7 January 2015

Mahindra CIE

spotlight

The Idea Junction

Stock Info

Bloomberg

MACA IN

CMP (INR)

207

Equity Shares (m)

322.0

M.Cap. (INR b)/(USD b)

66.6/1.1

52-Week Range (INR)

251/47

1,6,12 Rel. Perf. (%)

-11/19/256

Focused management to drive turnaround

Mahindra Forgings Europe (MFE) already witnessing sharp improvement

Financials & Valuation (INR m)

Y/E March*

Sales

EBITDA

NP

Adj. EPS (INR)

EPS Gr. (%)

BV/Sh. (INR)

RoE (%)

RoCE (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA (x)

27.2

2.8

12.3

18.1

2.4

9.4

13.6

2.1

7.3

2015E 2016E 2017E

54,101 59,986 67,716

6,260 7,739 9,370

2,450 3,684 4,906

8

LP

74

13.1

12.1

11

0.5

85

14.4

13.7

15

0.3

100

16.5

15.9

Management change brings focus, expertise and experience

Synergistic alliance, with complementary product portfolio

Key drivers - turnaround in MFE, growth in India

Margin expansion, improving asset turnover to drive EPS growth and RoE

Management change brings focus, expertise and experience

Mahindra CIE (MACA), an amalgamation of Mahindra Systech's auto components

business and CIE's Europe forgings business, has witnessed management change.

CIE Automotive now has ~53% stake, while M&M has ~20%. CIE is a focused global

player in auto components, with demonstrated ability to improve performance

of inefficient companies. CIE has an objective of profitable growth, led by financial

prudence, targeting FCF of at least 40% of EBITDA, RoCE of >15%, and net debt-

EBITDA of <2x.

* Assuming merger w.e.f 1/Apr/2013

Synergistic alliance, with complementary product portfolio

This alliance consolidates the two entities into a large global components supplier,

creating a global forgings player, having presence across key markets (except

Japan and Korea). Mahindra CIE would have a complementary product portfolio

and market mix. It also ensures a larger product and technology portfolio,

addressing the need to continuously upgrade operations. MACA will benefit from

leveraging the group's product portfolio and CIE's global customers to drive growth

in India. MACA will help CIE to drive market share in Asia, resulting in balanced

market mix for CIE.

Shareholding pattern (%)

As on

Jun-14 Mar-14

Promoter 41.3

41.6

DII

0.3

0.2

FII

13.8

14.4

Others

44.6

43.8

Jun-13

41.7

0.2

11.4

46.7

Notes: FII includes depository receipts

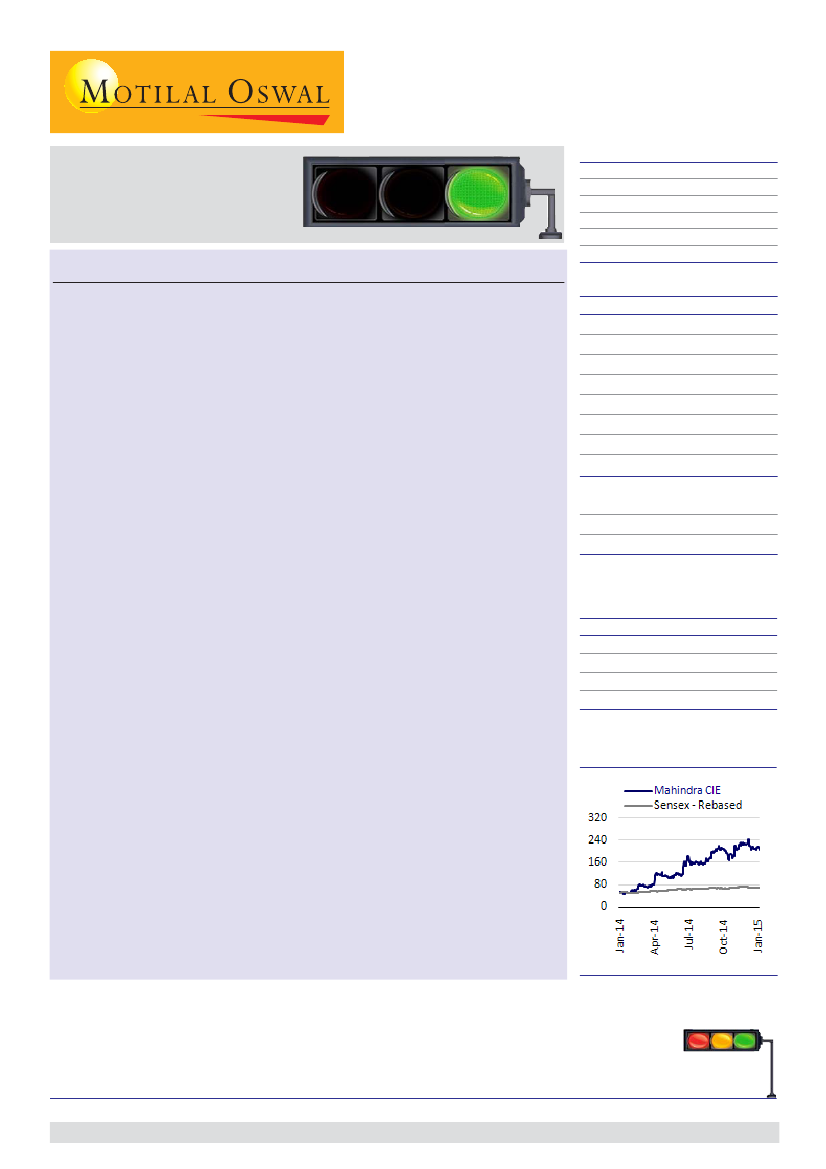

Stock performance (1 year)

Key drivers - turnaround in MFE, growth in India

CIE has set out the key medium-term focus areas for MACA as (1) turning around

MFE, and (b) improving productivity and entry in CIE's product and customer base

in India. MFE's operating performance has begun improving, led by (a) new

management team, (b) headcount reduction, (c) price renegotiation for select

parts with customers, and (d) process improvement. In 9MCY14, MFE's EBIT margin

expanded to 6.3% (target of ~6% by CY16). MCI (India) would be the key growth

driver for MACA and CIE, as it expands its horizons, leveraging on CIE's product

Spotlight

is a new offering from the Research team at Motilal Oswal. While our Coverage Universe

is a wide representation of investment opportunities in India, there are many emerging names in the

Mid Cap Universe that are not under coverage. Spotlight is an attempt to feature such mid cap stocks

by visiting such companies. We are not including these stocks under our active coverage at this point

in time. Motilal Oswal Research may or may not follow up on stocks under Spotlight.

RED: Caution

AMBER: In transition

GREEN: Interesting

1

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Investors are advised to refer through disclosures made at the end of the Research Report.