21 October 2014

2QFY15 Results Update | Sector:

Metals

JSW Steel

BSE SENSEX

26,576

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,928

JSTL IN

241.7

1,365/805

-7/-11/13

CMP: INR1,176

TP: INR1,678

Buy

Operating efficiencies continue to drive growth

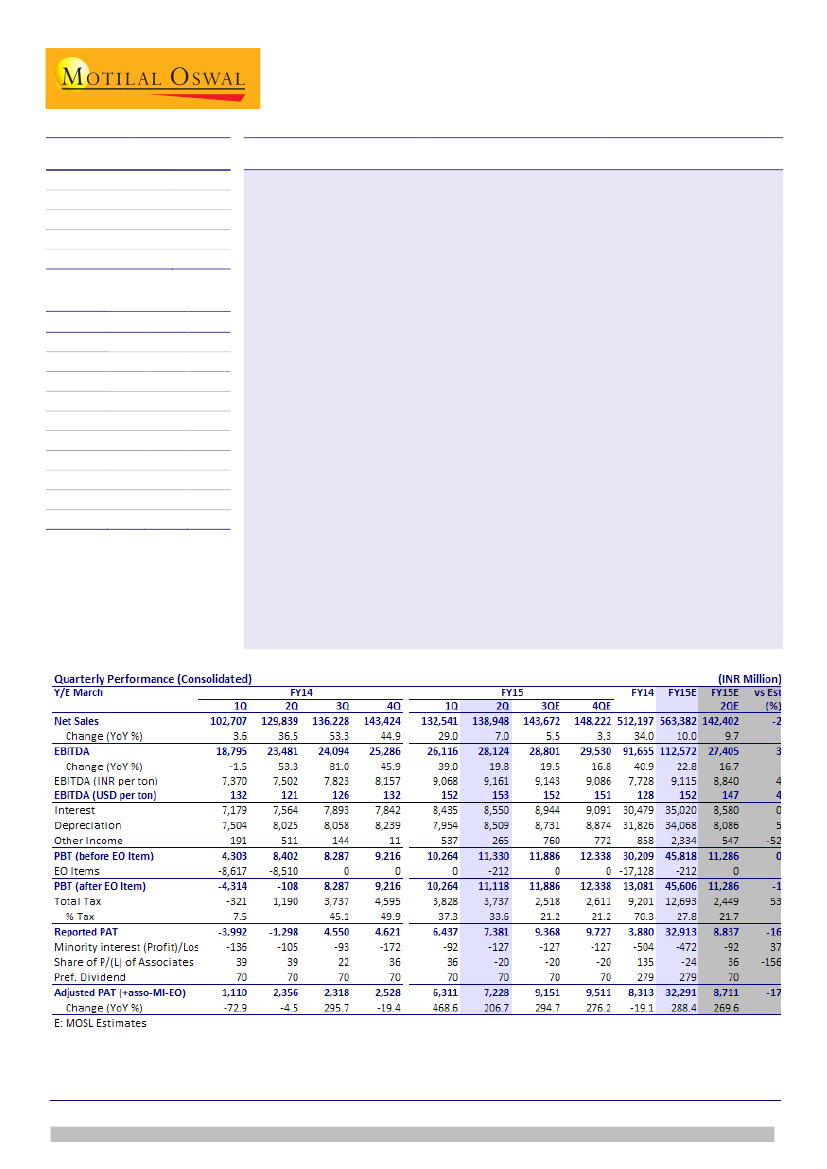

JSTL posted a good set of numbers, driven by operating efficiencies and higher

volumes. Consolidated pre-tax profit before exceptional items grew 10% QoQ (and

35% YoY), in line with our estimate. Growth was driven by lower coking coal cost,

efficiency gains from higher coke oven and pellet utilization, offset partly by lower net

blended realization (-2% QoQ). Consolidated EBITDA grew 8% QoQ to INR28.1b,

helped by better performance at subsidiaries.

Highlights:

While sales growth (4% QoQ) was below our estimate on lower-than-expected

realization, EBITDA was ahead (up 6% QoQ to INR26.2b) on higher efficiency

gains. The coke oven plant operated at 73% utilization while the pellet plant

operated at 65% utilization.

Standalone sales volume grew 7% QoQ along with improvement in value add mix

to 33% (from 29% in 1Q). Auto sales grew 13% QoQ.

EBITDA for subsidiary businesses grew 28% QoQ, driven by improved profitability

at Coated Products (despite lower realization) and Amba River Coke.

It took an investment write-off of INR1.9b – INR1.6b for its investment in US plate

mill and INR0.3b for advances relating to de-allocation of coal blocks.

Auction of category-C iron ore mines in Karnataka is expected before March 31.

We believe JSTL is well positioned, with market leadership in flat products, timely

investment in value addition, and operating efficiencies. It is the strongest contender

for closed category-C iron ore mines in Karnataka, whenever they come for sale. The

stock trades at an undemanding EV of 6.1x FY16E EBITDA. Maintain

Buy.

M.Cap. (INR b) / (USD b) 284.2/4.6

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

EV/EBITDA

( )

2015E 2016E 2017E

563.4

112.6

32.4

133.6

288.4

13.9

11.8

8.8

1.1

6.2

592.9

113.1

33.2

136.2

2.0

12.6

11.2

8.6

1.0

6.1

634.5

123.2

38.9

159.6

17.2

13.1

11.8

7.4

0.9

5.4

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com); +91 22 3027 8033

Investors are advised to refer through disclosures made at the end of the Research Report.