28 July 2014

1QFY15 Results Update | Sector:

Technology

Persistent Systems

BSE SENSEX

25,991

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,749

PSYS IN

40.0

51.4/0.9

1,400/504

16/6/119

CMP: INR1,313

TP: INR1,350

Buy

Financials & Valuation (INR Billion)

Y/E Mar

Sales

EBITDA

Adj. PAT

Adj. EPS

(INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

EV/EBITDA

( )

2015E 2016E 2017E

18.8

4.4

3.0

74.7

19.8

370.7

22.4

18.1

17.6

9.7

21.8

5.4

3.7

93.2

24.8

438.3

23.7

18.5

14.1

7.6

25.8

6.5

4.7

117.5

26.1

531.0

25.0

19.3

11.2

5.8

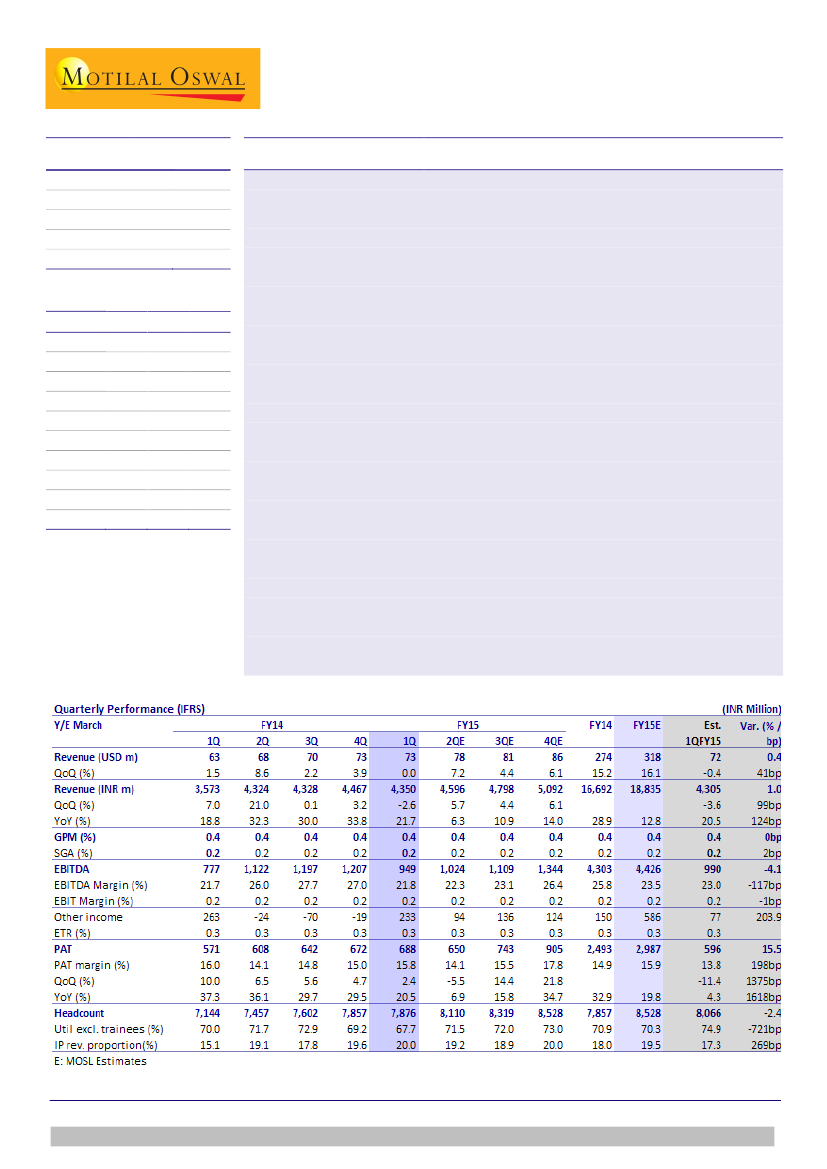

Revenues in line PAT above estimate:

PSYS’ 1QFY15 revenue was USD72.7m, flat

QoQ. EBITDA margin was 21.8%, -520bp QoQ, below our est. of 23% (-400bp

QoQ), on higher SGA (18.3% v/s estimate of 17.4%). Significantly higher other

income and forex drove PAT of INR688m, well above our estimate of INR596m.

IP-led revenues grow contrary to expectations:

The revenue mix was different as

IP-led revenues grew 2% QoQ to USD14.5m, v/s our est. of USD12.5m (-12%

QoQ).While linear revenues declined marginally to USD58.1m, v/s our est. of

USD59.8m.

Reiterates sanguine outlook for FY15:

PSYS has changed its go-to-market strategy

into three areas: [1] account [2] platform and [3] product / IP. PSYS is seeing a

healthy deal pipeline in all the three areas and is confident of achieving better

growth in FY15 compared to FY14’s 15.2% YoY. EBITDA margins faces headwinds

of ~250bp from salary hikes in the coming quarter. PSYS expects absence of visa

cost (150bp impact) and improvement in utilization to facilitate improving margin

trajectory through the remainder of the year. In FY14 EBITDA margins in 1Q were

21.7% while full year margins were 25.8%.

Adjusting our margin estimates for higher G&A:

We expect slightly better growth

in IP-led business, while moderating our expectations in the linear revenues. We

have revised our FY15 EBITDA margin downwards to 22.9%, 180bp lower,

following 1Q miss. Consequently, our EPS estimate for FY15 is lower by 2.4%.

Right place, right time; maintain Buy:

We believe PSYS is one of the few Tier-II IT

companies with the potential to grow revenues at or above 20%, given its focus on

the fast-growing SMAC business, multi-year relationships with marquee clientele

in the ISV space. Valuations offer limited upside in near term, but we remain

confident on company’s long term business fundamentals. Maintain

Buy

with a

target price of INR1,350.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Siddharth Vora

(Siddharth.Vora@MotilalOswal.com); +91 22 3982 5585

Investors are advised to refer through disclosures made at the end of the Research Report.