11 August 2014

1QFY15 Results Update | Sector:

Oil & Gas

MRPL

BSE SENSEX

25,519

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,626

MRPL IN

1,752.6

81/26

-4/31/79

CMP: INR64

TP: INR65

Neutral

M.Cap. (INR b) / (USD b) 112.9/1.8

Financials & Valuation (INR Billion)

Y/E Mar

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

BV/Sh.

(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2015E 2016E 2017E

742.8

18.3

7.3

4.2

22.2

43.6

10.0

7.2

15.4

1.5

757.8

33.0

14.1

8.0

91.8

49.8

17.2

15.6

8.0

1.3

735.8

34.1

15.1

8.6

7.1

56.4

16.2

15.0

7.5

1.1

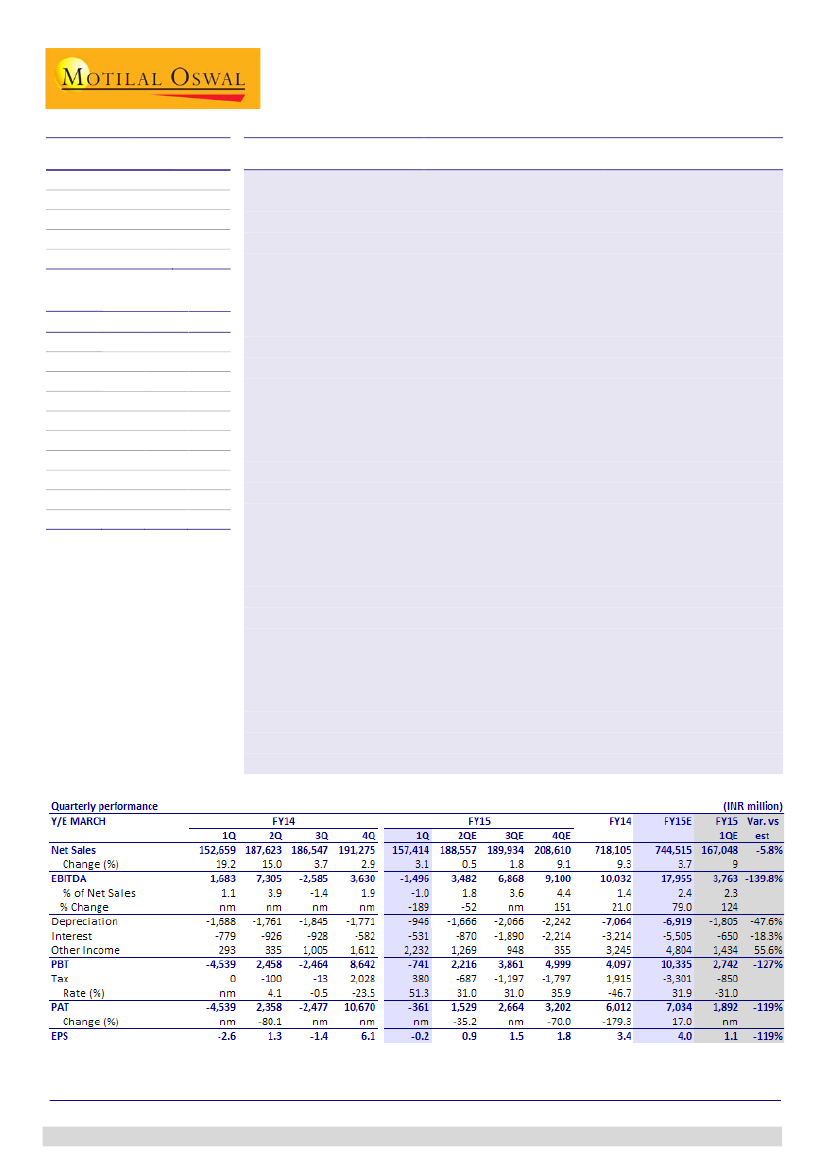

MRPL’s reported 1QFY15 EBITDA loss at INR-1.5b (est INR3.8b) was below estimate

led by GRM of USD0.66/bbl due to higher F&L (est USD3.4/bbl), and higher opex of

USD1.5/bbl (est of USD1.0/bbl). Reported net loss stood at INR-361m led by (a)

higher other income of INR2.2b, and (b) INR380m tax gain.

GRM at USD0.66/bbl impacted by integration issues:

MRPL reported GRM at

USD0.66/bbl (v/s 1QFY14 GRM of USD2.9/bbl and USD3.2/bbl in 4QFY14) was

lower than our estimate of USD3.4/bbl, due to higher Fuel and losses. Throughput

at 3.2mmt (est. of 3.35mmt) declined due to planned shutdown in the quarter. The

opex at USD1.5/bbl was higher than our estimate of USD1.0/bbl, due to power

plant commissioning and downstream unit shutdown.

MRPL’s Phase III project (INR150b) progress stands at 99.74% v/s 99.68% as on

April, 2014. Post the commissioning of DCU (Delayed Coker Unit), MRPL has been

selling petcoke from April 2014. PFCCU (Petro Fluidized Catalytic Cracking unit) and

the remaining one out of three trains of SRU (Sulphur Recovery Unit) is expected to

be completed in August 2014.

Higher other income at INR2.2b (7.6x YoY, +39% QoQ) due to complexity in Iran

crude purchase payment. MRPL expects to pay the remaining amount in the

coming quarters.

Polypropylene project progress is 96.3% v/s 95.6% in 4QFY14, and commissioning is

expected by 3QFY15 (v/s earlier estimate of 2QFY15).

We expect that post the commencement of full operations, benefit of high

complexity refinery will be seen from 3QFY15.

GRM outlook subdued:

While the near term GRM’s are expected to remain range-

bound, medium term outlook remains subdued due to refinery capacity additions

exceeding oil demand growth.

Valuation and view

MRPL being a standalone refiner is highly sensitive to GRM. For variation of USD1/bbl

in GRM, FY16 EPS changes ~30%. The stock trades at FY16E P/E of 8x and EV/EBITDA

of 5.3x. Neutral.

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Nitish Rathi

(Nitish.Rathi@motilaloswal.com); +91 22 3982 5558

Investors are advised to refer through disclosures made at the end of the Research Report.