31 July 2014

1QFY15 Results Update | Sector:

Consumer

Bajaj Electricals

BSE SENSEX

25,895

Bloomberg

Equity Shares (m)

M.Cap. (INR b)/(USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,721

BJE IN

100.3

28.7/0.5

385/150

-18/10/40

CMP: INR287

TP: INR350

Buy

Financials & Valuation (INR Million)

Y/E Mar

2015E 2016E 2017E

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

BV/Sh(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

46,649 54,243 62,853

2,939

1,234

12.3

-2,424

78.6

16.5

26.0

23.2

3.6

4,068

1,910

19.1

54.8

90.7

22.6

34.1

15.0

3.2

4,903

2,397

24.0

25.5

107.7

24.2

37.2

12.0

2.7

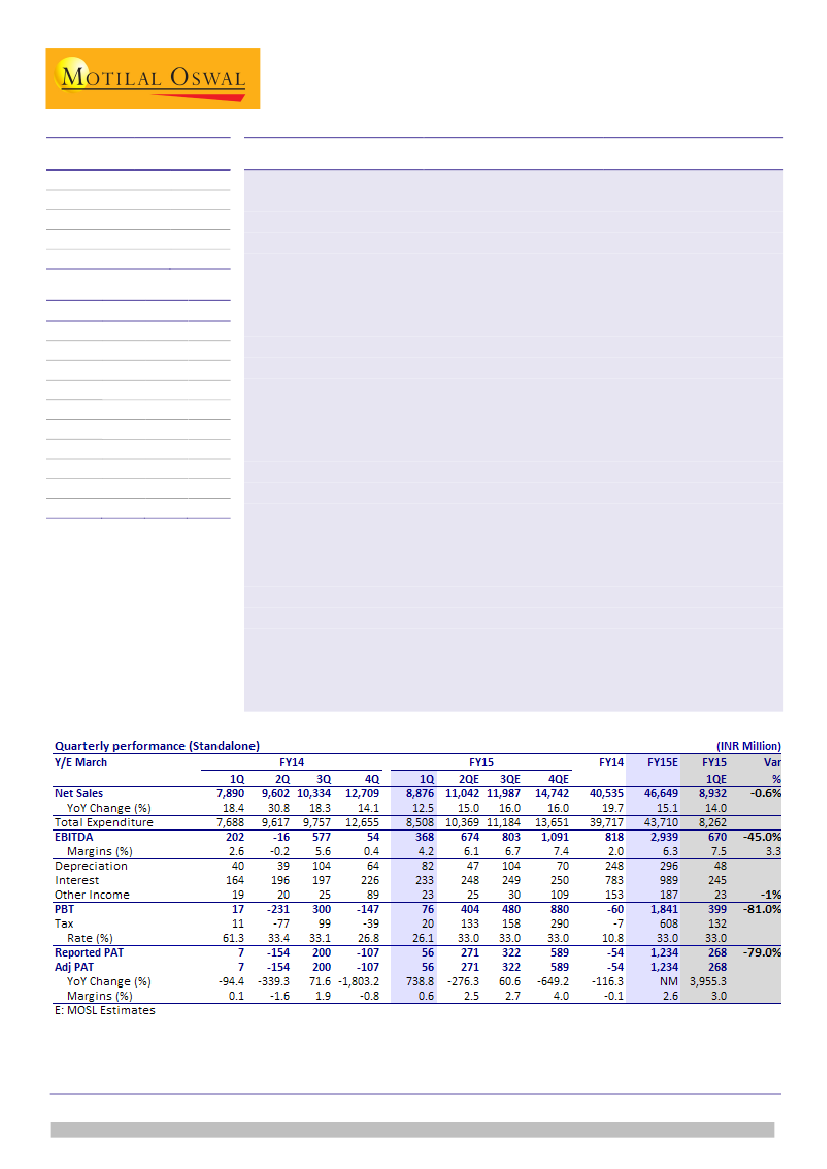

Growth in line; margins below expectation:

Bajaj Electricals (BJE) reported

revenue of INR8.9b (est. of INR8.9b), compared to INR7.8b in 1QFY14, marking a

YoY growth of 12.5%. Consumer Durables reported strong 16% growth, while

Lighting and E&P division’s growth was weak this quarter at 7.2% and 7.4%

respectively. EBITDA margin for 1QFY15 stood at 4.2% (est. 7.5%), against 2.6% in

1QFY14. While E&P reported better margins at -2.8%, against -13.7% in 1QFY14

(-4.7% 4QFY14), margins were below expectations due to unfavorable operating

leverage. Margins for Lighting (1.5% v/s 4.9%) were weak due to a sharp decline in

CFL business, which de-grew by 13% this quarter. Consumer Durables margins

recovered on a QoQ basis (6.9% v/s 3.6%), though on a YoY basis were weak (6.9%

v/s 9.2%) due to competitive pressure faced in Fans and Morphy Richards.

E&P turnaround on track:

BJE’s management maintained its guidance of 25%

growth in E&P business for FY15, with each of the next three quarters witnessing

progressive growth. Management expects 2Q revenue at INR3b, 3Q revenue at

INR4b and 4Q revenue at INR6b respectively. Similarly, it is confident of posting

6% EBIT margin (est 4%) in E&P division for FY15 and RoCE of 20%.

Consumer Durables outlook strong, Lighting segment to remain subdued:

We

believe BJE’s Consumer Durables division will continue to report robust growth in

FY15 and expect 15% revenue growth from the same. Lighting segment is

expected to remain under pressure due to accelerated shift from CFL (erstwhile

high growth, high margin for BJE) to LED (where it has negligible market share).

We expect Lighting to post 10% revenue growth in FY15E with stable margins YoY.

Valuation and view:

With the expected turnaround of E&P business, we believe

BJE’s valuation gap with peers will narrow down. We cut the EPS estimates for

FY15E and FY16E by 33% and 15% respectively to factor lower margins. We value

BJE at 18x FY16E EPS of INR19 and arrive at a target price of INR350. Maintain

Buy.

Atul Mehra

(Atul.Mehra@MotilalOswal.com); +91 22 3982 5417

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Investors are advised to refer through disclosures made at the end of the Research Report.