8 November 2014

2QFY15 Results Update | Sector:

Oil & Gas

Gujarat State Petronet

BSE SENSEX

27,869

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

8,337

GUJS IN

562.8

54.9/0.9

104/54

6/21/-30

CMP: INR98

TP: INR93

Neutral

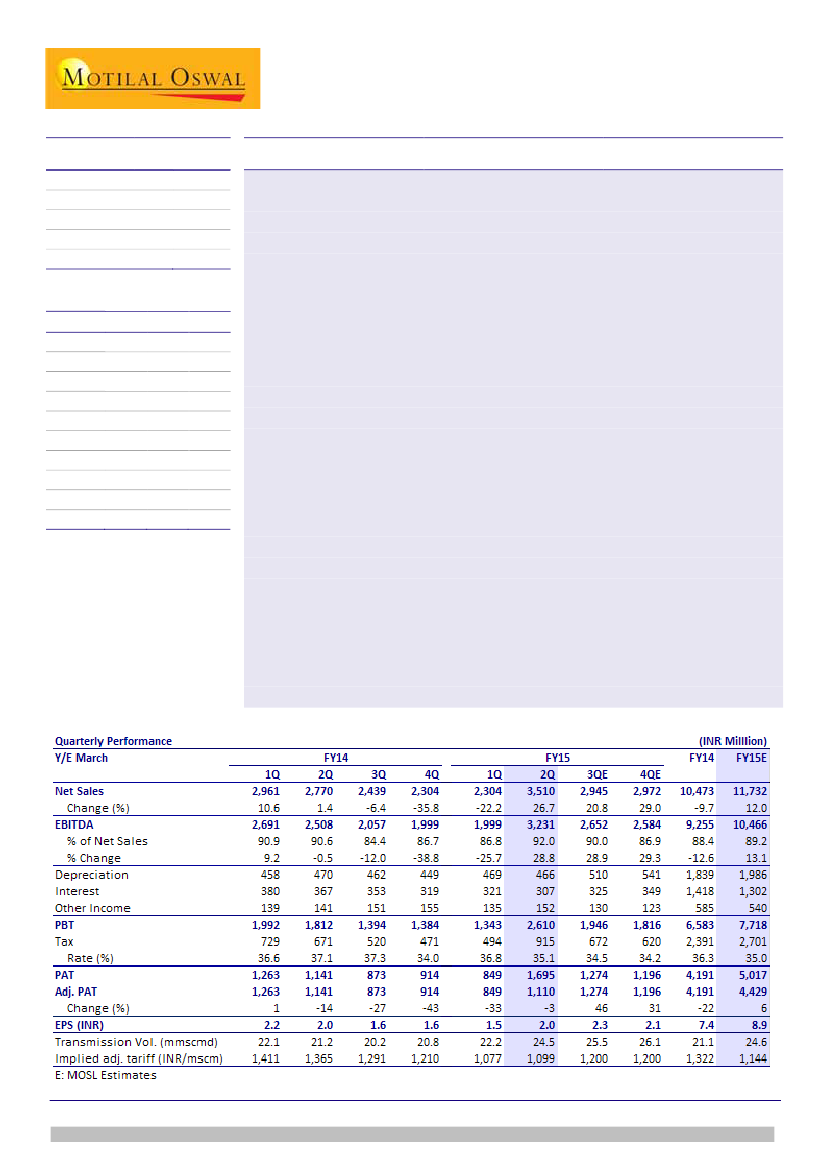

Gujarat State Petronet’s 2QFY15 reported net sales at INR3.5b included one-time

tariff write-back of INR0.9b. Adjusted revenues at INR2.6b (est. INR2.8b, (-6% YoY,

+13% QoQ), adj. EBITDA at INR2.3b (est INR2.5b; -7% YoY, +17% QoQ) were below

estimate due to lower than estimated adj. tariff at INR1,099/mscm (est.

INR1,175/mscm; -20% YoY, +2% QoQ). Adj. PAT stood at INR850m (v/s est INR1.1b;

-3% YoY, +31% QoQ).

Financials & Valuation (INR Billion)

Y/E Mar

Sales

EBITDA

Adj. PAT

Adj. EPS

(INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015E 2016E 20117E

11.7

10.5

4.4

7.9

5.7

66

14.3

18.0

12.4

1.5

12.1

10.6

5.3

9.5

20.1

75

13.4

16.7

10.3

1.3

12.8

11.2

5.7

10.2

7.5

84

12.9

16.3

9.6

1.2

Volumes revive 21% from 3QFY14 low; zonal tariff order implemented

n

n

n

2QFY15 transmission volumes stood at 24.2mmscmd (v/s est. 24.5mmscmd; -20%

YoY, +2% QoQ).

Implied tariff in 2QFY15 stood at INR1,099/mscm (v/s INR1,365/mscm in 2QFY14

and INR1,077/mscm in 1QFY15) and we model INR1,200 in 2HFY15. Average tariff

increased QoQ after five consecutive quarters of tariff decline led by removal of

take-or-pay revenues.

GSPL implemented PNGRB’s zonal tariff order effective from July 27, 2012

resulting in prior period write-back of ~INR900m.

GSPL’s volume have declined by 17mmscmd in 3QFY14 to 20.2mmscmd from its

peak of 36.8mmscmd in 1QFY12 led by fall in domestic production and continued

high LNG prices impacting demand.

Now with low oil prices and incremental LNG exports from US, LNG prices are

expected to remain soft. Also government efforts to increase gas availability to

power sector through pooling would augur well. We model volumes at

26/27mmscmd in 2HFY15/FY16 v/s 24mmscmd in 2QFY15.

Benign spot LNG prices could improve volume availability to some extent

n

n

Valuation and view:

The stock trades at 10.3x FY16E EPS of INR9.5. Our SOTP-based

target price stands at INR93.

Neutral.

Harshad Borawake

(HarshadBorawake@MotilalOswal.com); +91 22 3982 5432

Investors are advised to refer through disclosures made at the end of the Research Report.