19 January 2015

3QFY15 Results Update | Sector:

Metals

Hindustan Zinc

BSE SENSEX

28,262

Bloomberg

Equity Shares (m)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Free float (%)

S&P CNX

8,551

HZ IN

4,225.3

184/115

-6/-13/-10

35.1

CMP: INR160

TP: INR215 (+34%)

Buy

In-line: higher other income offsets sales volume miss

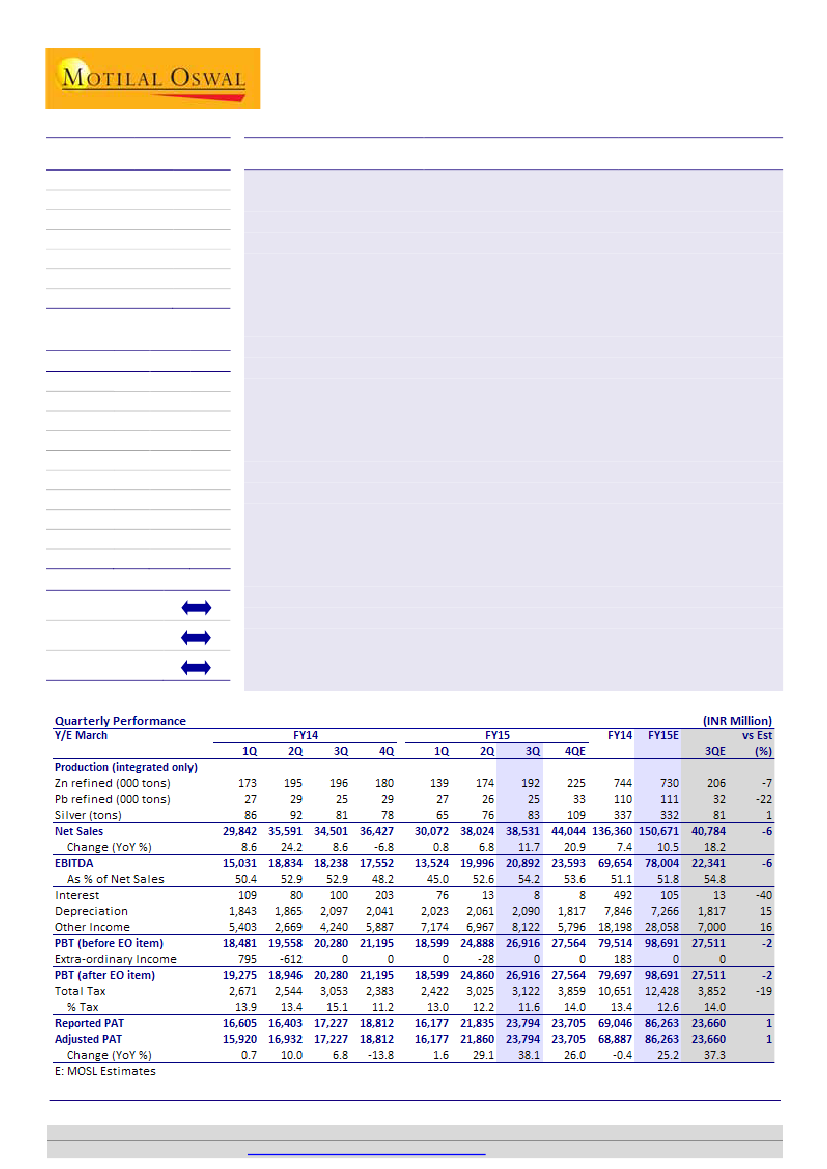

HZL’s (HZ) 3QFY15 PAT of INR23.8b (9% QoQ / 38% YoY) was marginally ahead of our

estimate as a higher-than-expected other income offset the impact of lower sales

volume. EBITDA of INR20.9b (4% QoQ/15% YoY) was a 6% miss on lower volumes and

zinc premium and was offset by slightly lower cost of production (CoP). Volume miss

was on account of higher cathode stocks, as mine production at 242kt was broadly in-

line with our estimate. Key result highlights:

n

Net sales grew 1% QoQ / 12% YoY to INR38.5b (6% miss to our estimate). Implied

zinc premium in 3Q was at 11.7%, below 12% in 2Q/14.7% in 3QFY14, as

increasing Chinese exports improved metal availability. Zinc metal production was

flat QoQ (+8% YoY) at 196kt despite the mine production rising 10% QoQ (14%

YoY) to 242kt. Lead production rose 20% QoQ (flat YoY) at 30kt.

n

Reported CoP (ex-royalty) declined 3% QoQ (-8% YoY) to INR50,534/t (lower than

our estimate) on better fixed cost absorption and lower diesel cost. Employee cost

was higher due to one-off wage renegotiation related charges and is expected to

reverse in the coming quarters.

n

Other income was at INR8.1b (92% QoQ / 17% YoY) on mark-to-market treasury

gains. Cash and cash equivalents closed at INR290b.

n

Royalty-linked charge, on recent amendments to MMDRA Act, is likely to increase,

but rules are yet to be framed. We await further clarity to factor the impact.

Valuation and view:

We lower FY15E-17E EBITDA forecast by 2-4% factoring the 3Q

result. Our 12-month target price stands reduced to INR215. Although metal sales

volumes surprised negatively in 3Q, mining ramp-up was in line with our estimate.

HZ’s mine production is estimated to post 3% CAGR over FY14-17E to 952kt

(management targets capacity of 1.2 mt). Maintain

Buy.

M.Cap. (INR b) / (USD b) 677.7/11.0

Avg Val(INRm)/Vol ‘000 256/1,666

Financials & Valuation (INR Billion)

Y/E MAR

Sales

EBITDA

NP

Adj.EPS(INR)

EPS Gr(%)

RoE (%)

RoCE (%)

P/E (x)

P/BV

EV/EBITDA(x)

2015E 2016E 2017E

150.7 157.3 161.0

78.0

86.3

20.4

25.2

20.9

23.0

7.8

1.5

4.5

81.1

79.5

18.8

-7.9

16.5

19.7

8.5

1.3

3.6

81.4

81.9

19.4

3.1

15.0

18.0

8.3

1.2

2.9

Estimate change

TP change

Rating change

Sanjay Jain

(SanjayJain@MotilalOswal.com); +91 22 3982 5412

Dhruv Muchhal

(Dhruv.Muchhal@MotilalOswal.com); +91 22 3027 8033

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.