19 January 2015

2QFY15 Results Update | Sector:

Consumer

Symphony

BSE SENSEX

28,262

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INR M)/Vol ‘000

Free float (%)

S&P CNX

8,551

SYML IN

35.0

78.1/1.3

2,255/401

10/92/425

38/36

25.0

CMP: INR2,231

TP: INR2,100 (-6%)

Neutral

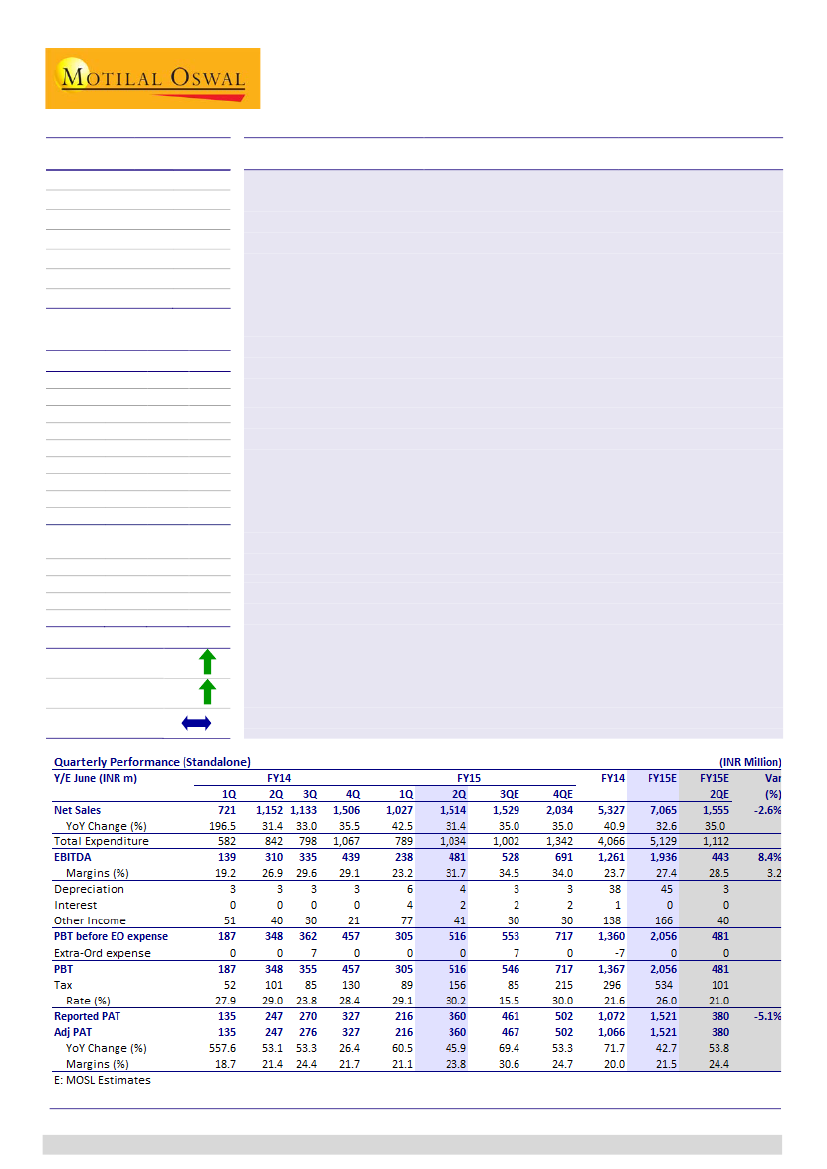

Revenue and PAT post marginal miss, EBITDA margin expansion robust

Symphony (SYML) posted a revenue of INR1.51b (est. INR1.55b) in 2QFY15, compared

to INR1.15b in 2QFY14, marking a YoY growth of 31.4%. During the quarter, company

witnessed 27.4% volume growth with total volumes aggregating to 2.4 lakh coolers,

while realizations grew 1.5% YoY from INR6,183/unit to INR6,277/unit. Domestic

revenue grew by 33.5% YoY to INR1.40b, while exports grew 10% YoY to INR113m.

EBITDA grew by 54.8% this quarter to INR481m, EBITDA margin stood at 31.7% in

2QFY15, compared to 26.9% in 2QFY14 (an expansion of 480bp YoY), largely on

account of better sales mix, softening of commodity prices and higher economies of

scale. Hence, PAT for 2QFY15 stood at INR360m (est. INR380m), compared to

INR247m in 2QFY14, marking a YoY growth of 46%.

Replicating asset light business model in Impco business:

Management is exploring

the possibility of outsourced manufacturing for Impco, with an aim to make the

business asset light, similar to its India operations. Further, management plans to

monetize Impco assets like plant and machinery and real estate, resulting in proceeds

of ~INR0.4b. We believe re-modeling of Impco into an asset light model will ensure

focus on R&D, marketing and product development activities thus resulting in superior

performance of the business. Also, Impco too could turn into a high RoCE and scalable

business, similar to domestic operations.

Valuation and view:

We raise FY15E, FY16E and FY17E earnings estimates by 5%, 11%

and 22% to reflect higher margins led by new product innovations. Given its leadership

with 50% market share, asset light business model (~72% RoCE), huge growth

opportunity in air coolers due to 8% penetration and expected shift from unorganized

(80% of market) to organized, we believe SYML deserves premium multiple of 25x

FY17E EPS, against its five-year average multiple of 15x one-year forward. We value

the stock at 25x FY17E EPS and arrive at a target price of INR2,100. Maintain

Neutral.

Financials & Valuation (INR Billion)

Y/E JUN

Sales

EBITDA

NP

EPS (INR)

EPS Gr. (%)

BV/Sh (INR)

RoE (%)

RoCE (%)

Payout (%)

Valuations

P/E (x)

P/BV (x)

EV/EBITDA

Div. Yld (%)

EV/Sales (x)

2015E 2016E 2017E

7.1

1.9

1.5

43.5

43.1

100.1

48.6

65.7

51.1

51.3

22.3

40.0

0.9

11.0

9.2

2.8

2.2

61.9

42.4

129.3

54.0

73.0

52.9

36.0

17.3

27.6

1.3

8.3

12.0

3.8

2.9

84.3

36.2

169.1

56.5

76.4

52.7

26.5

13.2

19.8

1.7

6.3

Estimate change

TP change

Rating change

22%

50%

Niket Shah

(Niket.Shah@MotilalOswal.com); +91 22 3982 5426

Atul Mehra

(Atul.Mehra@MotilalOswal.com); +91 22 3982 5417

Investors are advised to refer through disclosures made at the end of the Research Report.