15 January 2015

3QFY15 Results Update | Sector:

Technology

TCS

BSE SENSEX

28,076

Bloomberg

Equity Shares (m)

S&P CNX

8,494

TCS IN

1,958.7

CMP: INR2,545

TP: INR2,650 (+4%)

Disappointing growth in Services revenue

n

Neutral

M.Cap (INR b)/(USD b) 5,288/86.2

52-Week Range (INR) 2,834/1,970

1, 6, 12 Rel. Per (%)

Avg Val/Vol ‘000

Free float (%)

Financials & Valuation (INR b)

Y/E March

Sales

EBITDA

PAT

EPS (INR)

EPS Gr. (%)

BV/Sh.INR)

RoE (%)

P/E (x)

Div.Yld (%)

2015E 2016E 2017E

953 1,089 1,248

274

212

11.1

333

35.2

23.5

1.6

309

246

16.0

407

34.0

20.2

15.1

1.7

359

288

17.0

493

32.7

17.3

12.7

2.0

n

n

n

5/-5/-24

2,998/1,279

26.1

108.4 125.8 147.2

EV/EBITDA(x) 17.3

Estimate change

TP change

Rating change

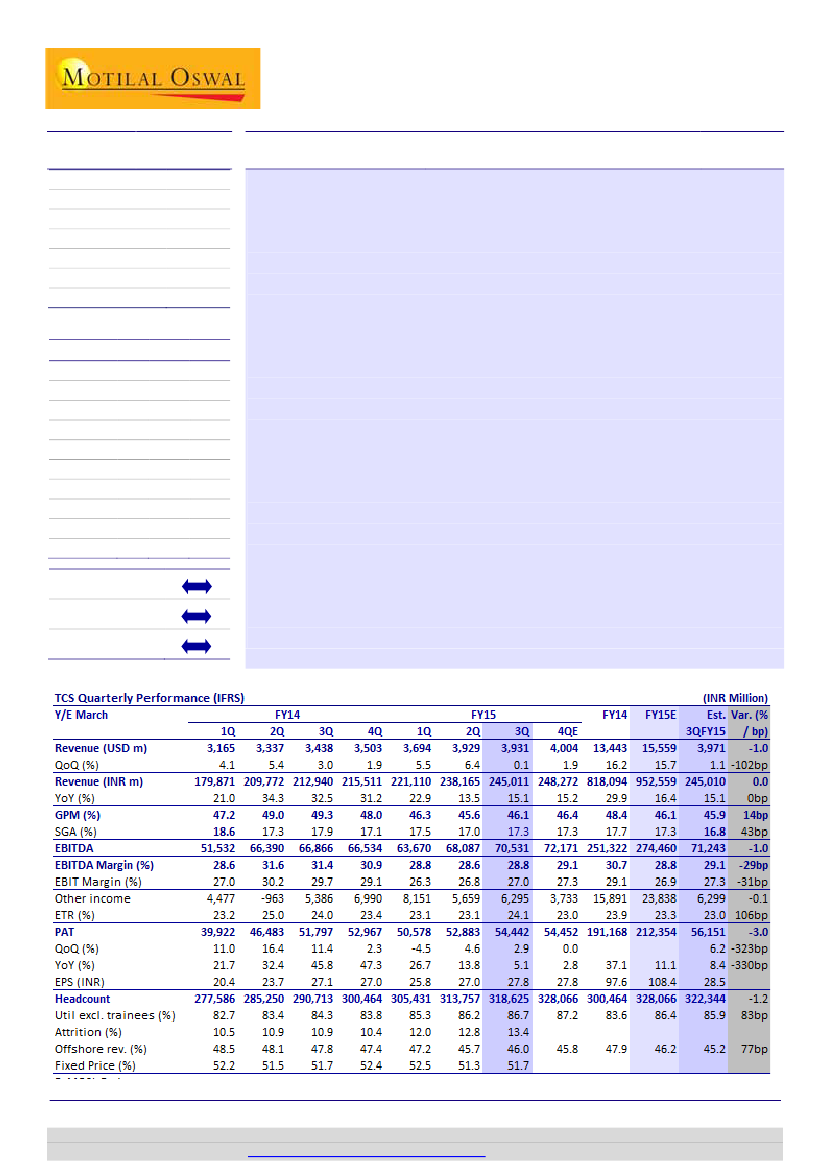

Disappointing services growth:

TCS’ 3QFY15 constant currency (CC) revenue

growth was 2.5% QoQ (v/s est. of 3.1%), but excluding the sale of equipment

(2.3% of business) services, CC revenue growth was 1.6% QoQ, below our

estimate. Volume growth of 0.4% QoQ is a 23-quarter low. EBIT margin was in

line at 27% (+20bp QoQ). PAT grew 2.9% QoQ to INR54.4b, below our estimate of

INR56.1b, on a tax rate of 24% v/s estimate of 23% and lower absolute operating

profit.

Contrasting trends across TCS and INFO:

The trend of volume-pricing split across

TCS and INFO contrasted in 3QFY15 – INFO’s CC realization declined 1.6% QoQ

and TCS’ rose by 2.3%. TCS’ volume growth was 0.4%, against INFO’s 4.2% QoQ.

Positive read through for industry:

TCS’ comments of larger structured programs

around Digital, likely recovery in Retail and positive growth outlook in the US and

Europe are positive. However, cost structure transformation initiatives in BFSI on

the back of multiple fines could lead to elongated deal cycles.

Valuation and view:

We have lowered the FY16E/17E revenue and EPS estimates

by ~3% mainly due to cross currency MTM. We note a catch-up in INFO’s

performance to TCS’ for the second consecutive quarter and continue to expect a

gradual convergence in the valuation gap. TCS’ growth will continue to lead peers

in the near term, but we expect continued tapering of outperformance delta. Our

target price of INR2,650 discounts FY17E EPS by 18x, in line with the long term

average. Higher multiple will be a function of sustained high growth delta to

peers, though there are few indicators of the same. Maintain

Neutral.

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Siddharth Vora

(Siddharth.Vora@MotilalOswal.com); +91 22 3982 5585

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.