Monday, July 07, 2014

Market Overview

Commodity

Exchange

NCDEX

NCDEX

NCDEX

NCDEX

NCDEX

NCDEX

MCX

NCDEX

NCDEX

MCX

NCDEX

MCX

Expiry

July

July

July

July

July

July

July

July

July

July

July

July

Price

2695

6346

11260

3978

693.65

3496

529.4

3028

1529

674.8

4306

1406.1

As per the latest release by SOPA, India's

Soybean meal exports in June plunged 98% YoY.

Exports were reported at just 2636 MT,

compared to 2.13 Lakh MT in June 2013. Poor

global demand of Soybean meal has led to lower

prices of meal, leading to disparity in crushing

margin and exports.

According to the latest weekly forecasts by IMD,

overall rainfall activity was deficient during last

week with central India 74% deficit rainfall from

the Long Period Average, reporting a fourth

straight week of poor rains after a delayed

onset.

Increasing stocks at exchange warehouses kept

Castor seed prices under pressure. However,

prices rebounded sharply from intraday lows as

lower-than-normal rainfall in top producing state

Gujarat stoked concerns about production which

has already fallen by 11% this year.

Chana futures ended at revised lower limits on

higher arrivals at major spot markets as supplies

picked up after government raided hoarders to

ease market concerns over possible supply

shortages.

Guar complex prices rose sharply on delayed

sowing of the commodity and reports of a

decline in guar acreage in major growing states

of Rajasthan and Haryana.

Soybean prices edged higher as weak monsoon

in Madhya Pradesh, largest soybean producing

state, has significantly delayed the sowing.

Tracking strong exports of Malaysian palm

products in June, we expect CPO prices to trade

firm in the near term.

%

Change

-3.99%

-1.55%

0.54%

0.40%

0.06%

0.23%

0.46%

-1.11%

0.00%

-4.30%

-1.44%

2.64%

Chana

Turmeric

Jeera

Soyabean

Soyoil

R M Seed

CPO

Sugar

Wheat

Mentha Oil

Castor Seed

Potato

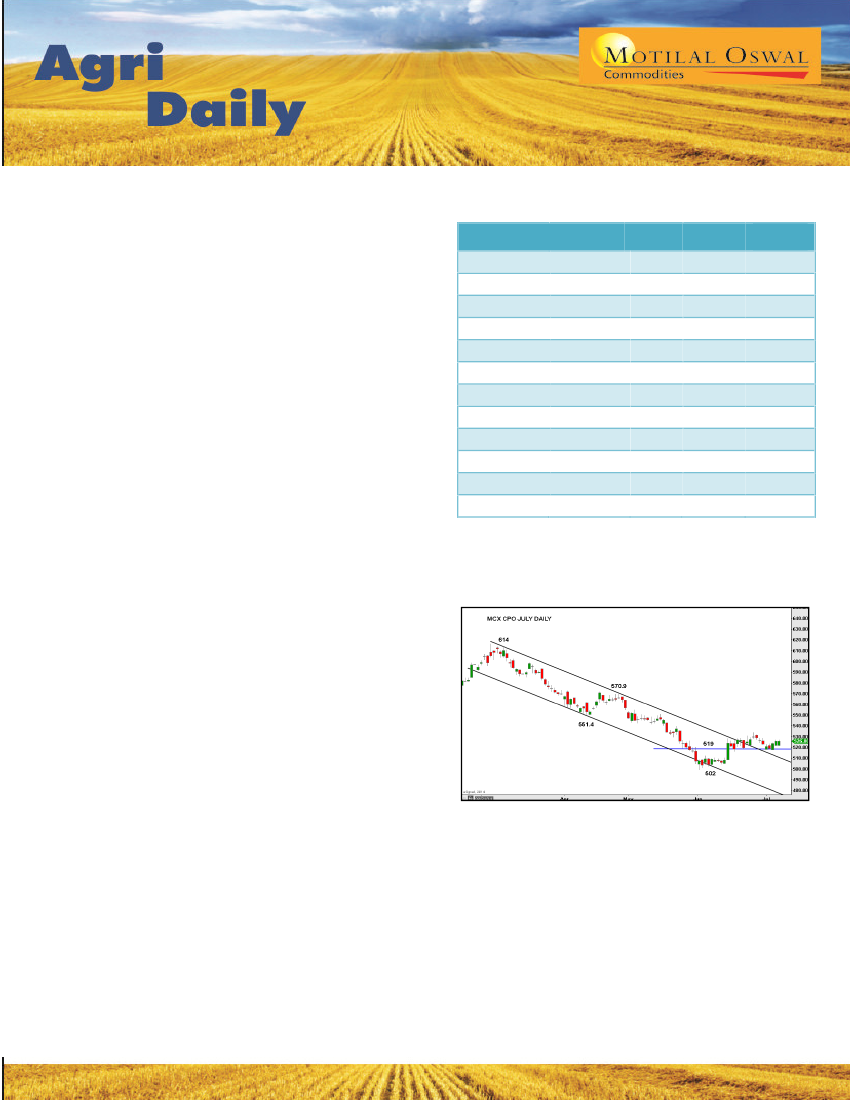

Chart of the Day: CPO

Bias for MCX CPO remains sideways to up as long

as 519 is held on downside which acts as key

support. Immediate resistance is at 534 and

break above the same could target 540 – 545.

Buying is advisable, but our view could negate if

it break below 519.

1

Please refer to disclaimer at the end of the report.