19 January 2015

3QFY15 Results Update | Sector:

Financials

Indiabulls Housing Finance

BSE SENSEX

28,262

Bloomberg

Equity Shares (m)

S&P CNX

8,551

IHFL IN

355.1

CMP: INR572

n

TP: INR738 (29%)

Buy

Business momentum healthy; spreads and asset quality stable

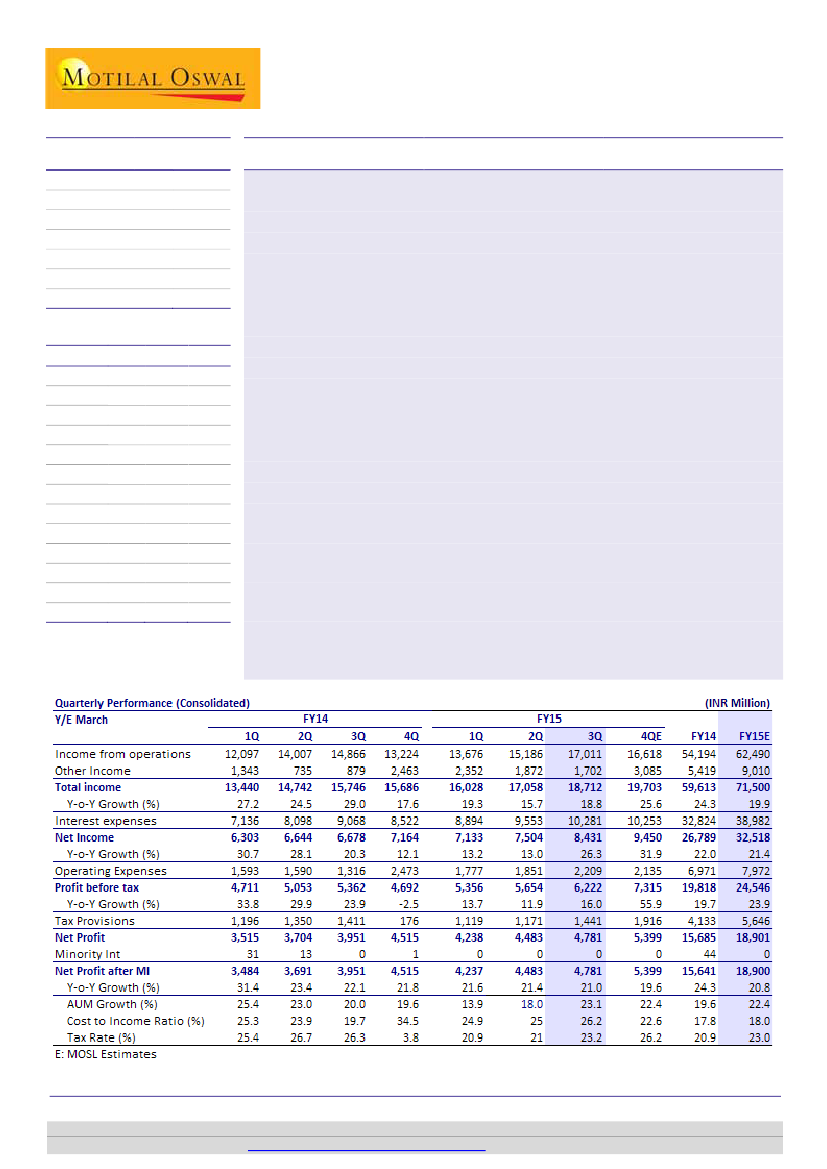

Indiabulls Housing Finance (IHFL) reported PAT growth of 21% YoY (+6.7% QoQ) to

M.Cap. (INR b) / (USD b) 203.1/3.3

INR4.8b (in line with est.). Healthy AUM growth of +23% YoY, strong disbursement

52-Week Range (INR)

580/188

growth of +71% YoY (+11% QoQ) and stable book spreads of 340bp were the key

1, 6, 12 Rel. Per (%)

23/43/122

highlights of the quarter.

Avg Val (INR m)/Vol ‘000 358/956

n

Healthy pick-up in disbursements at INR53.5b, grew +71% YoY and 11% QoQ, led

Free float (%)

72.2

to +23% AUM growth at INR480.8b. The overall AUM mix skewed slightly in favor

of mortgages (76% share v/s 73% in 3QFY14), with the share of corporate being

Financials & Valuation (INR Billion)

stable at 21%.

Y/E March 2015E 2016E 2017E

Net Fin inc

23.5

28.5

35.3

n

GNPAs percentage remained steady at 0.86% and NNPAs at 0.34% respectively.

Provisions of INR740m during the quarter were towards accelerated writeoffs and

PPP

27.8

33.5

41.3

did not include any specific account.

EPS (INR)

54.2

64.2

79.0

EPS Gr. (%)

15.8

18.4

23.2

n

Other highlights:

a) book spreads of 340bp and incremental spreads of 310bp

BV/Sh.

were stable QoQ, b) IHFL’s cumulative disbursements till date reached INR1t, c)

189

215

246

( )on

RoA

INR650m debited from net worth for outstanding ZCB, d) securitized assets worth

3.6

3.7

3.7

(%)

RoE (%)

30.7

32.4

34.3

INR7b during the quarter, e) bond issuance contributed 43% of incremental

Payout (%)

71.4

60.8

60.8

borrowings, f) opex includes INR150m towards CSR expenses.

Valuations

n

Valuation and view:

IHFL has transformed from a diversified lender to a focused

P/E (x)

10.6

8.9

7.2

mortgage player. Mortgage focus has yielded returns, with RoE/RoA improving

P/BV (x)

3.0

2.7

2.3

from 3%/0.8% in FY09 to 30%/3.7% in 9MFY15. Focus on mortgage and market

P/BV (x)

3.0

2.7

2.3

share gains will drive AUM growth of ~23% for the next three years. Lowest

Div. Yld (%)

5.8

5.8

7.2

levered HFC (6.1x) to support growth without dilution. Asset quality trend to

remain stable. Improved borrowing profile, better credit rating and liquidity buffer

will aid the company maintain healthy spreads. IHFL offers superior return ratios

with +6% dividend yield. Maintain

Buy

with a target price of INR738 (3x FY17E BV).

Sunesh Khanna

(Sunesh.Khanna@MotilalOswal.com); +91 22 3982 5521

Alpesh Mehta

(Alpesh.Mehta@MotilalOswal.com); +91 22 3982 5415

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.