31 July 2014

1QFY15 Results Update | Sector:

Technology

HCL Technologies

BSE SENSEX

25,895

Bloomberg

S&P CNX

7,721

HCLT IN

CMP: INR1,555

TP: INR1,750

Buy

Equity Shares (m)

700.1

M.Cap. (INR b) / (USD 1,129.0/18.8

b)

52-Week Range (INR)

1,624/838

1, 6, 12 Rel. Per (%)

2/-20/32

Financials & Valuation (INR Billion)

Y/E June

Sales

EBITDA

PAT

EPS (INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

EV/EBITDA

2015E 2016E 2017E

363.2

91.4

71.5

100.5

11.5

370.1

35.6

30.2

15.5

10.4

412.7

101.4

81.7

114.1

13.5

458.2

31.4

27.6

13.6

8.9

461.7

109.1

88.8

123.8

8.5

556.1

27.5

24.6

12.6

7.7

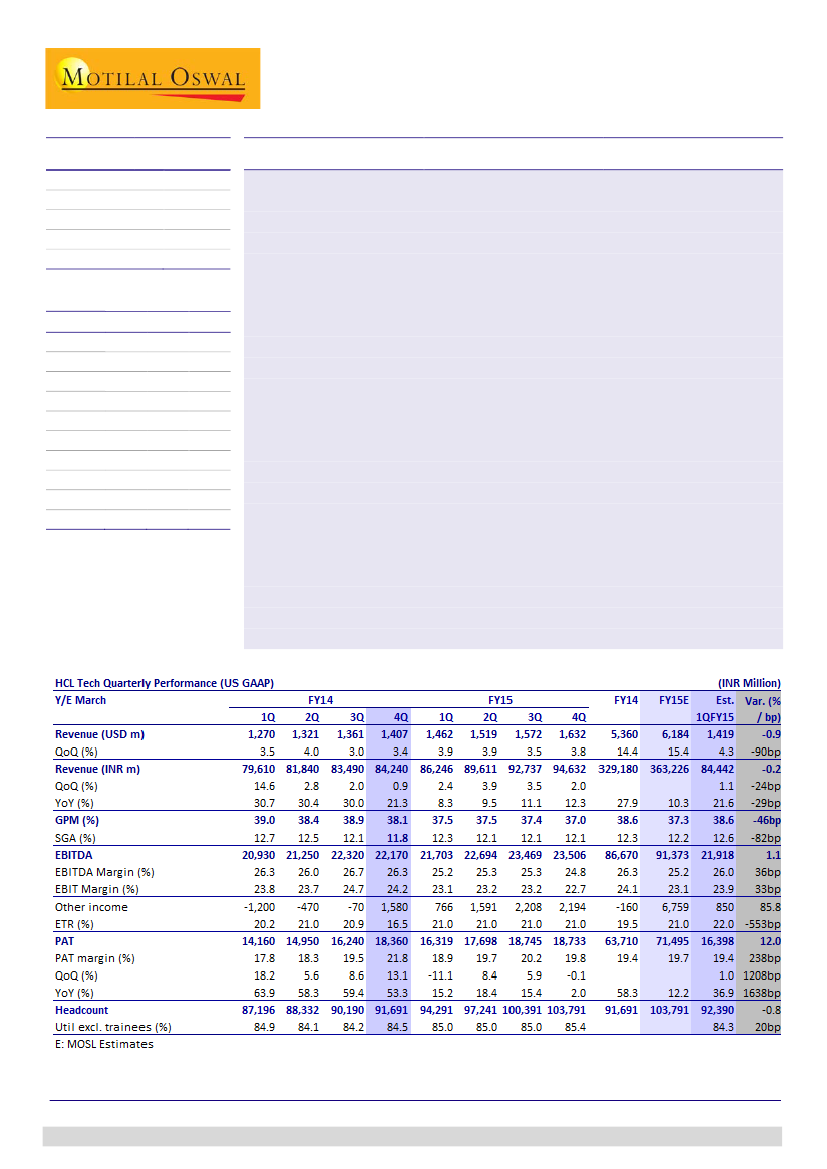

Revenue below estimate on lower IMS growth:

HCL Tech’s 4QFY14 USD revenues

grew 3.4% QoQ to USD1,407m (marginally below estimate of 4.3% QoQ growth to

USD1,419m). In constant currency, revenue grew 2.8% QoQ, v/s estimate of 3.8%

QoQ. EBITDA margin was 26.3%, -40bp QoQ (in line with estimate of 26%, -70bp

QoQ) – as lower gross margin (38.1% v/s estimate of 38.6%) was offset by SGA (at

11.8% v/s estimate of 12.6%). PAT at INR18.34b grew 13.1% QoQ, above estimate

of INR16.4b, +1% QoQ), due to lower tax rate of 16.5%, v/s estimate of 22%, and

also higher other income (INR1.6b including forex loss, v/s estimate of INR0.85b).

Healthy growth in deal signings YoY:

HCLT has signed 50+ transformational

engagements totaling over USD 5b in TCV in FY14. This compares with USD3b+ in

FY13, lending healthy visibility on revenue growth acceleration.

Peers catch up on IMS growth, expect Software Services growth to improve:

Acceleration at peers and deceleration at HCLT in IMS have meant that the growth

rates are now similar (QE June 2014 YoY – TCS: +24%, INFO: +21%, HCLT: +26%).

However, HCLT guided for software services growth to get stronger in FY15

facilitated by ramp ups in the deals won during the year.

Growth visibility intact, Maintain BUY:

We retain our estimates post the results,

and expect HCLT to accelerate growth on the back of continued traction in deal

wins. While the profitability for the company may cool off going forward, our

FY16E EBIT margin estimate of 22.4% is 170bp lower than FY14, building cushion

for multiple headwinds. We expect HCLT to grow its USD revenues at a CAGR of

15% over FY14-16E and EPS at a CAGR of 13% during this period. Our target price

of INR1,750 discounts FY16E by 15x. Buy.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Siddharth Vora

(Siddharth.Vora@MotilalOswal.com); +91 22 3982 5585

Investors are advised to refer through disclosures made at the end of the Research Report.