Monday, May 19, 2014

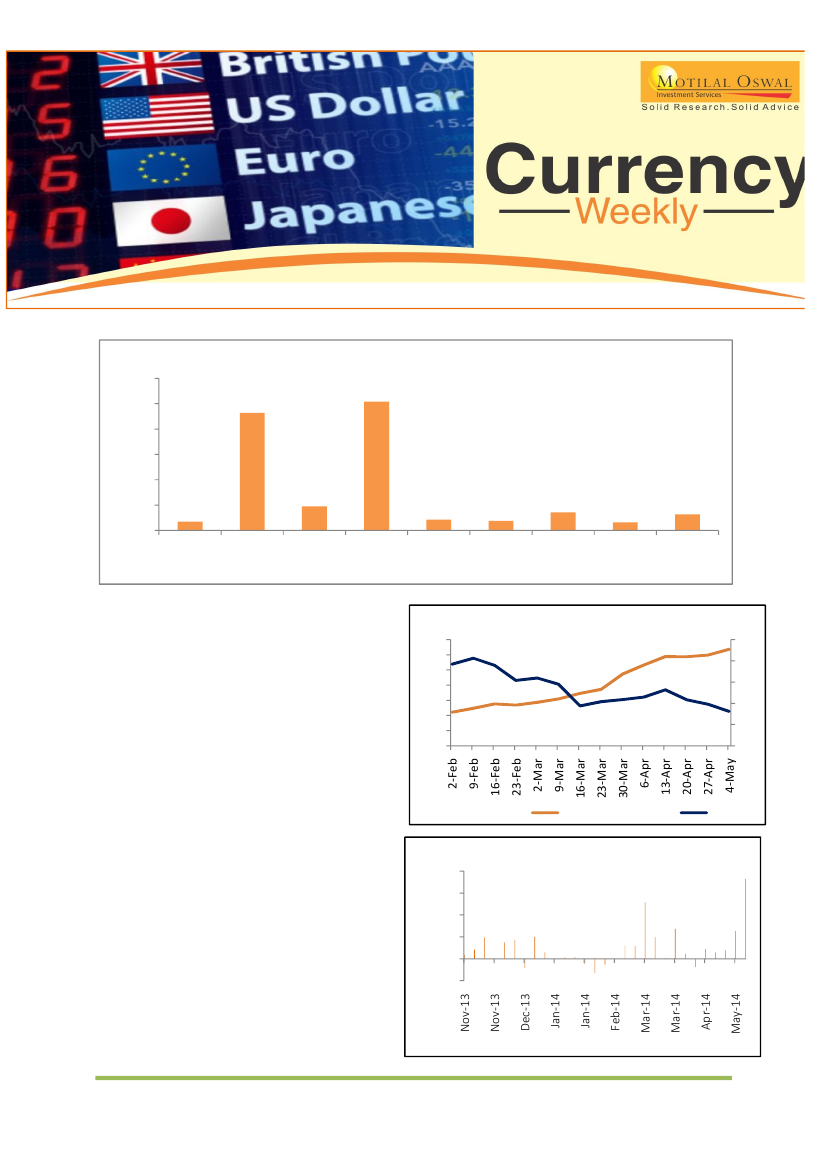

Major Global Currencies % change for the week

3.00%

2.50%

2.00%

1.50%

1.00%

0.47%

0.50%

0.00%

Dollar

Index

USDINR

EURUSD

EURINR

GBPUSD

GBPINR

USDJPY

JYPINR

EURGBP

0.18%

0.21%

0.19%

0.35%

0.16%

0.32%

2.32%

2.54%

Rupee strengthened to its highest level in 11 months

and posted its best weekly gain in eight months as the

BJP and its allies headed towards an overwhelming

majority in the country's elections. Foreign investors

have pumped in over Rs 1 lakh cr in the Indian stock

market since Narendra Modi was announced as the PM

candidate by BJP in September last year. In 2014

alone, FIIs have infused a net amount of over

Rs.74,000 Cr in the domestic market, which included

more than Rs.41,000 Cr in equities and nearly

Rs.33,000 Cr in the debt.

US dollar traded high against major global currencies

last week, after the report showed that US housing

starts rose 13.2% last month, after a 2.0% increase in

March. It was the largest increase in five months,

indicating that the economy is shaking off the effect of

a weather related slowdown over the winter. The

upbeat housing data was overshadowed by a report

showing that consumer confidence in the US

deteriorated this month. The University of Michigan's

consumer sentiment index dropped to 81.8, from 84.1

the month before.

Rupee Vs Domestic Forex Reserves

315

310

305

300

295

290

285

280

63

62

61

60

59

58

Source: Reuters

India Forex Reserves

USDINR

FII Flows weekly

40000

30000

20000

10000

0

-10000

Source: Reuters

Please refer to the disclaimer at the end of the report.