4 July 2014

KEC International

spotlight

The Idea Junction

Stock Info

Bloomberg

CMP (INR)

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1,6,12 Rel. Perf. (%)

KECI IN

132

257.1

33.9/0.6

134/23

9/117/280

Margins to expand as new businesses stabilize

Macro push to provide new growth opportunities

Financials & Valuation (INR b)

Y/E March

2014

79.0

4.9

0.7

2.9

14.8

46.3

6.4

15.0

45.5

2.8

0.6

2015E 2016E

88.5

6.4

1.7

6.6

126.3

52.3

13.3

18.9

20.1

2.5

8.0

0.6

101.8

7.5

2.4

9.4

42.4

61.1

16.5

21.2

14.1

2.2

6.8

0.5

Sales

EBITDA

NP

EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

Valuations

P/E (x)

P/BV (x)

EV/Sales (x)

Operating margins to expand as new businesses stabilize

During FY08/FY09 onwards, KECI diversified into new business verticals of

Power Systems, Railways, Cables and Water to leverage upon its project

management skills. New businesses contributed 25% of FY14 revenues (FY09-

14 CAGR of 29%). Given the initial learning curve and the need to build pre-

qualifications, these businesses impacted the EBIDTA margins in the interim

period (FY14 EBIDTA margins at 6.2%, vs ~12% in FY11/12).

During FY14, there had been a gradual improvement in the quarterly margins,

largely led by stabilization in the performance of these businesses. The

management stated that the incremental orders even in these segments are

being taken at margins of 8-9%, and thus as the legacy projects are executed,

we expect margins to improve to normative levels. We model FY15/FY16

EBIDTA margins at 7.2% / 7.4% largely led by expectations of stabilization in

new businesses.

Of the INR102b order book as at end FY14, new business segments contributed

to just INR20.2b (20% of the order book, down 30% YoY). KECI has become

selective in terms of intake; with increased thrust towards infrastructure

(including Power, Railways, Water, etc), we expect these segments to

contribute ~25% of the order book in FY16.

EV/EBITDA (x) 10.3

Shareholding pattern (%)

As on

Mar-14 Dec-13 Mar-13

Promoter

49.4

48.2

44.6

Dom. Inst 33.2

33.3

34.5

Foreign

3.1

2.9

2.9

Others

14.4

15.7

18.0

Consistent Performance from the transmission business to continue

KECI's transmission business has been a consistent performer; with FY12-14

revenue CAGR at ~15% and operating profit margins of ~8-9%. Order intake

has also increased at CAGR of 15% from ~INR60b in FY12 to ~INR80b in FY14.

Growth drivers will be led by increased push for power T&D capex in India,

including the Renewable Energy Corridors. KECI has increased its geographical

reach with acquisition of SAE towers which has helped to establish its

presence in Americas. Globally, transmission capex is expected to remain

robust especially in Africa, Middle East, United states and North American

markets led by replacement demand emanating from aged networks,

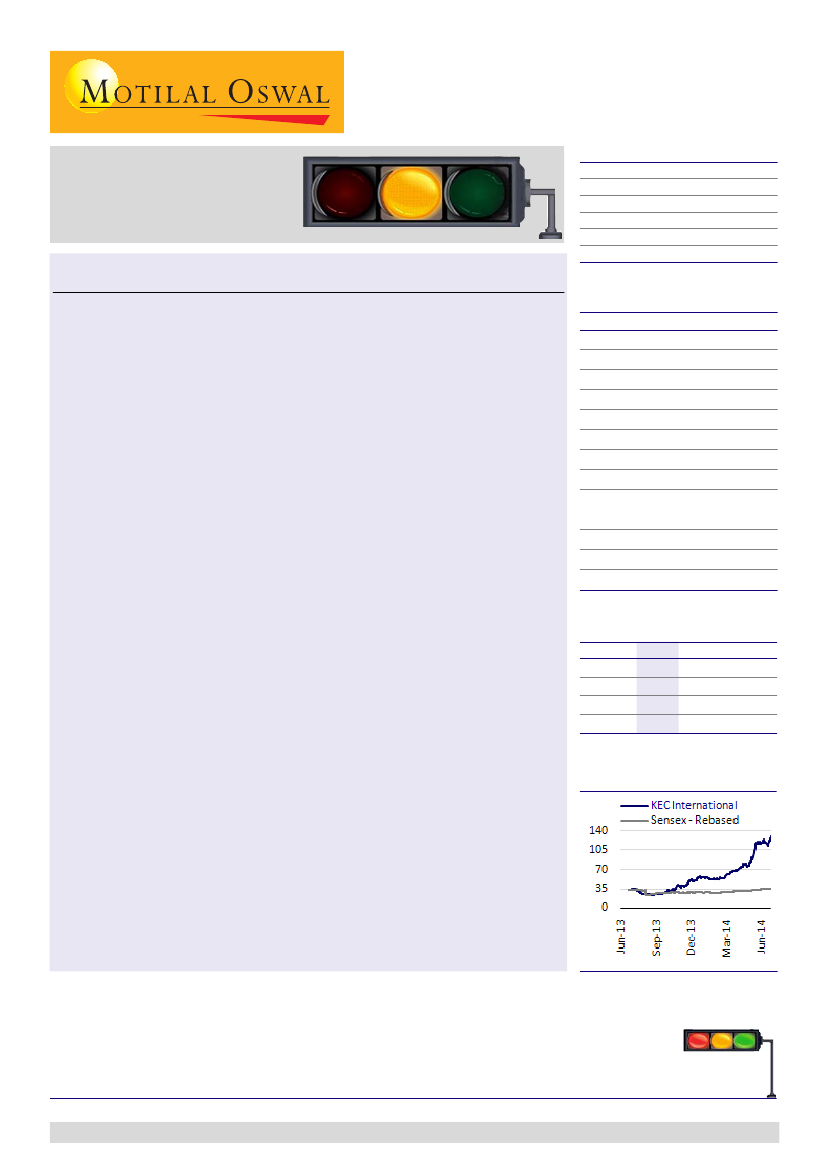

Stock performance (1 year)

Spotlight

is a new offering from the Research team at Motilal Oswal. While our Coverage Universe

is a wide representation of investment opportunities in India, there are many emerging names in the

Mid Cap Universe that are not under coverage. Spotlight is an attempt to feature such mid cap stocks

by visiting such companies. We are not including these stocks under our active coverage at this point

in time. Motilal Oswal Research may or may not follow up on stocks under Spotlight.

Satyam Agarwal

(Satyam.Agarwal@MotilalOswal.com); +91 22 3982 5410

Amit Shah

(Amit.Shah@MotilalOswal.com) /

Nirav Vasa

(Nirav.Vasa@MotilalOswal.com)

Investors are advised to refer through disclosures made at the end of the Research Report.

RED: Caution

AMBER: In transition

GREEN: Interesting

1