15 November 2014

2QFY15 Results Update | Sector:

Travels

Cox & Kings

BSE SENSEX

28,047

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

S&P CNX

8,390

COXK IN

136.5

42.1/0.7

366/94

0/79/131

CMP: INR306

TP: INR380

Buy

Financials & Valuation (INR m)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr.h (%)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015E 2016E 2017E

25,179 24,029 27,151

10,068 9,419 10,616

3,828

28.0

50.0

23.1

12.7

10.9

2.7

3,738

27.4

-2.4

139.7

21.6

14.3

11.2

2.2

4,549

33.3

21.7

170.7

21.5

16.2

9.2

1.8

BV/Sh.INR 114.1

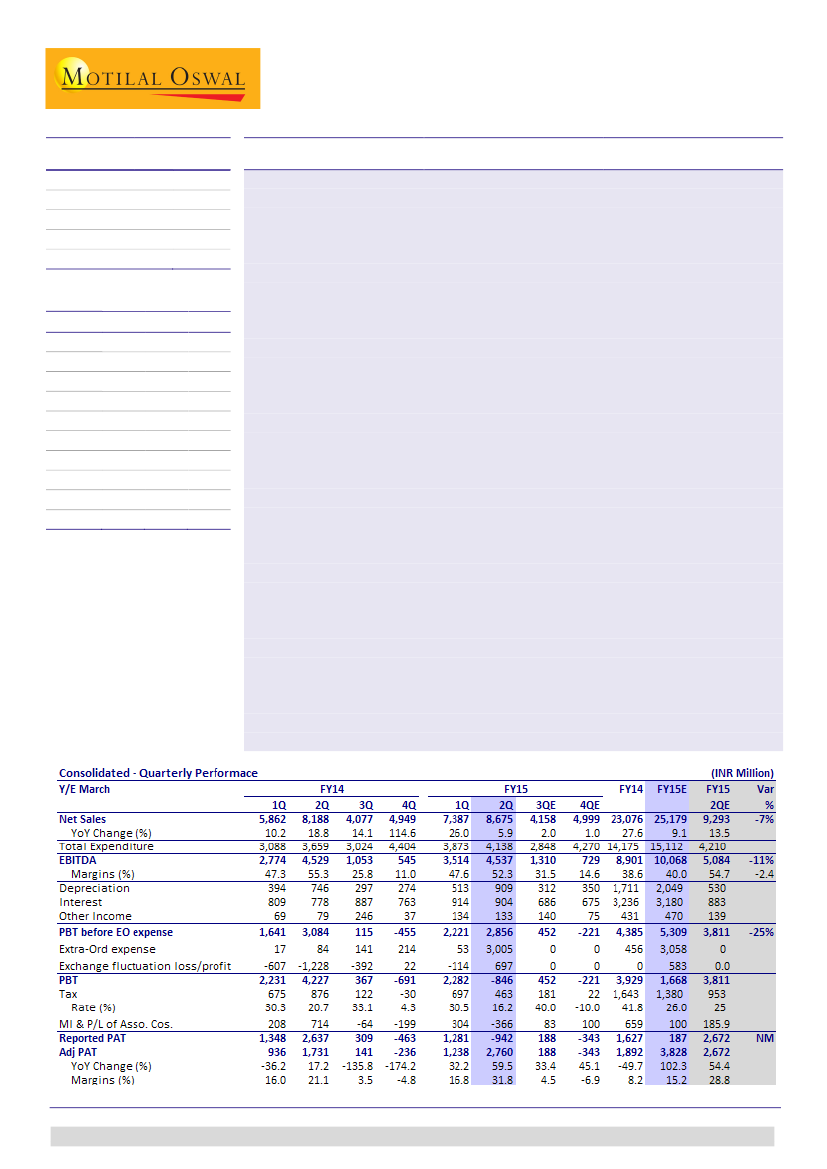

Results below estimates:

COXK reported overall revenue of INR8.8b (est. INR9.2b)

in 2QFY15, against INR8.2b in 2QFY14, marking a YoY growth of 6%. EBITDA

margin de-grew by 300bp, from 55.3% in 2QFY14 to 52.3% (est. 54.7%). Margin in

Leisure India and Education business expanded while Leisure international

business declined. PAT stood at INR(-942m) (est. INR2.67b), against INR2.63b in

2QFY14, primarily due to extraordinary writeoffs of goodwill on account of

camping sale amounting to INR5.5b and cancellation charges of forward contract

amounting to INR1b. Adjusting for this, PAT stood at INR2.7b, against INR1.7b,

making a YoY growth of 59.5%.

Strong growth in Education and Meininger business to drive margins:

During the

quarter, Education business posted revenue of INR2b, growing at 10% YoY, while

EBITDA grew 19% to INR1.1b. PGL and NST are showing strong performance, with

65% capacity utilization assisted by better utilization in lean season. Management

is planning to add 1,000 beds going forward in Australia and France, which will

drive growth. Meininger reported a revenue growth of 9% to INR950m, while

EBITDA growth was 17% to INR470m. It marked occupancy of 92%, against 87% in

FY14. Realization improved by 5.4% from 36 euro/bed to 27.4 euro/bed.

Management believes that demand exceeds supply, thus driving the higher

occupancy. Pre-booking for Meininger has already reached ~80% for FY16 and

12% for FY17, a testimony of robust demand.

Debt reduction on course:

With the sale of camping business, debt reduction in

on course, with net debt standing at INR34.7b, against INR39.6b in 1QFY15.

Management guided for further debt reduction of INR2b in FY15 and INR5b in

FY16 and FY17 each. We believe the company is on course for a debt reduction,

which will reduce net debt/equity to 1.2 by FY17E.

Valuation and view:

We remain optimistic on Education and Meininger business’

growth, given the capacity addition. We believe COXK is on the path of

deleveraging its balance sheet led by the sale of camping business. Company is

expected to post ~21% PAT CAGR over FY14-17E. The stock trades at 10.9x FY15E

and 11.2x FY16E earnings. We value COXK at 14x FY16E earnings of INR27.4, with a

target price of INR380. Maintain

Buy.

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Atul Mehra

(Atul.Mehra@MotilalOswal.com); +91 22 3982 5417

Investors are advised to refer through disclosures made at the end of the Research Report.