29 May 2014

4QFY14 Results Update | Sector:

Oil & Gas

ONGC

BSE SENSEX

24,234

Bloomberg

S&P CNX

7,236

ONGC IN

CMP: INR375

TP: INR435

Buy

Equity Shares (m)

8,555.5

M.Cap. (INR b) / (USD 3,205.3/54.3

b)

52-Week Range (INR)

425/234

1, 6, 12 Rel. Per (%)

9/9/-8

Financials & Valuation (INR Billion)

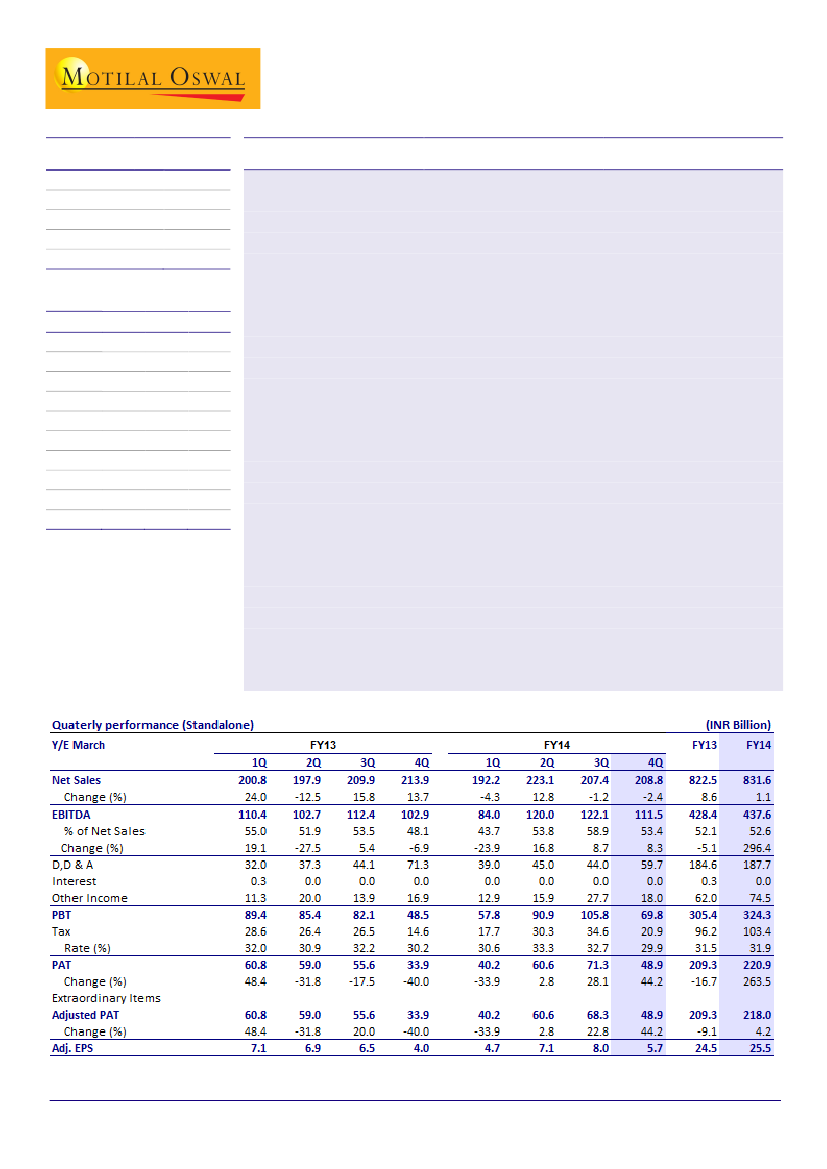

Y/E Mar

Net Sales

EBITDA

Adj PAT

EPS (INR)

Growth

(%)

BV/Share

(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2014 2015E 2016E

1,732

570

264

31.0

9.9

199

16.6

14.6

12.1

1.9

1,881

632

301

34.8

14.2

221

16.6

14.3

10.9

1.7

2,032

752

348

40.2

15.6

247

17.2

14.9

9.3

1.5

ONGC’s reported largely in-line EBITDA at INR111b (+8% YoY, -9% QoQ) despite higher

subsidy at INR162b (est INR141b) due to (a) lower opex at INR33b (est INR43b; -30%

YoY) and (b) higher oil and gas revenues by INR8b and (c) lower staff cost at INR4.5b

(est. INR6b, -38% YoY). Difference at PAT level increased due to higher D,D&A at

INR59.7b (est. INR51b) partly compensated by higher other income at INR18b (est

INR15.6b).

Full year standalone (SA) PAT stands at INR221b and EPS at INR25.8 (+5% YoY) and

adj. consolidated PAT at INR264b and EPS at INR30.8 (+9% YoY). Higher

consolidated EPS growth is led by OVL and MRPL returning back to black.

4QFY14 net realization at USD32.8/bbl:

4QFY14 gross realization stood at

USD107/bbl (-6% YoY and -1% QoQ) and post the subsidy stood of USD73.9/bbl

net realization stood at USD32.8/bbl (-36% YoY, -29% QoQ).

Expect under recoveries to halve by FY16 v/s FY14:

We expect gross under

recoveries to reduce by ~48% by FY16 to INR729b. We expect government to first

take benefit of lower subsidy and hence model upstream subsidy reduction of only

27% by FY16.

Maintain Buy:

We remain positive on ONGC due to (1) likely increase in net

realization due to lower subsidy driven by continued diesel price hikes, (2)

significant beneficiary of scheduled gas price hike in FY15, (3) attractive valuations.

Upside potential to our FY15 gas price assumption:

We model gas price of

USD6.3/mmbtu from FY15 v/s likely new gas price of USD8.4/mmbtu, to factor in

likely subsidy towards power/fertilizer sector. However, if the full gas price benefit

is passed to Oil India then FY15E EPS will further increase by 16%.

Implied dividend yield at ~3% on FY15E. The stock trades at 9.3x FY16 EPS of

INR40.2. Our SOTP-based target price for ONGC stands at INR435/sh. Buy.

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Nitish Rathi

(Nitish.Rathi@motilaloswal.com); +91 22 3982 5558

Investors are advised to refer through disclosures made at the end of the Research Report.