31 October 2014

2QFY15 Results Update | Sector:

Cement

JK Lakshmi Cement

BSE SENSEX

27,866

Bloomberg

Revenue in line as strong volume negated by weak realizations:

JK Lakshmi

Equity Shares (m)

117.7

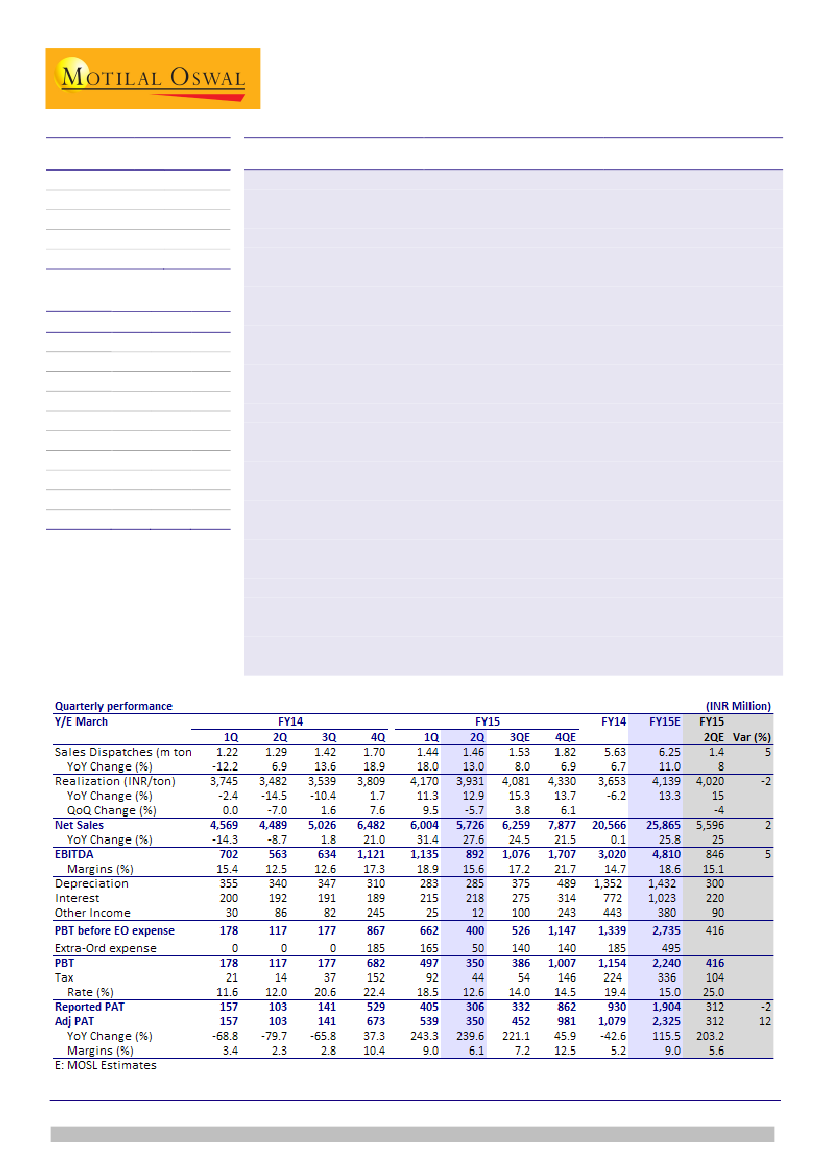

Cement’s (JKLC) 2QFY15 revenue grew by ~27.6% YoY to ~INR5.7b (v/s est.

M.Cap. (INR b)/(USDb)

43.2/0.7

INR5.6b), led by strong volume growth. Cement volumes grew 13% YoY (+1% QoQ)

52-Week Range (INR)

383/64

to 1.46mt (v/s est. 1.4mt), while realizations declined ~5.7% QoQ (+13% YoY) to

INR3,931/t (v/s est. ~INR4,020). Price moderation in north during August and

1, 6, 12 Rel. Per (%)

-3/194/412

September led to sequential decline in realizations in 2QFY15.

Financials & Valuation (INR Million)

Cost savings offset lower utilization; EBITDA/t up 40% YoY:

EBITDA grew by ~58%

YoY (-21% QoQ) to ~INR892m (v/s est. INR846m), translating into margin of 15.6%

Y/E MAR

2015E 2016E 2017E

(-3.3pp QoQ, +3.1pp YoY). EBITDA/ton stood at ~INR612 (v/s est. ~INR608),

Net Sales

25,865 33,471 40,791

declined ~INR176/t QoQ (+INR176/t YoY). Higher volume-led operating leverage

EBITDA

12,606 17,162 21,804

resulted in cost/ton to be lower-than-estimate and moderated 2% QoQ (+9% YoY).

AdjEPS (INR)

19.8 26.6 45.2

Adj PAT grew ~240% YoY (-35% QoQ) to ~INR350m (v/s est ~INR312m).

Gr.(%)

115.5 34.8 69.7

RoE (%)

16.9 19.7 27.0

Other updates:

The mother plant at Durg (clinker capacity 1.5mt and grinding

capacity of 1.7mt) is set to commence operations in 4QFY15, while the Orissa split

RoCE (%)

12.2 17.0 24.8

grinding unit (1mt) is yet to get the approval from Supreme Court (wildlife

P/E (x)

18.2 13.5

8.0

committee PIL) and is likely to commence operations by Mar 2016. Surat grinding

P/BV (x)

2.9

2.5

1.9

unit (0.7mt) has received the environment clearance and is expected to commence

EV/EBITDA

11.4

6.9

4.4

operations by 3QFY16. The next leg of capex plan will be evaluated after Durg

( )

EV/Ton(USD)

109

86

77

plant stabilizes over next two years.

Raise FY15E/16E EPS 14.5%/8.9%:

We revise (a) FY15E/16E volume growth

estimates to 11%/18% (v/s earlier 10%/15%), (b) realization estimates of

FY15E/16E to INR24 and INR20 per bag respectively (v/s earlier INR27 and INR15

per bag), (c) lower depreciation and interest cost for FY15E due to phasing out of

Durg capacity commencement till Mar 2016 and (d) lower tax rates (MAT credit). It

translates into 14.5%/8.9% upgrade in FY15E/16E EPS and a target price of INR427

(USD100 EV/t and implied FY16E EV/EBITDA of 8x). Maintain

Buy,

16% upside.

S&P CNX

8,322

JKLC IN

CMP: INR368

TP: INR427

Buy

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Investors are advised to refer through disclosures made at the end of the Research Report.