13 November 2014

2QFY15 Results Update | Sector:

Metals

SAIL

BSE SENSEX

27,941

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

8,358

SAIL IN

4,130.1

113/54

2/-12/-51

CMP: INR80

n

n

TP: INR104

Neutral

Operating leverage, lower staff and RM cost expanded margin

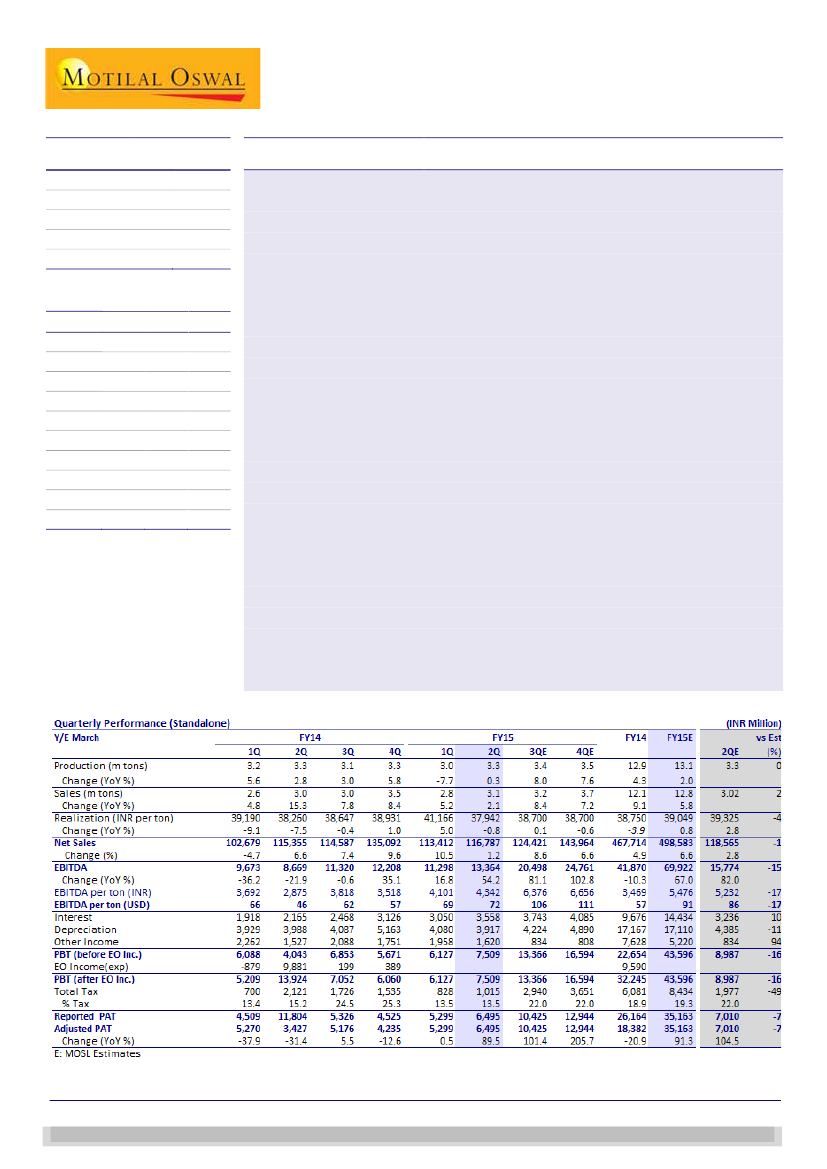

2QFY15 EBITDA grew a healthy 18% QoQ (54% YoY) to INR13.3b, it was 15% below

our estimate driven primarily by lower-than-expected realization.

While we had estimated realization to decline 4% QoQ on pricing pressure, the

decline was steeper at 8%. EBITDA per ton still improved 6% QoQ to INR4,342/t on

lower wage bill, raw material cost and operating leverage. Steel production

increased 11% QoQ to 3.3mt. Sales volumes increased 12% QoQ to 3.1mt.

Segmental EBIT of Bhilai steel plant increased 60% QoQ to INR8b, while other

plants witnessed no improvement in EBIT.

Interest expense increased 17% QoQ on capitalization of new production facilities.

Depreciation remained flat QoQ on reassessment of useful life of plants and

machinery pursuant to Companies Act 2013 becoming effective from April 1, 2014.

Other income remains high as SAIL continues to maintain high amount of liquid

funds. Adjusted PAT increased 23% QoQ to INR6.5b. Net debt remained

unchanged at ~INR230b. Capex was largely funded from internal accruals.

Company is likely to benefit from the commissioning of new 2.4mtpa steel

capacity at ISP, Burnpur, unlike Roorkela whose products are oversupplied. ISP,

Burnpur is likely to get fully commissioned during 2HFY15. We expect ISP to

contribute additional 2mt volumes in FY16E. This plant is well placed to cater to

the expected demand growth from construction sector.

Though Indian steel demand has so far failed to pick up, we expect a pick-up in

4QFY15.

We expect EBITDA to post a CAGR of 33% to INR107b over FY14-17E aided by the

benefit of operating leverage. Stock trades at FY16E EV/EBITDA of 6.5x. Maintain

Neutral.

M.Cap. (INR b) / (USD b) 331.6/5.4

Financials & Valuation (INR Billion)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

EV/EBITDA

( )

2015E 2016E 2017E

502.6

75.7

37.0

9.0

95.4

8.3

8.2

9.0

0.7

7.7

575.5

97.1

40.8

9.9

10.3

8.6

8.7

8.1

0.7

6.5

652.9

106.6

39.4

9.5

-3.5

7.8

8.2

8.4

0.6

6.1

n

n

n

n

n

n

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com); +91 22 3027 8033

Investors are advised to refer through disclosures made at the end of the Research Report.