22 October 2014

2QFY15 Results Update | Sector:

Financials

Kotak Mahindra Bank

BSE SENSEX

26,787

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

7,996

KMB IN

771.3

820.9/13.4

1,086/631

3/13/22

CMP: INR1,064

TP: INR990

Neutral

Financials & Valuation (INR Billion)

Y/E MAR

NII

OP

NP

NIM (%)

EPS (INR)

EPS Gr. (%)

BV. (INR)

RoE (%)

RoA (%)

Payout (%)

Valuations

P/E(X) (Cons.)

26.6

2015E

42.3

28.9

18.0

4.7

39.9

20.7

275.0

15.6

1.9

2.9

2016E

50.6

35.1

21.9

4.6

48.9

22.6

322.5

16.4

1.9

2.9

21.7

3.3

3.4

0.1

2017E

61.8

43.8

27.3

4.6

59.8

22.4

380.5

17.0

1.9

2.9

17.7

2.8

2.8

0.1

P/BV (X)

(C

P/ABV)(X)

( Yield

Div. )

(%)

3.9

3.9

0.1

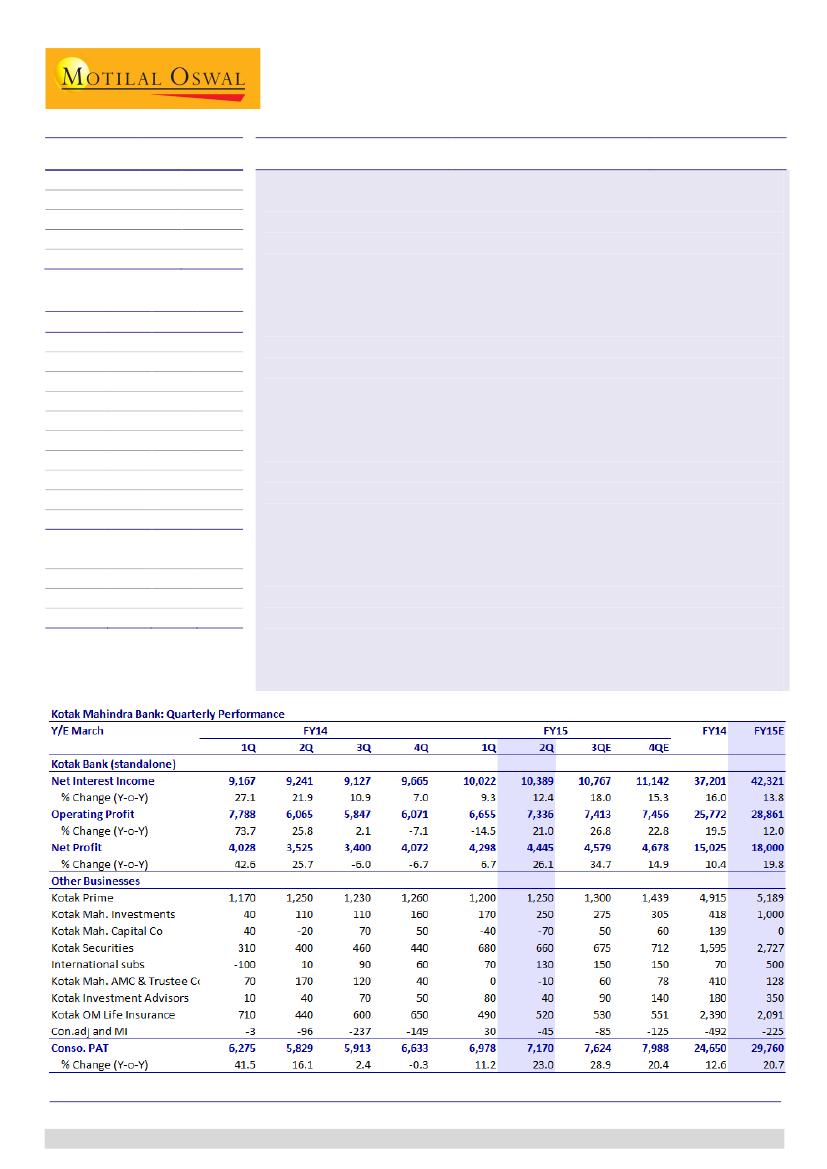

KMB’s 2QFY15 consolidated PAT grew 23% YoY to INR7.2b (in-line) led by

lending business PAT growth of 22% YoY to INR5.9b.

Standalone business:

Standalone PAT grew 26% YoY to INR4.4b (in-line). Fees

registered impressive growth of 51% YoY in 2Q and 44% YoY in 1HFY15.

Employee expenses grew 34% YoY due to ESoPs related accounting. Loans grew

20% YoY, though ex-CV it was healthy at 28% YoY, driven by strong growth of

43% YoY in corporate segment. CASA deposit grew 11% QoQ (37% YoY) and

CASA ratio was stable QoQ at 31%.

Other businesses:

(1) K-Sec market share declined 20bp QoQ to 2.7%, (2) car

disbursements grew 28% YoY to INR18.3b, (3) strong growth in LAS (NBFC)

business – customer assets up 3x YoY and 50%+ YTD, (4) asset management

AUM grew 9% YoY but declined 2% QoQ to INR657b and (5) average AUM for

Kotak AMC grew 5% QoQ and 7% YoY to INR378b, of which equity average AUM

was at INR52b (INR39b a quarter ago and INR29b a year ago).

Other highlights:

(1) consolidated NIM (5%) and GNPAs (including stress assets -

1.6%) were stable QoQ and (2) KMB acquired 15% stake in MCX.

Valuation and view:

Increasing evidence of improvement in macro-economic

conditions coupled with strong capital position (Tier I of ~17%), improved liability

profile and distribution, robust risk management system (stress loans at just 1.2%)

and strong presence across loan product segments place KMB in a strong position to

lever any growth opportunities. We raise the earnings estimates by ~4% to factor

the strong growth. Earnings CAGR of ~22% is expected over FY14-17E, while RoA and

RoE are expected to be ~1.9%/16%+. However, rich valuations of 3.3x FY16E

consolidated BV and 23x (at LPA) consolidated EPS limit the upside. Maintain

Neutral.

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Vallabh Kulkarni

(Vallabh.Kulkarni@MotilalOswal.com); +91 22 3982 5430

Investors are advised to refer through disclosures made at the end of the Research Report.