29 May 2014

4QFY14 Results Update | Sector:

Consumer

Bajaj Electricals

BSE SENSEX

24,234

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,236

BJE IN

100.1

32.0/0.5

385/150

-1/75/75

CMP: INR320

TP: INR370

Buy

Financials & Valuation (INR Million)

Y/E Mar

2014 2015E 2016E

Net Sales

EBITDA

Adj PAT

EPS (INR)

Growth

(%)

BV/Share

( )

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

40,298 46,256 53,559

818

-53

-0.5

71.1

-0.7

8.3

-601.1

4.5

3,701

1,851

18.6

85.0

23.8

38.4

17.2

3.8

4,445

2,291

23.0

23.8

101.0

24.7

41.6

13.9

3.2

-116.2 -3,584.9

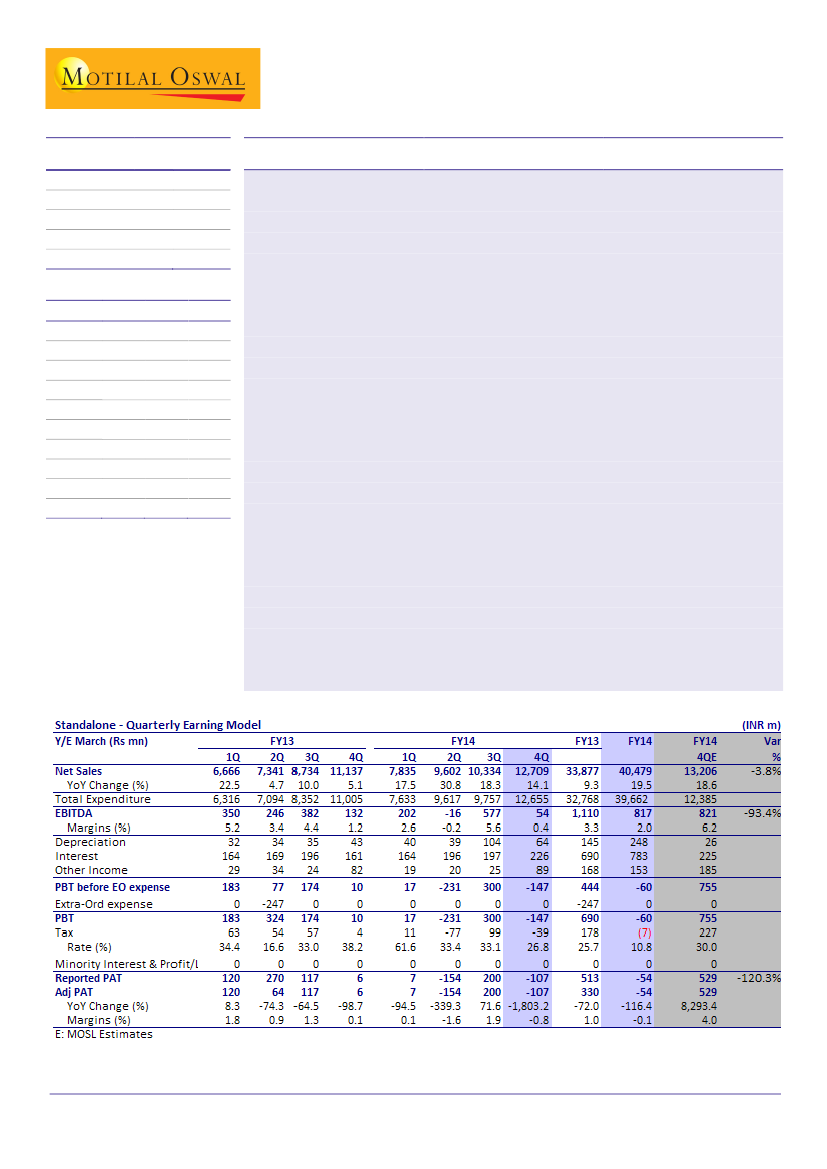

E&P turnaround on track; worst of margins in consumer business is behind:

Bajaj

Electricals (BJE) reported revenue of INR12.7b (est. of INR13.2b), compared to

INR11.1b in 4QFY13, marking a YoY growth of 14.1%. While E&P division reported

robust 54% growth, poor demand environment impacted growth in Lighting (4%

growth YoY) and Consumer Durable (-2% growth YoY) businesses. EBITDA margin

for 4QFY14 stood at 0.4% (est. 6.2%), against 1.2% in 4QFY13. While E&P posted a

strong turnaround with margins for the quarter standing at -4.7%, against -17.8%

in 4QFY13, margins for the Lighting (3% v/s 7.9%) and Consumer Durable (3.6% v/s

8%) were weak due to large discounting during the quarter and unfavorable

operating leverage.

FY15 to witness strong improvement in profitability:

BJE’s management guided

for 15% growth in Lighting and Consumer Durable divisions and 25% growth in

E&P business for FY15. With most legacy contracts for E&P division concluded in

FY14, coupled with strict timeliness in execution of new projects, E&P is set to turn

profitable from 1QFY15. Management is confident on improving E&P division’s

RoCE to 20%, thus improving overall RoCE profile. We believe the worst of decline

in margins in consumer facing businesses is behind and with favorable exchange

rate environment and recovery in demand, margins will bounce back. We expect

earnings to grow from INR-53m in FY14 to INR1.8b in FY15E / INR2.3b in FY16E.

Valuation and view:

Over the last three years, E&P division’s dismal performance

clouded BJE’s robust underlying consumer franchise. With expected turnaround of

E&P business, we believe BJE will continue to get re-rated thus reducing the

valuation gap with peers. We cut the earnings estimate for FY15E and FY16E by

13% and 7% respectively to factor the lower margins. We value BJE at 16x FY16E

EPS of INR23 and arrive at a target price of INR370. Maintain

Buy.

Atul Mehra

(Atul.Mehra@MotilalOswal.com); +91 22 3982 5417

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Investors are advised to refer through disclosures made at the end of the Research Report.