21 July 2014

1QFY15 Results Update | Sector:

Real Estate

Oberoi Realty

BSE SENSEX

25,642

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,664

OBER IN

328.2

78.8/1.3

276/154

-8/-7/-6

CMP: INR240

TP: INR297

Buy

Financials & Valuation (INR m)

Y/E Mar

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2015E 2016E 2017E

11,584 19,388 28,610

6,297 11,071 16,687

3,979

12.1

27.9

8.7

11.4

19.8

1.7

6,962 10,969

21.2

75.0

162.6

13.8

17.8

11.3

1.5

33.4

57.6

192.5

18.8

24.7

7.2

1.2

BV/Sh. INR 143.7

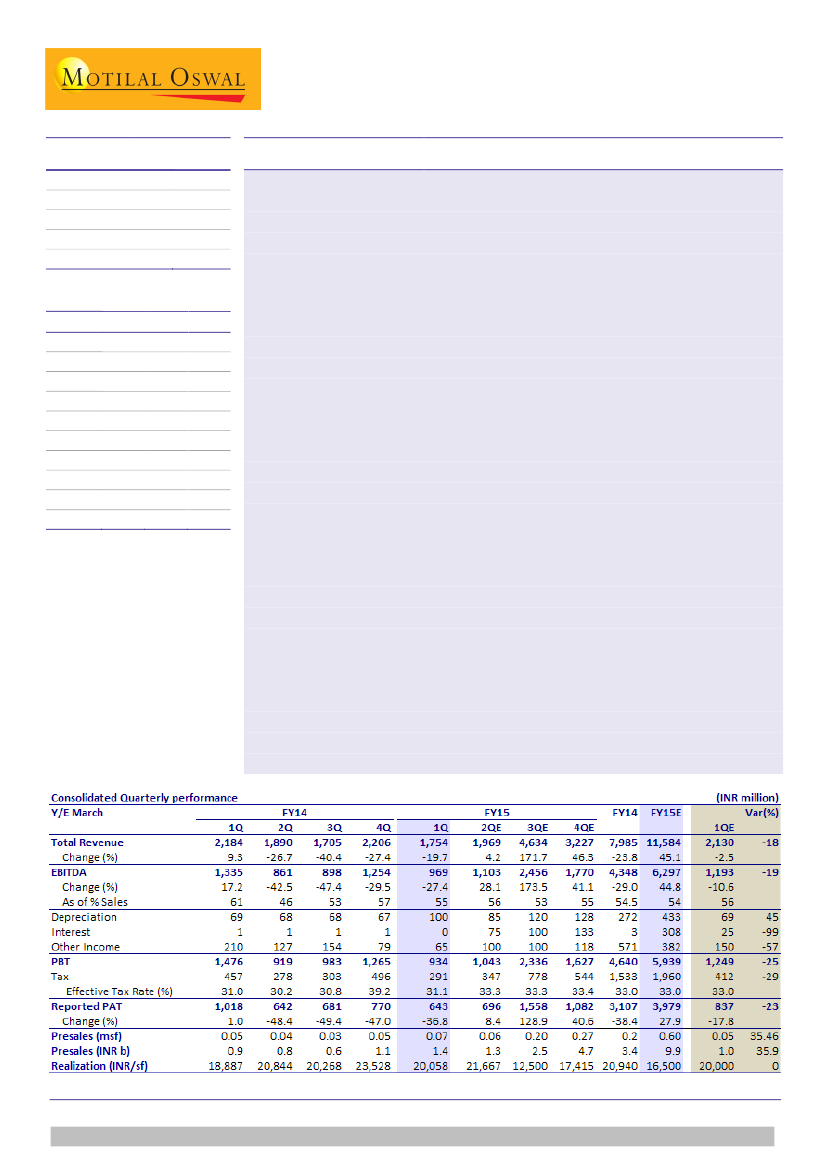

Revenue below estimates, margin in line:

Oberoi Realty (OBER)’s 1QFY15 revenue

de-grew 19.7% YoY (-20% QoQ) to INR1.8b (v/s est. of INR2.1b). EBITDA de-grew

27% YoY (-23% QoQ) to INR0.97b (v/s est of INR1.2b), translating into margin of

55% (-2pp QoQ). Residential revenue was entirely contributed by Exquisite. Lower

revenue trickled down to PAT, which de-grew 37% YoY to INR643m, led by higher

depreciation (impact of schedule 11 of companies act) and lower other income.

Seasonally weaker hotel operations dent annuity business:

Annuity revenue was

down 3% QoQ (grew 6% YoY) on account of seasonally weaker contribution from

hotel operations (-10% QoQ). QoQ weakness in margin was also attributable to ~

INR40mof prior period property tax provision in hotel operations, which dent its

margin to 13% in 1QFY15 (v/s 33.4% in 4QFY14 and 30.8% in 1QFY14).

Presales improve QoQ:

Presales was at 0.07msf (INR1.4b) v/s 0.05msf (INR1.1b) in

4Q and est of INR1b. Blended realization declined QoQ 15% (+6% YoY) to

INR20,058/sf. Entire presales was accounted by Exquisite and Esquire.

Collections up QoQ, Payment on Borivali land led net FCFE –ve of INR10.8b:

Broadly, we calculate, inflow of INR1.9b in 1QFY15 including (a) INR1.4b

collections (v/s INR1b in 4QFY14), and (b) INR0.4b rentals EBITDA. These were

largely spent in ~INR2b in ongoing constructions/capex, (b) INR10.2b of balance

payment to Borivali deal, and (c) tax & admin of INR0.4b. Consequently net FCFE is

–ve at INR10.8, leading to net debt of INR6b (net DER of 0.13x) on B/S (v/s net

cash of INR4.7b in 4QFY14).

Operations near bottom, overhangs diluted, maintain Buy:

Key overhangs viz.

Mulund MoEF, Worli hotel operator, JVLR project conversion approval, and new

land acquisition (at Borivali) etc was addressed to a meaningful extent. It should

pave the way for a new monetization cycle and better cash flows 2HFY15 onwards.

Seamless execution over last 2 years should benefit its cash flow with ready assets

once demand turns favorable in Mumbai. It trades at 11.3x FY16E EPS, 1.5x FY16E

BV.

Buy

with a target price of INR297. Await further clarity in concall scheduled at

4 PM July 21, 2014. DIAL IN +91 22 3960 0645/+91 22 6746 5845.

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Investors are advised to refer through disclosures made at the end of the Research Report.