10 November 2014

2QFY15 Results Update | Sector:

Capital Goods

VA Tech Wabag

BSE SENSEX

27,875

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

8,344

VATW IN

26.8

41.9/0.7

1,748/480

-9/76/110

CMP: INR1,565

n

TP: INR1,725

Buy

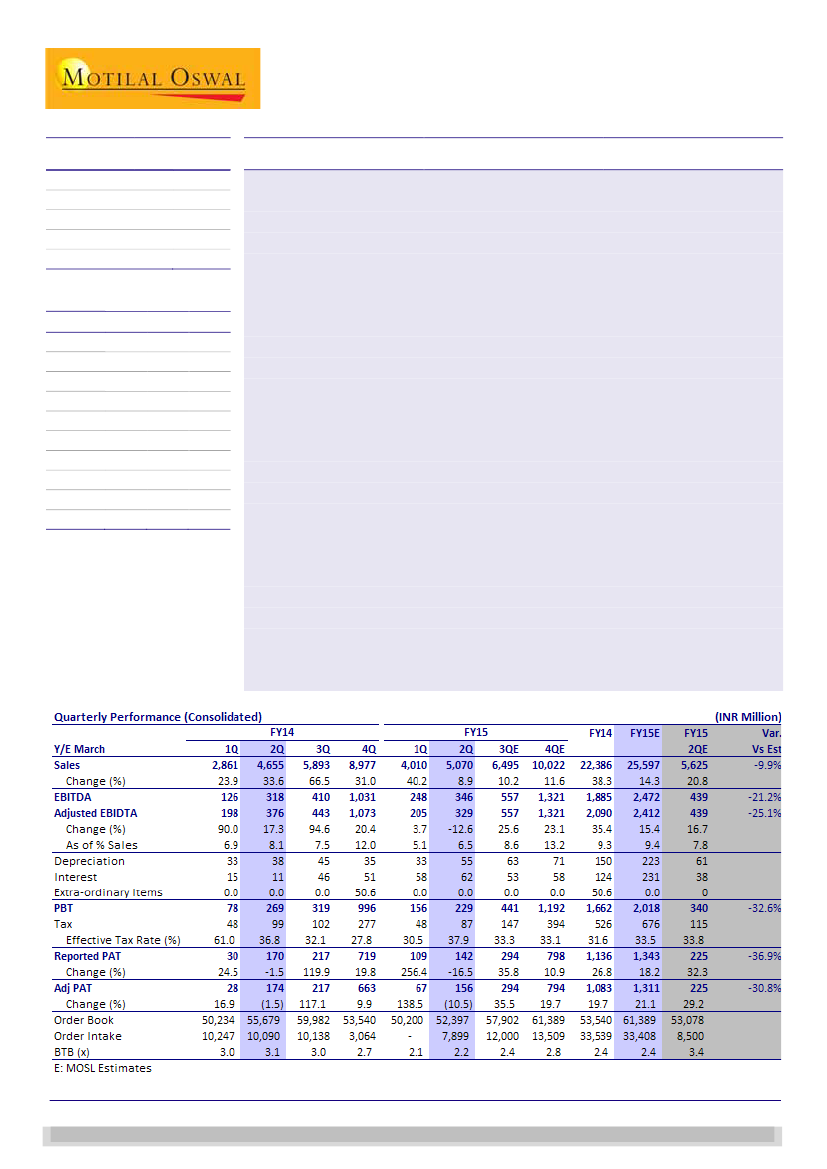

Performance below est., order inflows led by overseas projects

Operating performance below estimates:

2QFY15 consolidated revenue at

INR5.1b (up 8.9% YoY) was below estimate of INR5.6b, largely led by lower

revenue in overseas subsidiaries at INR2.7b (up 10% YoY) v/s estimate of INR3.3b.

Standalone revenue at INR2.4b (up 5% YoY) was in line. Management maintained

FY15 revenue guidance at INR26-27b v/s INR22.3b in FY14.

Adjusted EBITDA at INR329m (v/s est. of INR439m) was down 13% YoY and 25%

below estimate. Standalone EBITDA was in line at INR236m (v/s est. of INR250m),

while subsidiary EBITDA declined 51% YoY in 2QFY15 at INR93m and was

meaningfully below estimate of INR189m.

Achieves 25% of targeted firm order inflow in 1HFY15:

Order inflow in 1HFY15

stood at INR7.9b, led mainly by overseas orders (91% of inflows) and INR16.2b

including framework orders. For FY15, management maintained the order intake

guidance at INR32-34b and thus 1H represents ~50% of full year number.

Management stated that India orders are likely to remain constrained in FY15,

with contribution likely at ~15-20%. However, given the strong government

intent, several opportunities in treatment for sewage/effluent could open up with

Ganga Rejuvenation Plant (INR510b), Delhi Jal Board (INR190b) etc. VATW is

expanding into new geographies, including South East Asia, Sub-Sahara Africa,

Latam, Central Asia/Middle East (Turkey), with the initial orders having been

encouraging.

Valuation and view:

NWC stood at 72 days at end-2QFY15 v/s 49 in end-FY14,

given higher advances to sub-contractors and suppliers, and the attempt is to

curtail at FY14 levels. At CMP, VATW trades at 23x / 18x FY16E/17E EPS of

INR69.5 /85.2. Maintain

Buy

with a target price of INR1,725 (20x FY17E).

Financials & Valuation (INR billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS(INR)

EPS Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015E 2016E 2017E

25.6

2.5

1.3

49.5

21.1

356.9

13.8

22.2

31.6

4.4

32.1

3.2

1.8

69.5

40.5

412.4

16.8

25.3

22.5

3.8

36.8

3.8

2.3

85.2

22.5

480.0

17.7

26.7

18.4

3.3

n

n

n

n

Satyam Agarwal

(AgarwalS@MotilalOswal.com); +91 22 3982 5410

Amit Shah

(Amit.Shah@MotilalOswal.com) /

Nirav Vasa

(Nirav.Vasa@MotilalOswal.com)

Investors are advised to refer through disclosures made at the end of the Research Report.