28 January 2015

3QFY15 Results Update | Sector: Automobiles

Amara Raja Batteries

BSE SENSEX

29,559

Bloomberg

Equity Shares (m)

52-Week Range (INR)

S&P CNX

8,914

AMRJ IN

170.8

946/321

CMP: INR915

TP: INR1,093 (+19%)

Buy

In-line performance; new capacities, weak lead prices to drive performance

FY16 onwards

M.Cap. (INR b) / (USD b) 156.3/2.5

AMRJ’s performance was in line with EBITDA/PAT of ~INR1.8b/1b, despite higher

other expenses. FY16 is an inflection year for AMRJ, with significant new capacities

1, 6, 12 Rel. Per (%)

3/73/128

driving revenue growth (~23% CAGR) and benign lead prices driving margins (+250bp

Avg Val (INR M)/Vol ‘000 173/309

by FY17E), translating into ~34% EPS CAGR (FY15E-17E) after a muted FY15. Stable

Free float (%)

47.9

competitive environment, significant FCF generation (~INR7b over FY16E-17E) and

improving RoE (4pp by FY17E to ~31%), coupled with potential shift from unorganized

Financials & Valuation (INR Million)

to organized players, due to GST, would continue to drive re-rating of the stock.

y/e MAR

2015E 2016E 2017E

7,246

4,131

24.2

11.6

98.7

27.1

37.8

37.8

9.3

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

BV/Sh.INR

RoE (%)

RoCE (%)

P/E (x)

P/BV (X)

42,288 52,893 63,315

9,617 12,383

5,481

32.1

32.7

123.8

28.8

40.7

28.5

7.4

7,468

43.7

36.3

158.0

31.0

44.1

20.9

5.8

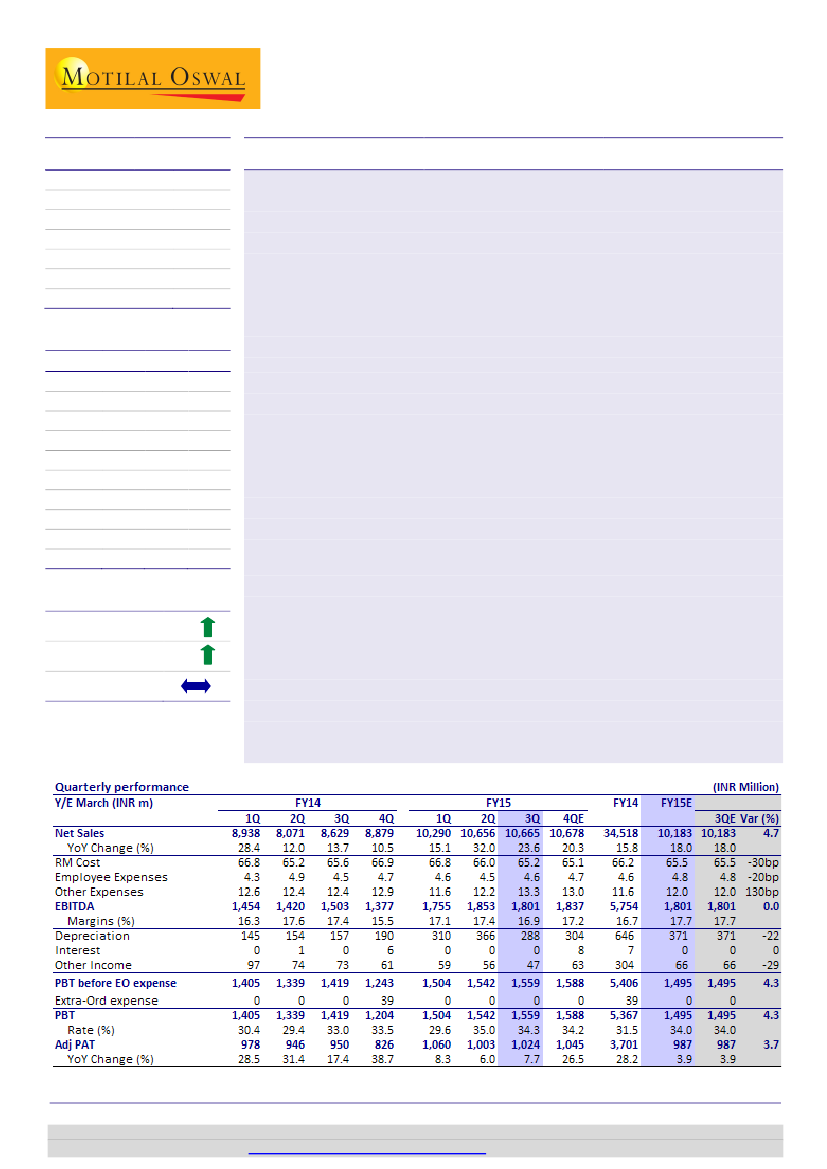

Net sales grew 23.6% YoY (+0.1% QoQ) to INR10.7b (est. INR10.2b), driven by

telecom (~29% YoY) and replacement segment (~20% YoY).

RM cost declined by 40bp YoY (-80bp QoQ) to 65.2% on account of favorable mix

and stable lead price (in INR terms).

Other expenses were higher at 13.3% of sales (+90bp/+110bp YoY/QoQ v/s est.

12%), due to higher marketing spend and higher CSR spend.

EBITDA margin declined 50bp YoY/QoQ at 16.9% (v/s est. 17.7%) for 3QFY15.

However, EBITDA at ~INR1.8b (in-line) grew by 20% YoY (-3% QoQ).

PAT grew by 7.7% YoY (2.1% QoQ) to INR1b (v/s est. INR0.98b).

Estimate change

TP change

Rating change

11%

39%

Takeaways from management interaction:

a) Lead prices for 3QFY15 for the company

stood at ~INR121/kg (v/s INR121/kg in 2QFY15), almost flat QoQ, b) capacity

expansion is on track, with four-wheeler battery plant to be operational by end of

current quarter and two-wheeler battery plant by April-May 2015, c) capex of ~INR4b

each for FY15 and FY16 and d) excise duty hike of 2% passed on to customers.

Valuation and view:

We raise FY16E/17E EPS estimates by ~6%/11% to ~INR32/44 to

factor the strong revenue growth and benign lead prices. We value AMRJ at ~25x

FY17E EPS (v/s 20x earlier) to factor the increased visibility of superior competitive

positioning and capital efficiencies. Maintain

Buy

with a target price of ~INR1,093.

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Jay Shah

(Jay.Shah@MotilalOswal.com); +91 22 3078 4701

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.