30 January 2015

1QFY15 Results Update | Sector:

Capital Goods

Siemens

BSE SENSEX

29,183

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INRm)/Vol ‘000

Free float (%)

S&P CNX

8,809

SIEM IN

356.1

370.4/6

1,083/512

10/5/31

323/389

25.0

CMP: INR1,040

TP: INR930 (-11%)

Sell

Operating performance above estimates, Material costs at lowest levels in

past 10-12 years supported by sharp EUR depreciation

n

Financials & Valuation (INR Billion)

Y/E SEP

Net Sales

EBITDA

Adj PAT

AdjEPS(INR)

EPS Gr (%)

BV/Sh(INR)

RoE (%)

RoCE (%)

Valuations

P/E (x)

P/BV (x)

119.5

8.5

73.4

7.3

55.6

6.8

2014 2015E 2016E

106.6 112.2

5.9

3.1

8.7

82.5

7.4

8.3

9.1

5.0

14.2

62.8

10.6

11.7

128.9

11.1

6.7

18.7

31.9

152.8

12.6

13.7

n

n

122.9 143.4

Estimate change

TP change

Rating change

64%

n

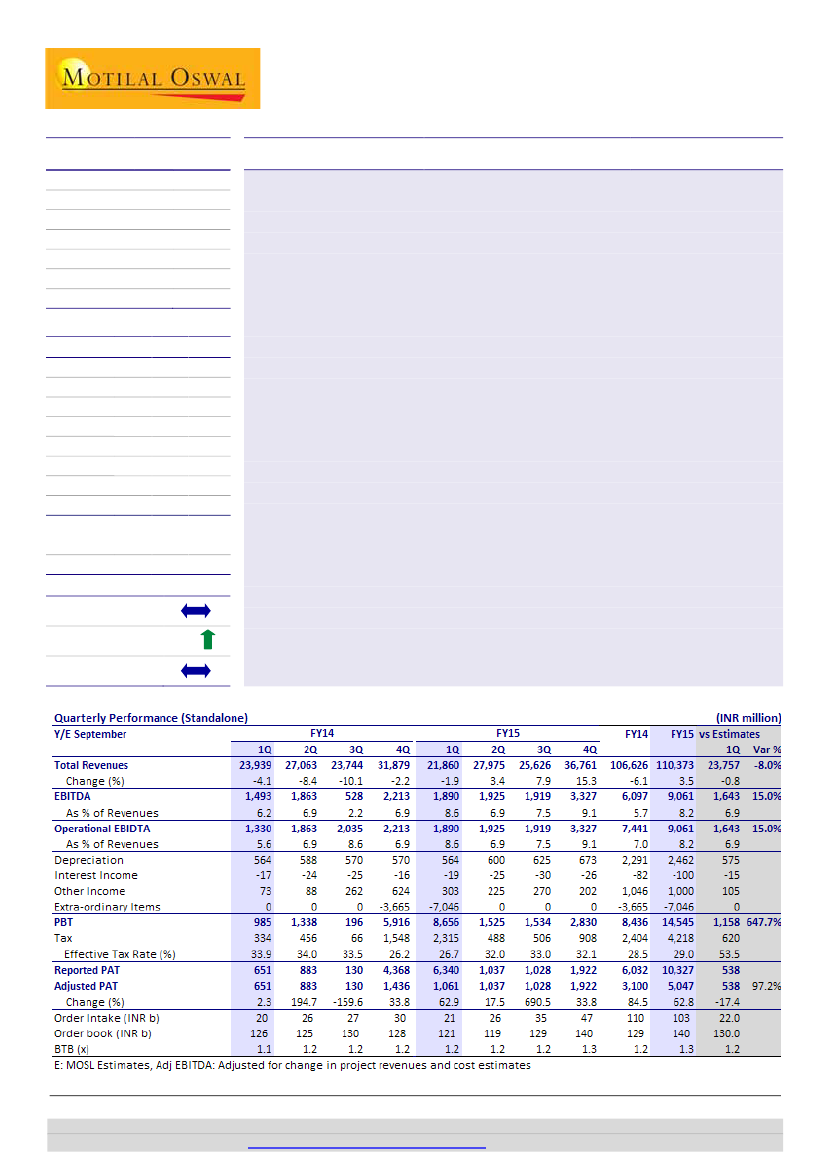

Operating performance above expectation:

SIEM’s 1QFY15 operating

performance have been above estimates, with adjusted revenues at INR23.2b

(down 1.9% YoY) vs estimates of INR23.8b, Adj EBIDTA margins at 8.6% (up

309bp YoY) vs estimates of 6.9% and adj net profit of INR1.1b (up 63% YoY) vs

estimates of INR538m. Exceptional gain pertains to sale of Metal Technologies

business to VAI Metals (Post tax gains at INR5.3b).

Material costs at lowest levels in past 10-12 years supported by sharp EUR

depreciation:

Importantly, material costs for SIEM has declined to just 65.5% in

1QFY15 and is at the lowest levels in the past 10-12 years. We believe that this

is possibly supported by the sharp appreciation of 8% in INR vs EUR in the last

one year. Sustainability of the same will be keenly monitored. For SIEM, Raw

Material imports in FY14 comprised of 55% of the total RM costs, and of this,

~82% was procured from SIEM AG / Group companies; thus the company has

strong leverage to currency volatility. Also, staff cost at INR3.3b are lower by

2.3%; during September 2014, employees stood at 10,933 vs 11,469 YoY.

Order inflows stable; book-to-bill at 1.2x:

Order intake for the quarter stood at

INR20.9b vs INR20.1b in 1QFY14, stable YoY. For FY14 order intake was at

INR103.2b vs INR109.6b in FY13, declining by 6% on YoY basis. Book to Bill has

remained stable at 1.2x.

Valuations at premium; maintain Sell:

At the CMP, SIEM trades at 73x / 56x its

FY15E / FY16E EPS of INR14.2/18.7. Given the premium valuations, we maintain

Sell

rating with revised TP of INR930 (we shift to DCF based valuation).

Satyam Agarwal

(AgarwalS@MotilalOswal.com); +91 22 3982 5410

Amit Shah

(Amit.Shah@MotilalOswal.com)

/ Nirav Vasa

(Nirav.Vasa@MotilalOswal.com)

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.