Monday, December 08, 2014

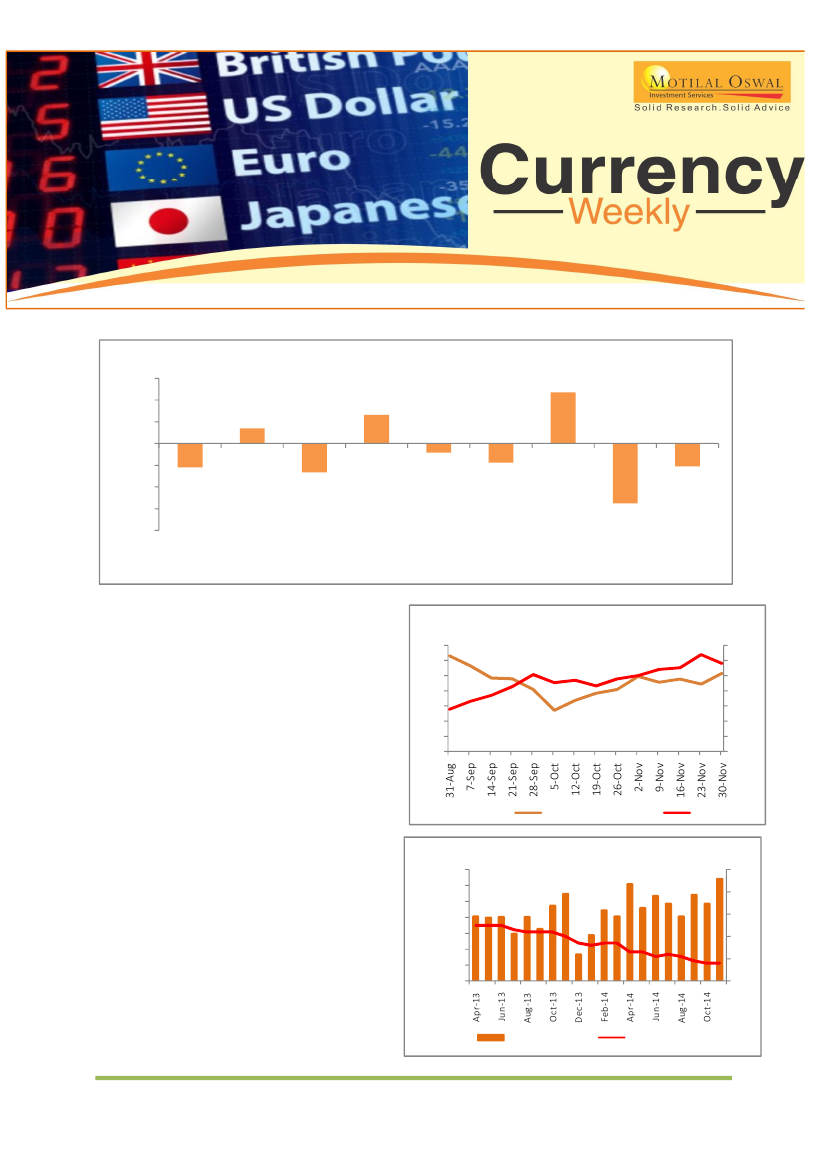

Major Global Currencies % change for the week

3.00%

2.00%

1.00%

0.00%

-1.00%

-2.00%

-3.00%

-4.00%

Dollar

Index

USDINR

EURUSD

EURINR

GBPUSD

GBPINR

USDJPY

JYPINR

EURGBP

-1.11%

-1.33%

-0.42%

-0.88%

-2.75%

-1.04%

0.70%

1.31%

2.36%

Rupee traded higher last week after RBI kept the

key rates unchanged. India’s foreign exchange

reserves grew by $1.43bn to $316.31bn for the week

ended Nov 28 v/s $314.87bn in the week before.

FIIs have bought debt worth $1.2bn so far in

December, while equity inflows stand at $650.8mn.

In the week ahead all eyes will be on India’s CPI

numbers which is due on Friday.

Dollar index remained close to six-year highs against

a basket of other major currencies last week, after

data showed that the US economy added more jobs

than expected last month lent broad support to the

dollar. US economy added 321,000 jobs in

November, exceeding expectations for jobs growth

of 225,000, v/s 243,000 previously.

Growth in China's manufacturing sector slowed in

November, suggesting that it is still losing

momentum and adding pressure on authorities to

ramp up stimulus measures after unexpectedly

cutting interest rates last month. The official PMI

eased to an eight-month low of 50.3 last month, still

indicating a modest expansion in activity but below

forecasts for 50.6 and October's 50.8.

Rupee v/s Forex Reserves Weekly

320

318

316

314

312

310

308

306

62.5

62

61.5

61

60.5

60

59.5

59

Source: Reuters

India Forex Reserves

INR (RHS)

US Jobs Market

350,000

300,000

250,000

200,000

150,000

100,000

50,000

0

10

9

8

7

6

5

Source: Reuters

Nonfarm Payrolls

Unemployment Rate (RHS)

Please refer to the disclaimer at the end of the report.