11 August 2014

Lakshmi Machine Works

spotlight

The Idea Junction

Stock Info

Bloomberg

LMW IN

CMP (INR)

3,738

Equity Shares (m)

11.3

M.Cap. (INR b)/(USD b)

42.6/0.7

52-Week Range (INR) 4,019/1,726

1,6,12 Rel. Perf. (%)

-3/11/73

Best early cycle play in Indian textiles

Dominant presence with 60% market share

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

NP

EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

EV/Sales (x)

RoE (%)

RoCE (%)

2015E 2016E 2017E

28.4 33.8 39.9

3.6

4.5

5.3

2.6

3.4

4.3

229.8 300.9 385.5

32.9 30.9 28.1

1,163 1,392 1,681

16.3

3.2

8.4

1.1

21.4

30.6

12.5

2.7

5.9

0.8

23.6

33.7

9.7

2.2

4.0

0.5

25.1

35.8

Lakshmi Machine Works (LMW) is among the best plays on textiles capex in India. It

commands a 70% volume market share and 60% value market share in India and has

been able to defend its market share despite entry of global players like Rieter (15%),

Truzler (13%) and other Chinese players.

Indian textiles sector is poised for strong growth. Multiple factors aiding India's structural

advantage include: 1) raw material availability - strong self-sufficiency in cotton, 2)

competitive cost with lowest wage structure, 3) competitive currency - INR has

depreciated by 35% against Yuan and 4) supportive government policies.

Order book of INR33.5b translates into a book to bill of 1.6x FY14 revenue, which

provides strong revenue visibility. We expect earnings to post a CAGR of 31% over

FY14-17E. LMW trades at a PE multiple of 16.3x FY15E and 12.5x FY16E earnings.

Market leader in textile machinery, with 60% value market share

Globally, LMW is one of the only three players that manufactures the entire

range of spinning machinery, making it one of the biggest manufacturers of yarn

spinning machinery in the world. LMW commands 70% volume market share and

60% value market share in India and has been able to defend its market share

despite the entry of global players like Rieter (15%), Truzler (13%) and other

Chinese competitors. LMW has many advantages over competition, including

cost competitiveness, strong after sales network, a huge customer base and world

class technology to manufacture products. Textile machinery can last for a period

of 25-30 years and many leading spinning companies regularly modernize their

machinery by replacing old machines with newer ones. Thus, there is a strong

secondary market for textile machinery. Indian textile players hence prefer LMW

over European and Chinese companies as LMW's spare parts are cheaper and also

as they are unsure of Chinese machinery's second hand value.

Shareholding pattern (%)

As on

Jun-14

Promoter 28.4

DII

23.8

FII

2.4

Others

45.5

Mar-14

28.4

23.1

2.6

46.0

Jun-13

28.3

23.7

1.6

46.3

Notes: FII includes depository receipts

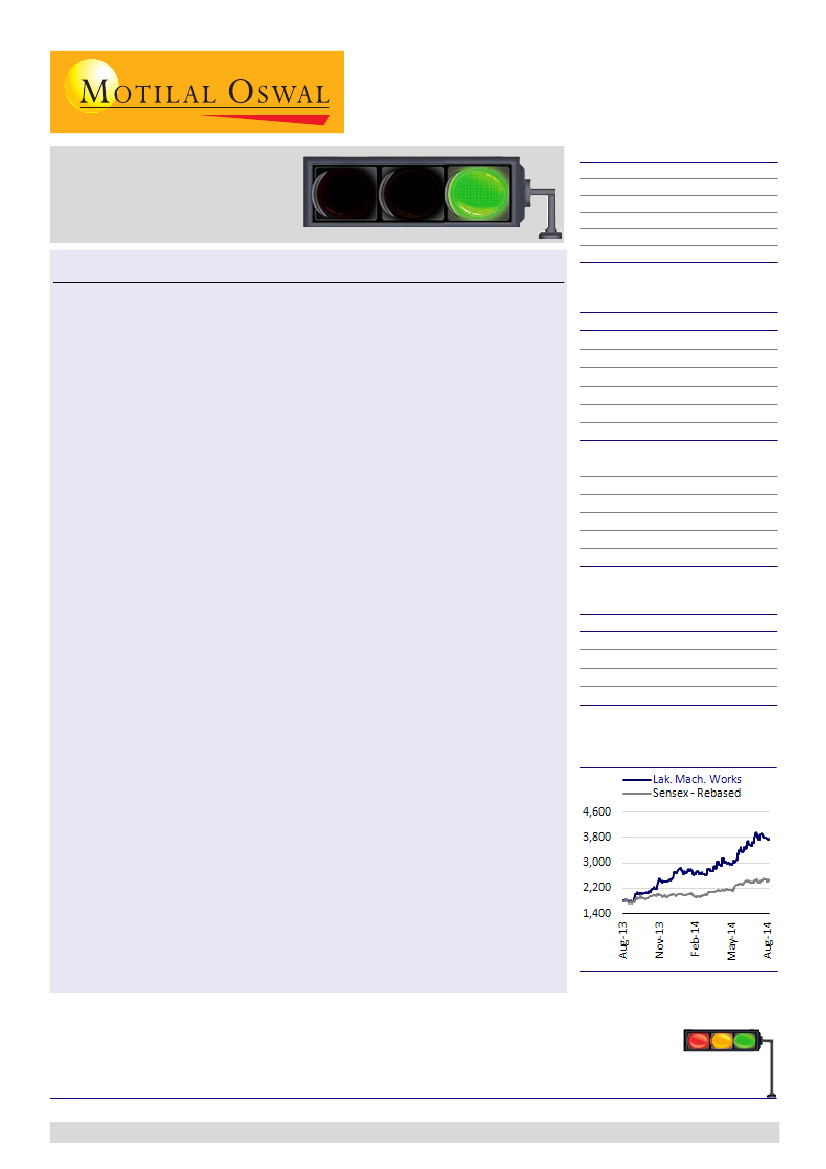

Stock performance (1 year)

Cost competitiveness and superior service network - biggest USPs

LMW's products are cheaper compared to European manufacturers due to lower

cost of production. On an average, LMW's machinery is 10-15% cheaper compared

to European competitors who have set up a base in India. LMW enjoys the

advantage of having set up capacities at historical low costs, while MNCs finding

a foothold in India have to bear the brunt of prevailing costs of capital investment.

Secondly, castings (substantial inputs used in the manufacture of textile

Spotlight

is a new offering from the Research team at Motilal Oswal. While our Coverage Universe

is a wide representation of investment opportunities in India, there are many emerging names in the

Mid Cap Universe that are not under coverage. Spotlight is an attempt to feature such mid cap stocks

by visiting such companies. We are not including these stocks under our active coverage at this point

in time. Motilal Oswal Research may or may not follow up on stocks under Spotlight.

Atul Mehra

(Atul.Mehra@MotilalOswal.com); +91 22 3982 5417

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Investors are advised to refer through disclosures made at the end of the Research Report.

RED: Caution

AMBER: In transition

GREEN: Interesting

1