28 July 2014

1QFY15 Results Update | Sector:

Cement

J K Cement

BSE SENSEX

26,127

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,790

JKCE IN

69.9

26.8/0.4

419/148

-8/91/54

CMP: INR383

TP: INR520

Buy

Financials & Valuations (INR b)

Y/E Mar

2015E 2016E 2017E

37.7

6.0

20.6

92.2

7.9

9.0

18.6

1.5

9.0

45.5

9.2

47.6

131.1

16.7

14.0

8.1

1.3

5.4

53.3

12.3

80.9

70.0

23.8

18.5

4.7

1.0

3.3

Sales

EBITDA

Adj EPS

EPS Gr.

RoE (%)

RoCE (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA

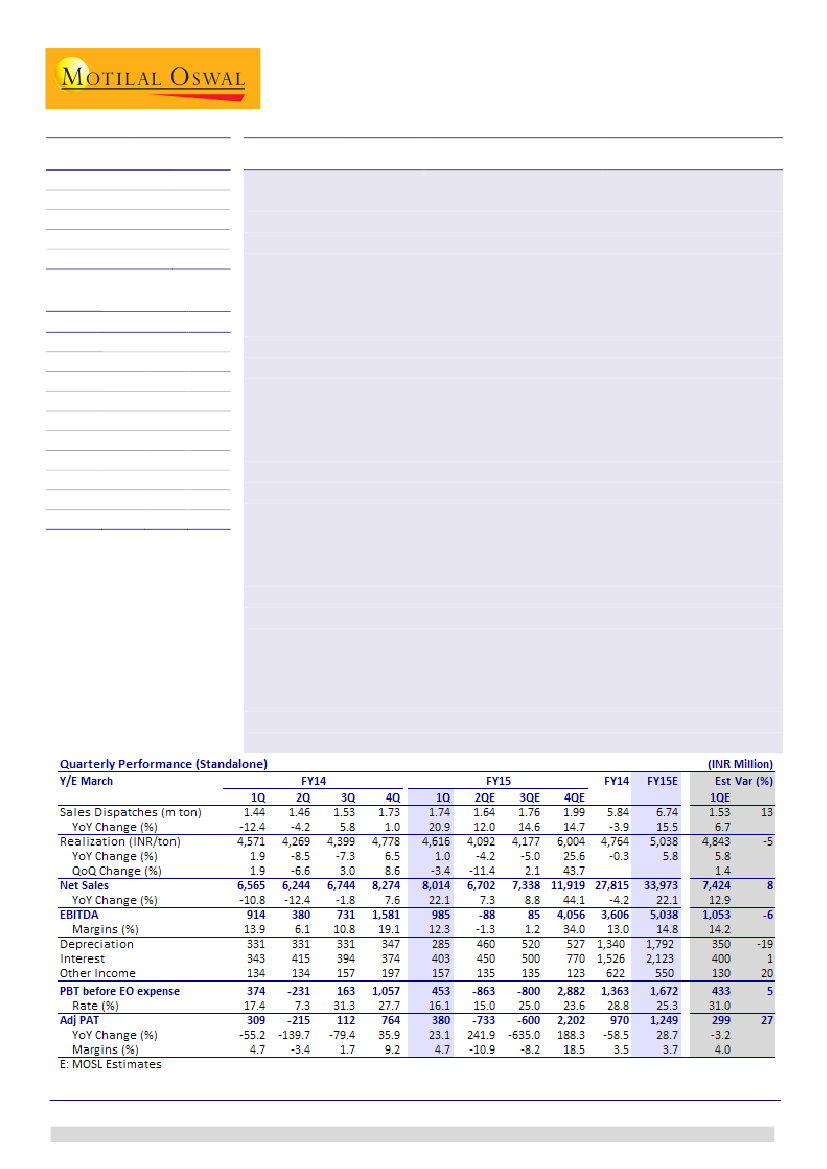

Revenue beat on higher volumes, realizations disappoint:

Net sales grew by 22%

YoY (-3% QoQ) to INR8b (v/s est. of INR7.4b). Cement volumes grew by 21% to

1.74mt (v/s est. 1.53mt). Grey cement volume grew 22% YoY (+1% QoQ) at 1.54mt

(v/s est. of 1.34mt) led by South volumes growing 39% and North growing 15%.

White cement (incl putty) volumes grew 12% YoY to 0.2mt (in-line). Blended

realizations at INR4,616/ton (v/s est. INR4,834) were down 3.4% QoQ. Grey

cement realizations declined 1.6% QoQ to INR3,844/ton (v/s est of INR3,949/ton),

as South realizations declined 4% and North realizations declined 1%. Further,

white cement realizations declined 3% QoQ INR10,685/ton (v/s est. of

INR10,942/ton), impacted by lower contribution of white cement.

Lower realizations and weaker mix impacts profitability:

EBITDA was ~INR985m

(+8% YoY, -38% QoQ) v/s estimate of INR1.05b. Blended EBITDA/ton at

~INR567/ton (v/s est. ~INR687) was impacted by lower realizations, weaker mix

(lower white cement contribution) and higher cost (pet-coke price inflation and

maintenance cost). Grey cement EBITDA/ton was at ~INR327/ton (-INR333/ton

QoQ). Lower depreciation and lower tax boosted PAT to ~INR380m (v/s est.

~INR299m), a growth of 23% YoY.

Brownfield expansion at Rajasthan commenced operations:

3mt brownfield

capacity addition at Rajasthan is now ready, with commissioning of clinker

production in 1QFY15 and cement production to start from August 2014. Further,

UAE plant is fully functional with sales of ~35,000t of till June mainly in GCC region

and East Africa. Sales are likely to pick up from October onwards after the end of

lean period till September and registration of its product in various countries.

Revised estimates, Maintain Buy:

We are revising our EPS estimates for

FY15E/16E by -9%/+5% to factor for a) strong volume growth, b) weaker

realizations, c) lower depreciation and d) lower tax. The stock trades at 8.1xFY16

EPS, 5.4x EV/EBITDA and USD71/ton (blended). Maintain

Buy

with a target price of

INR520 (USD56/ton for Grey cement capacity and 10x FY16E White cement EPS).

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Investors are advised to refer through disclosures made at the end of the Research Report.