2 July 2014

Inox Leisure

spotlight

The Idea Junction

Stock Info

Bloomberg

CMP (INR)

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

INOL IN

160

96.2

14.8/0.2

167/51

15/18/124

Cinema paradiso

Exhibiting signs of growth

Financials & Valuation (INR b)

INOL is the second-largest multiplex player in India with 79 properties, 310 screens

and 83,809 seats with ~15% Bollywood and 25-30% Hollywood market share.

Management plans to increase the aggression by opening ~83 screens in FY15, which

should lead to faster growth, going forward.

We expect INOX (Global) to improve its key matrices like ATP and SPH going forward,

with increased focus on North India market (only 9% of revenue), which should help to

drive growth and market share.

Management expects ad revenue/screen to grow at 50% over the next two years,

thereby leading to higher growth and margin expansion.

With the expansion into newer geographies like North India, higher number of movie

releases per annum and improved content, we expect an occupancy rate of 29% by

FY16E.

INOL's management expects GST implementation to result in 200bp margin expansion.

We expect INOL to post a revenue CAGR of 25.5% and PAT CAGR of 46% over FY15-17E,

primarily due to newer screen additions and higher growth in ad revenue. The stock

trades at 19.3x FY16E and 13.4x FY17E earnings.

Y/E March

Sales

EBITDA

NP

EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

Div Yield (%)

28.6

3.5

10.8

0.6

19.3

3.1

8.3

0.6

13.4

2.5

6.4

0.6

2015E 2016E 2017E

11.1

1.6

0.5

5.6

45.9

45.1

13.1

16.1

20.7

14.2

2.1

0.8

8.3

47.8

52.2

17.0

19.6

14.0

17.6

2.7

1.1

11.9

44.5

63.0

20.7

23.7

9.7

Pure play focus on exhibition business, aggressive expansion

Movie exhibition industry is highly concentrated with three large focused players,

namely PVR, INOL and Big Cinemas, which are in an aggressive expansion mode

and hence the best plays. Historically, INOL has been adding ~29 screens on an

average over the last three years, which the management plans to increase the

aggression by opening ~83 screens in FY15, which should lead to faster growth,

going forward. We expect the gap between PVR to reduce with the expansion,

which will lead to a re-rating going forward.

Shareholding pattern (%)

As on

Mar-14 Dec-13 Mar-13

Promoter

48.7

48.7

66.6

Dom. Inst

3.5

2.1

2.3

Foreign

1.2

1.2

0.8

Others

46.6

48.0

30.4

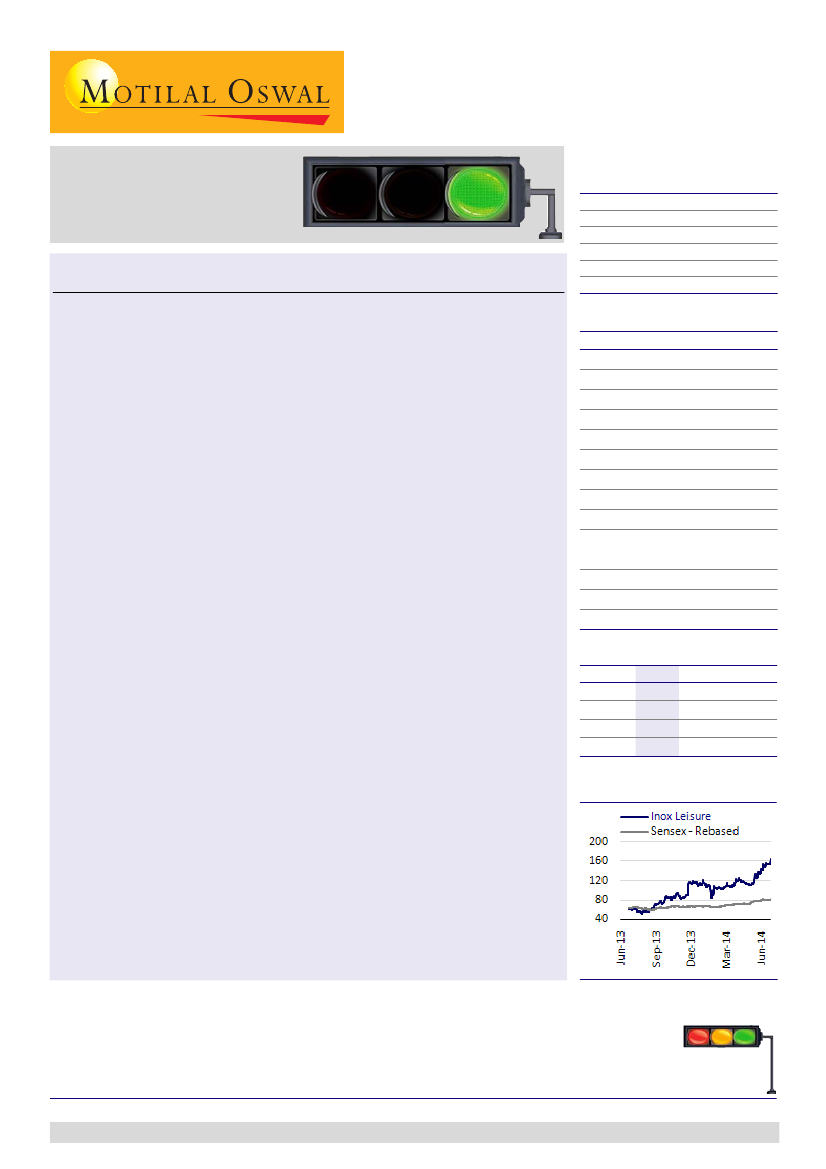

Stock performance (1 year)

Focus to improve presence in North India to drive growth

INOL has ~116 screens in west and 45 screens in North India, compared to PVR's 200

screens in west and 125 in north. In our view, this has been the primary reason for

higher ATP, SPH and ad revenue/screen for PVR. However, we expect INOL to

improve its matrices going forward, with increased focus on North India market

(only 9% of revenue), which should help to drive growth and market share.

Spotlight

is a new offering from the Research team at Motilal Oswal. While our Coverage Universe

is a wide representation of investment opportunities in India, there are many emerging names in the

Mid Cap Universe that are not under coverage. Spotlight is an attempt to feature such mid cap stocks

by visiting such companies. We are not including these stocks under our active coverage at this point

in time. Motilal Oswal Research may or may not follow up on stocks under Spotlight.

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Sagar K Shah

(Sagark@MotilalOswal.com); +91 22 3312 4958

Investors are advised to refer through disclosures made at the end of the Research Report.

RED: Caution

AMBER: In transition

GREEN: Interesting