21 October 2014

2QFY15 Results Update | Sector:

Others

UPL

BSE SENSEX

26,576

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,928

UPLL IN

428.6

388/149

-4/35/86

CMP: INR327

TP: INR414

Buy

Margin declines, but gross debt continues to reduce

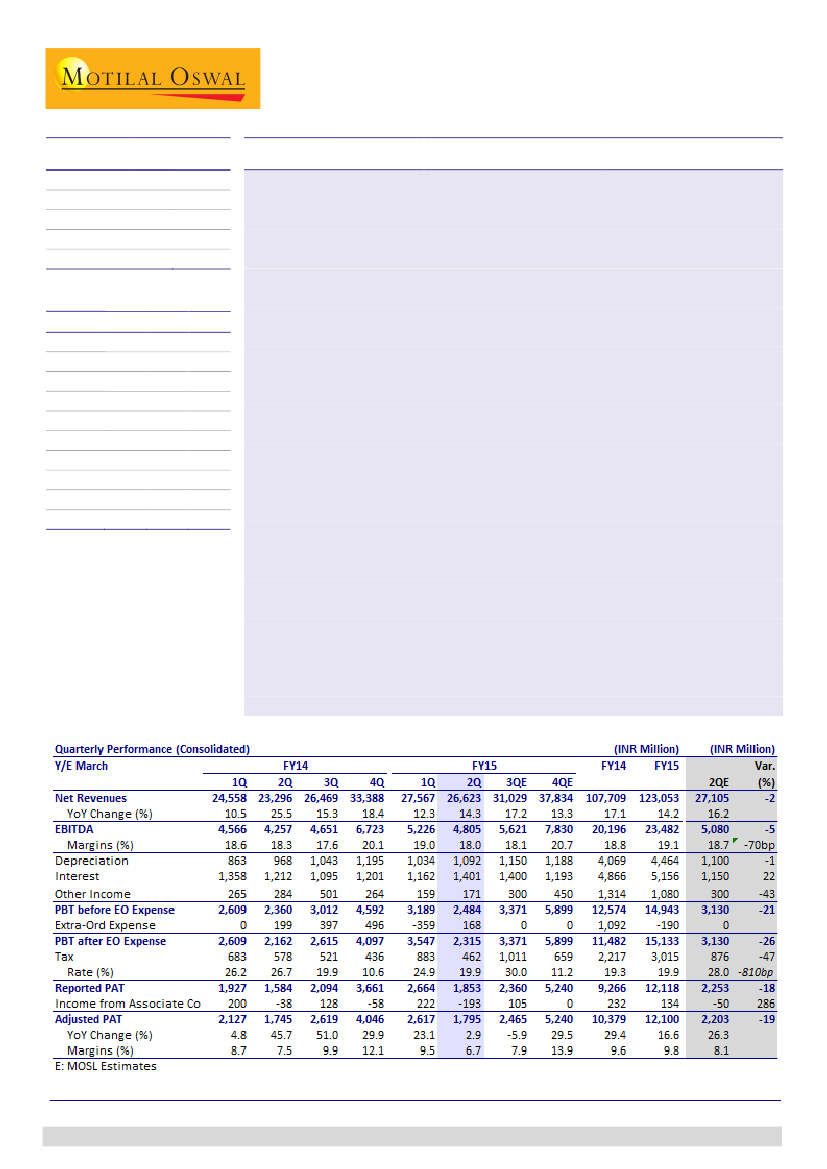

2QFY15 performance is below estimate with revenues of ~INR26.6b (v/s est

INR27.1b), EBITDA margins of 18% (v/s est of 18.7%), and adj. PAT growth of just

3% YoY to ~INR1.8b (v/s est INR2.2b).

Consolidated revenues grew by 14% YoY. India revenues grew of ~7.5% YoY and

international revenue growth of ~16%. International revenues were driven by 27%

growth in EU, ~30% growth in RoW and 20% growth in LatAm. US revenue

declined 12% YoY. While volumes grew ~15%, pricing grew 2% and forex impacted

growth by 2%.

Gross margins of 38.6% were highest in 14 quarters. However, higher other

expenses on promotion of branded products restricted EBITDA margins at 18% (-

30bp YoY). EBITDA grew 13% to ~INR4.8b (v/s est ~INR5.1b).

Working capital increased QoQ by 8 days to ~102 days (-7 day YoY), for inventory

build-up for LatAm. Gross debt reduced further by ~INR1b QoQ, but net debt

increased ~INR3.3b QoQ, due to working capital increase and dividend payout.

FY15 guidance maintained:

FY15 revenue growth of 12-15% (constant currency),

EBITDA margin of 19-20% and tax-rate of 22-25%. Capex maintained at ~INR5.5b.

Key highlights of the analyst meet:

a) US market has de-grew 3-5% due to soft

commodity prices leading to reduced input intensification, b) launched 2 new

products in US - Satellite (Pendimethalin) & Lifeline (Glufosinate), c) DVA Agro

(Brazilian subsidiary) margins are now comparable with average, but expected to

improve further driven by product mix and operating leverage, d) Low commodity

prices and devaluation of Brazilian Real is a concern for Brazil, and e) higher

market access expected through increased registrations in African countries.

We are downgrading our FY15/FY16 EPS by 4%/1% to INR28.2/34.5, to factor in

for higher other expenses and interest cost. The stock trades at very attractive

valuation of 11.6x/9.5x FY15/FY16 EPS and 2.2x/1.8x FY15/FY16 P/B. Maintain

Buy

with target price of INR414 (~12x FY16E EPS).

M.Cap. (INR b) / (USD b) 140.0/2.3

Financials & Valuation (INR Million)

Y/E Mar

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

2015E 2016E 2017E

123,053 138,890 157,237

23,482 27,031 31,397

12,252 14,795 18,017

28.2

16.6

21.0

21.5

11.6

2.2

34.5

22.3

177.3

21.3

23.1

9.5

1.8

42.0

21.8

215.3

21.4

24.2

7.8

1.5

BV/Sh.(INR) 146.9

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Investors are advised to refer through disclosures made at the end of the Research Report.