6 August 2014

1QFY15 Results Update | Sector:

Automobiles

Amara Raja Batteries

BSE SENSEX

25,665

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,672

AMRJ IN

170.8

88.2/1.4

520/208

5/21/97

Financials & Valuation (INR Million)

Y/E March

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

BV/Sh (INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015E

7,286

4,186

24.5

13.1

98.0

27.6

38.5

21.1

5.3

2016E

2017E

42,092 51,048 59,612

9,153 10,704

5,314

31.1

27.0

121.2

28.4

40.0

16.6

4.3

6,376

37.3

20.0

149.0

27.6

39.2

13.8

3.5

CMP: INR517

TP: INR560

Buy

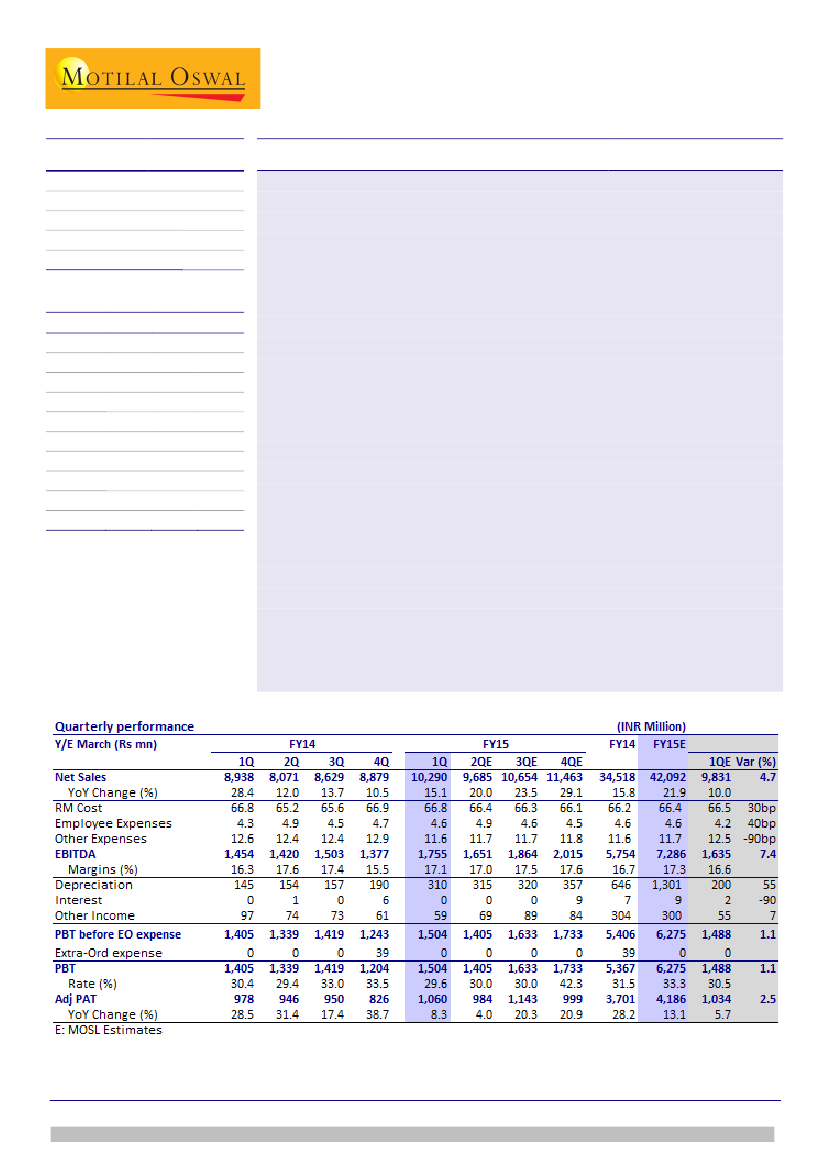

Strong operational performance, outlook remains robust

AMRJ’s 1QFY15 operational performance was above expectation driven by

higher-than-expected revenue and margins.

Net sales grew 15.1% YoY (+15.9% QoQ) to INR10.3b (est. of INR9.8b).

EBITDA margin at 17.1% (est. 16.6%) improved by 80bp YoY/160bp QoQ.

Other expenditure declined 130bp QoQ (100bp YoY) driven by lower share of

home UPS (trading business) and cost reduction measures (particularly for

power & fuel).

Despite the robust 20.7% YoY EBITDA growth, PAT growth was restricted to

8.3% to INR1.06b (est. INR1.03b) on higher depreciation charge (as per the

provisions of new Companies Act).

Takeaways from management interaction:

Robust volume growth in industrial (22%

YoY) and 2Ws (78% YoY). 4W volumes grew 2% YoY, with OEM growth of 3%. 15%

growth in 4W replacement demand was offset by a decline in demand in private

label manufacturing. Exports grew 20% (~5% of revenue). Demand outlook remains

robust across segments. Margin guidance of 16-16.5% levels as cost pressures are

fairly benign. Capacity expansion plans on track and expect to gain market share.

Capex guidance of INR5b/1.5-2b for FY15/16 respectively.

Upgrade earnings and target price, maintain Buy:

Considering superior 1Q

performance and improved business outlook, we upgrade FY15E/16E EBITDA by

5%/6.8%; though EPS upgrade is restricted to 1.8%/3.2% on higher depreciation

charge. The stock trades at 21.1x/16.6x FY15E/16E EPS of INR24.5/31.1 respectively.

Maintain

Buy.

Chirag Jain

(Chirag.Jain@MotilalOswal.com); +91 22 3982 5418

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Investors are advised to refer through disclosures made at the end of the Research Report.