13 August 2014

1QFY15 Results Update | Sector:

Metals

Tata Steel

BSE SENSEX

25,919

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,740

TATA IN

971.2

579/224

0/17/87

CMP: INR535

TP: INR650

Buy

Below estimates; EPS cut; cash flow outlook intact

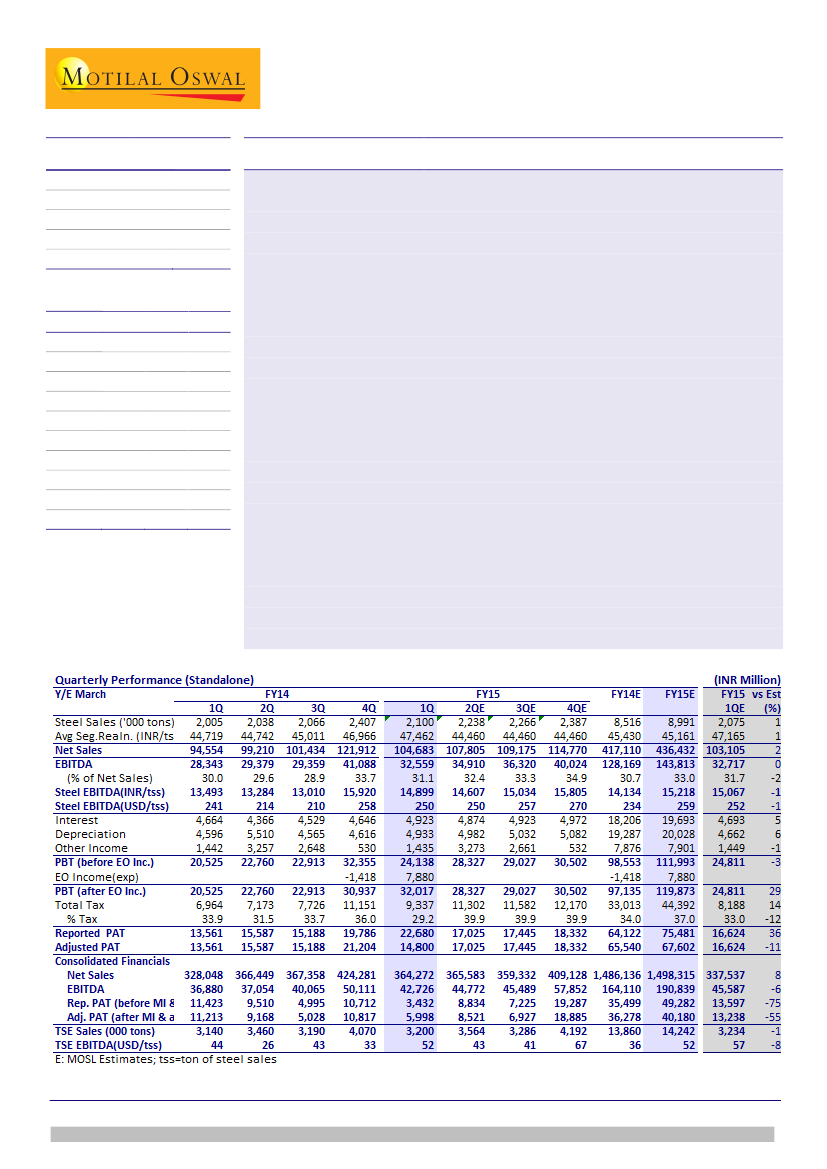

EBITDA below estimates on disappointment in subsidiaries:

consolidated EBITDA

increased 16% YoY to INR42.7b (v/s est. of INR45.6b). Indian operation’s (TSI)

EBITDA at INR32.6b (+15% YoY) was in-line on strong margins and volumes.

European operation’s (TSE) EBITDA increased 28% YoY to INR9.95b (v/s est. of

INR11b). TSE’s EBITDA per ton was respectful at USD52/t. The contribution from

other subsidiaries disappointed due to pressure from Chinese competition.

Higher interest depreciation & tax rate dragged PAT:

Depreciation charges were

7% higher than estimates pursuant to Companies Act 2013 becoming effective on

1st April, 2014. Interest cost increased 7% QoQ due to higher interest on term

loans. Consolidated PBT (before EO) increased 14% YoY (-32% QoQ) to INR16.9b,

23% below estimates as a combined effect of lower EBITDA, higher interest and

depreciation charges. Adjusted PAT declined 47% YoY (-45% YoY) to INR6b (v/s

est. of INR13.2b).

INR16b cash inflow from asset sales:

Extra-ordinary items dragged reported

consolidated PAT by net INR2.6b to INR3.4b. There was gain of INR13.1b (INR16b

net cash inflow during the quarter) on sales of investment in Dhamra Port and

impairment of INR15.7b towards investment in Mozambique coal mines.

EPS cut but cash flow outlook intact; Maintain Buy:

Although our consolidated

EBITDA estimates remain unchanged, there is a cut of 27%/ 24% in FY15/ FY16

EPS respectively due to higher interest and depreciation charge. The cash flow

outlook remains intact. Tata Steel is well positioned with new capacities in India

to capitalize on expected acceleration in demand growth. Maintain

Buy.

M.Cap. (INR b) / (USD b) 519.3/8.5

Financials & Valuation (INR Billion)

Y/E Mar

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

EV/EBITDA

( )

2015E 2016E 2017E

1,498.3 1,474.7 1,557.6

190.8

48.1

39.5

11.3

12.6

9.7

13.5

1.6

6.5

196.0

49.4

49.0

24.0

12.4

9.6

10.9

1.4

6.3

222.9

60.6

60.5

23.4

13.6

10.6

8.8

1.2

5.5

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Investors are advised to refer through disclosures made at the end of the Research Report.