17 October 2014

2QFY15 Results Update | Sector:

Financials

Axis Bank

BSE SENSEX

26,109

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,780

AXSB IN

2,359.8

424/202

3/22/56

CMP: INR402

TP: INR527

Buy

M.Cap. (INR b) / (USD b) 948.5/15.4

Financials & Valuation (INR Billion)

Y/E Mar

NII (Rs b)

OP (Rs b)

NP (Rs b)

EPS (Rs)

EPS Gr. (%)

BV/Share

P/E (x)

P/BV (x)

RoE (%)

RoA (%)

2015E 2016E 2017E

141.0

131.5

73.4

31.2

18.0

188.3

12.9

2.1

17.8

1.8

162.7

152.5

86.3

36.7

17.6

219.6

10.9

1.8

17.9

1.8

192.9

181.3

101.6

43.3

17.7

256.3

9.3

1.6

18.1

1.7

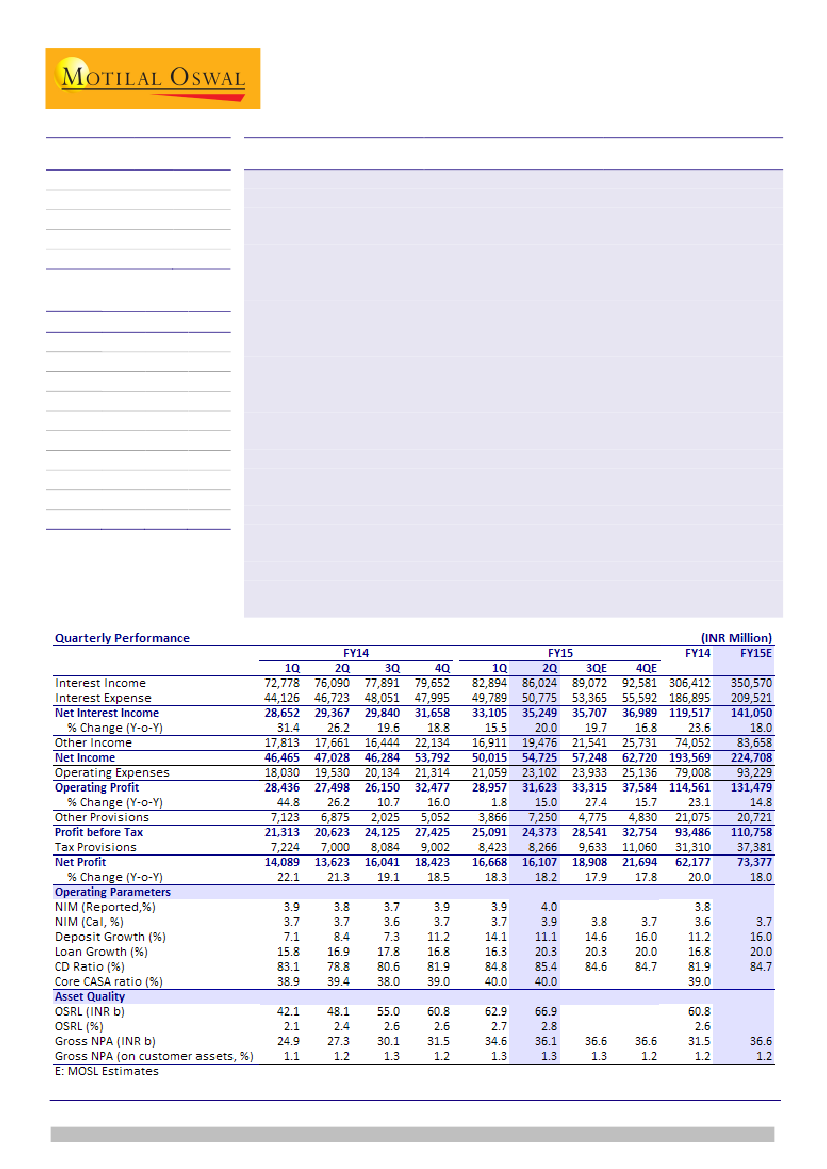

Axis Bank’s (AXSB) 2QFY15 PAT was in line with estimate at INR16.1b (18% YoY).

Higher-than-estimated NIM (+10bp QoQ) compensated for higher provisions.

While overall fees growth remained muted at 11% YoY, retail fees continued to

show strong traction and grew 32% YoY (ex retail, fees grew just 1% YoY).

Gross stress additions increased to INR14.8b (2.9% of loans) v/s INR11.1b in

1QFY15. Aided by strong operating profit, AXSB aggressively provided for NPL

(1.1% credit cost). Led by higher write-offs (INR5.7b), calc.PCR was stable at ~67%.

Strong control over cost of funds (stable QoQ) and improvement in yield on funds

(+10bp QoQ) drove NIM expansion. Despite 70%+ of the incremental loan growth

during the quarter being driven by corporate and international business,

improvement in yield on funds is impressive.

Other highlights:

(1) Avg. daily SA deposit growth of 19% YoY, (2) Avg. daily CASA

ratio was flat QoQ at 40%, (3) Loans grew 20% YoY and 5% QoQ led by strong

growth in corporate and international loans (8% QoQ and 13% YoY), (4) Retail

loans grew 4% QoQ and 27% YoY and (5) Fund-based exposure to Metals and Infra

increased to 18.25% v/s 17.4% a quarter ago.

Maintain Buy:

AXSB has utilized the last three years to build capacity and is geared to

ride the next growth cycle with strong capitalization (12.6% Tier I), healthy RoA (1.7%)

and expanding liability franchise (2,505 branches). While gross slippages and fresh

restructuring increased QoQ in 2QFY15, stress additions are expected to be

manageable. While high exposure to Infra remains a risk, reforms in this space could

ease the pressure. Contingency provisions of INR7.8b (32bp of loans), PCR of 78% and

75bp of credit cost factored in the estimates over FY15E/17E would provide a cushion

to earnings. Maintain

Buy.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Vallabh Kulkarni

(Vallabh.Kulkarni@MotilalOswal.com); +91 22 3982 5430

Investors are advised to refer through disclosures made at the end of the Research Report.