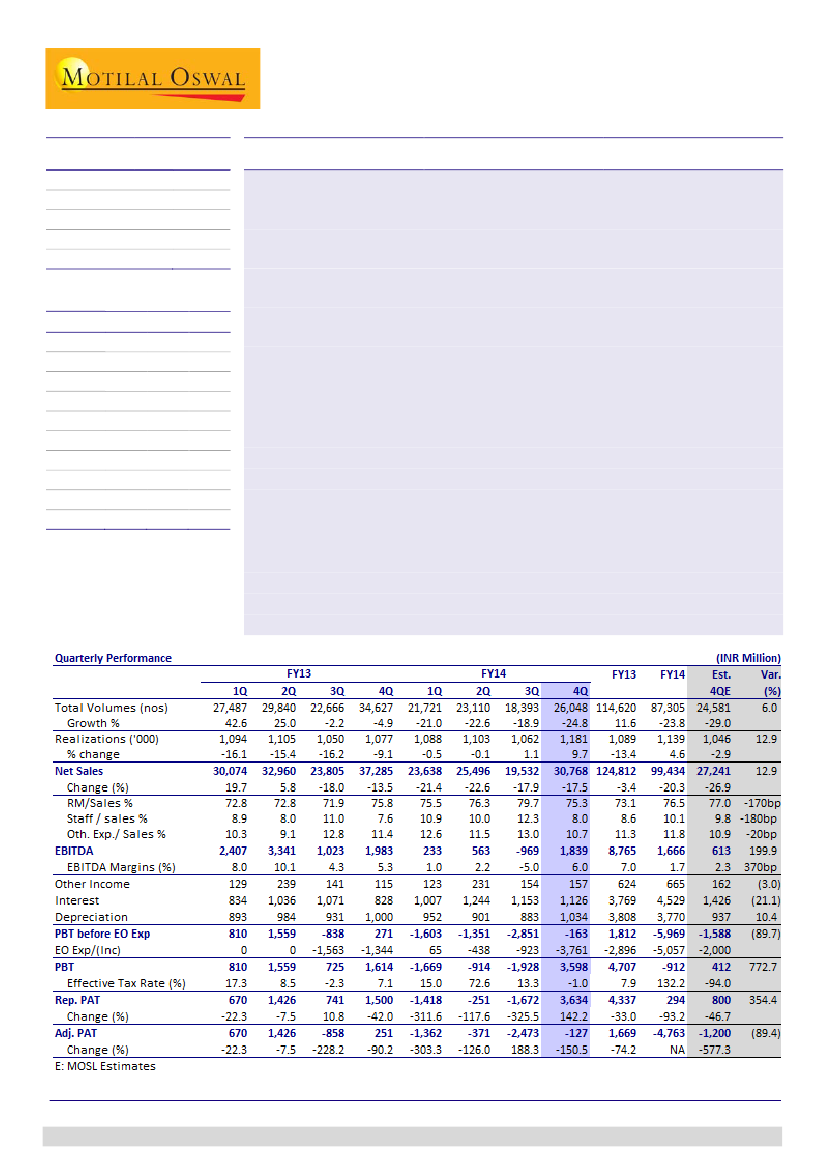

Ashok Leyland’s (AL’s) net sales declined 17.5% YoY to INR30.8b (est. INR27.2b),

led by volume decline of 24.8%, while realizations rose 9.7% YoY (up 11.2% QoQ).

EBITDA margin improved from -5% in 3QFY14 to 6% in 4QFY14 (est. 2.3%). Loss

before extraordinary item and tax stood at INR163m (est. INR1.6b).

AL booked a profit of INR3.8b on sale of non-core long term investments/assets.

Considering the weak financial performance, company refrained from declaring

dividend for FY14 (first time in 15 years, INR0.6/share in FY13).

AL, for the first time, reported consolidated financial performance. Consolidated

net sales stood at INR115b, with EBITDA margin of 3.7%. Loss before extraordinary

item and tax stood at INR8.2b (v/s INR6b for standalone).

Management commentary on results

Management believes the worst is over. Recovery is likely 2QFY15 onwards.

AL largely retained its MHCVs share in FY14, despite higher competition.

Company aggressively worked on cost reduction measures and working capital

reduction.

Continue to focus on various restructuring initiatives to improve operational

efficiency and leaner balance sheet.

Valuation and view:

Our industry interactions indicate that MHCVs cycle is

bottoming out. Typically, MHCVs demand rebounds sharply with an economic

recovery. AL is best placed among CV OEMs to play the CV upcycle. We will review our

estimates post the con-call scheduled tomorrow at 11am (# 91 22 3915 5460).

Maintain

Buy.

-16.1 -158.2

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Chirag Jain

(Chirag.Jain@MotilalOswal.com); +91 22 3982 5418

Investors are advised to refer through disclosures made at the end of the Research Report.