11 August 2014

1QFY15Results Update | Sector:

Healthcare

Divi's Laboratories

BSE SENSEX

25,519

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel.Per (%)

S&P CNX

7,626

DIVI IN

132.7

1,549/920

1/-14/20

CMP: INR1,512

TP: INR1,575

Buy

M.Cap. (INR b) / (USD b) 200.7/3.3

Financials & Valuation (INR Million)

Y/E MAR

Net Sales

EBITDA

Adj PAT

Adj.EPSINR)

Gr.(%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015E 2016E 2017E

29,492 35,472 42,613

11,840 14,224 17,002

8,570 10,395 12,495

64.6

11

259

26.8

34.2

23.4

5.8

78.3

21

298

28.1

35.9

19.3

5.1

94.1

20

345

29.3

37.4

16.1

4.4

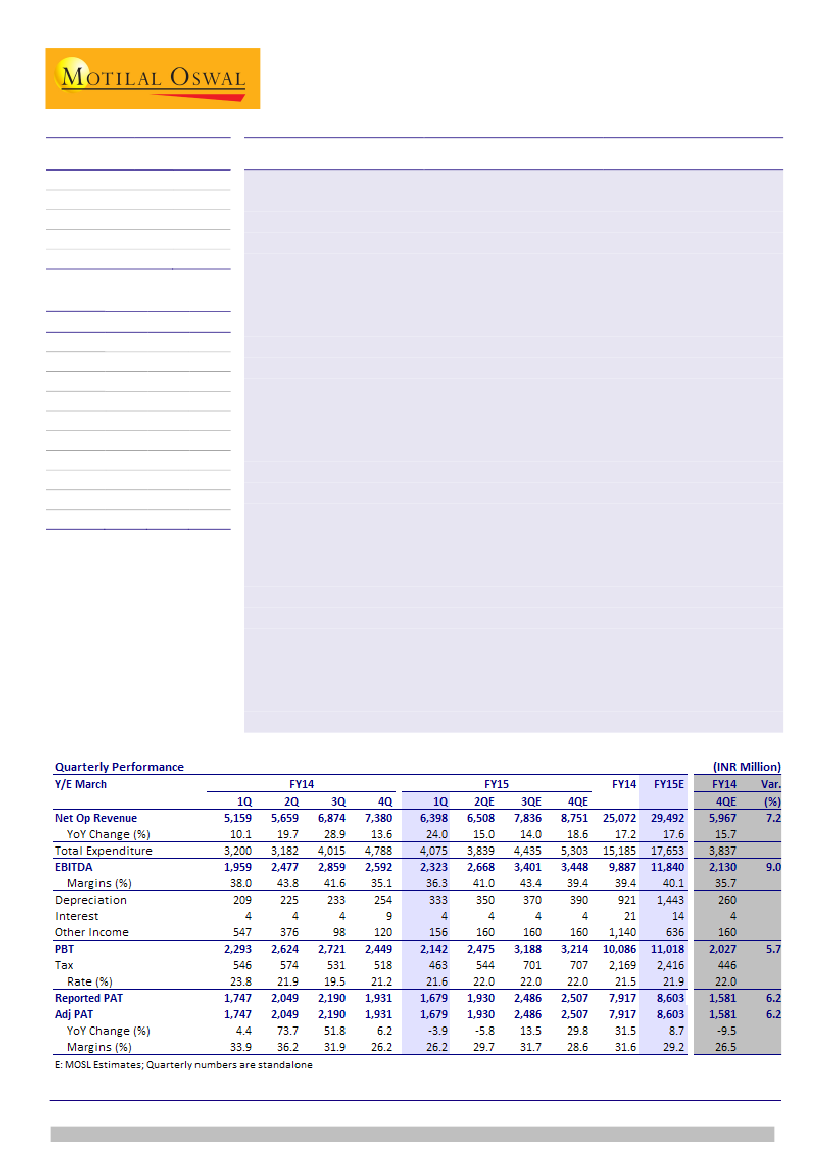

Divi’s Labs 1QFY15 results were above estimates. Revenues grew 24% YoY to

INR6.4b (7% beat), while EBITDA grew 19% YoY to INR2.3b (9% beat). PAT

declined 4% YoY to INR1.7b (6% beat). There was a forex gain of INR10m included

in other income compared to INR430m in 1QFY14, resulting in a YoY decline in

PAT. Adj for the forex gains, PAT growth is 24%.

Growth was led by healthy performance in both CRAMS as well as API business.

All the five blocks at the DSN SEZ have been inspected by the US FDA and the

capacity utilization has increased to 75%. Divi’s is seeing a sequential

improvement in volume growth over the last few quarters.

EBITDA margin contracted 170bp YoY to 36.3%, but was higher than our est.

35.7%. The revenue mix continued to be skewed towards low-margin API

business. This led to 450bp YoY decline in gross margins. However, lower

employee costs and other expenses as % of sales brought in benefits of operating

leverage.

FY15 guidance:

The management has maintained the FY15E revenue growth

guidance at 20% (on constant currency basis) and EBITDA margin guidance at

40%. Revenue would grow as capacity utilization at DSN SEZ is expected to

increase from current 75% to 80-85% by end of the year. The capex guidance

stands at INR700-800m (apart from INR1940m addition from CWIP), while tax

rate guidance is maintained at 22%.

Post the 1QFY15 results, we have largely retained our earnings estimates for FY15-

FY17. Divi’s has a robust business model with significant barriers to entry. While this

model is likely to have q-q lumpiness, the longer term outlook is very encouraging.

Though current valuations have limited upside to our target price, we believe Divi’s

estimate may surprise positively over the next two quarters as it is likely to be a key

player in the generic supply of Diovan in US. We re-iterate Buy with a revised TP of

INR1,575 (20x FY16E EPS).

Alok Dalal(Alok.Dalal@MotilalOswal.com);+91

22 3982 5584

Hardick Bora(Hardick.Bora@MotilalOswal.com);+91

22 3982 5423

Investors are advised to refer through disclosures made at the end of the Research Report.