3 February 2014

2QFY15 Results Update | Sector:

Cement

Shree Cement

BSE SENSEX

29,000

Bloomberg

S&P CNX

8,757

SRCM IN

CMP: INR10,836

TP: INR12,272 (+13%)

Buy

Equity Shares (m)

34.8

M.Cap. (INR b) / (USD

200.0/3.3

b)

52-Week Range (INR) 11755/4234

1, 6, 12 Rel. Per (%)

Avg Val INRm/Vol ‘000

Free float (%)

Financials & Valuation (INR b)

Y/E June

Sales

EBITDA

NP

Adj EPS

EPS Gr. %)

BV/Sh .INR

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

EV/EBITDA

EV/Ton.USD

2015E 2016E 2017E

68.4

16.2

6.9

199.0

-10.4

1,522

13.8

14.3

54.7

7.2

23.0

275

85.7 106.2

23.8

11.2

61.3

19.3

21.2

34.0

6.0

15.1

242

33.8

19.4

73.2

26.9

31.8

19.6

4.7

10.0

230

12/33/103

134/18

35.2

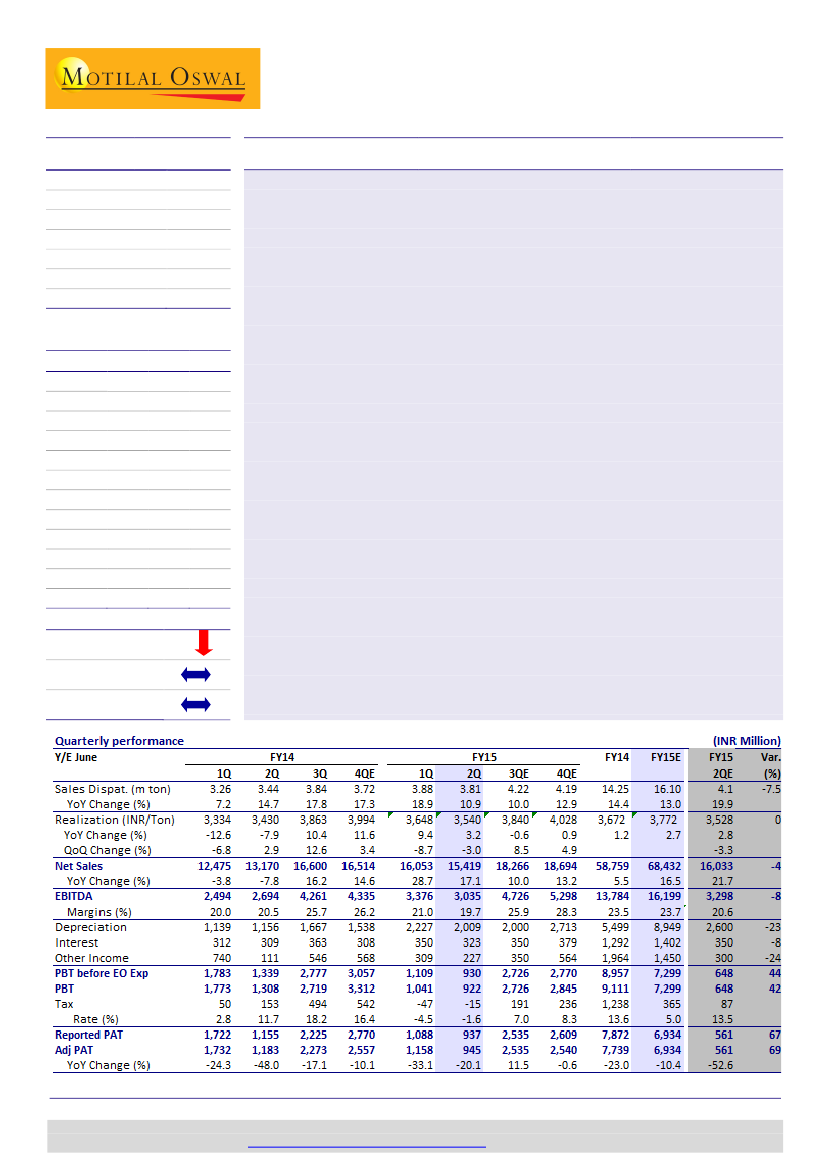

EBITDA below est. on lower volume and increase in freight cost; strong

quarter for merchant power

Volume-led revenue miss in cement:

SRCM’s 2QFY15 revenue grew 17% YoY

(-3.9% QoQ) to INR15.4b v/s estimate of INR16b. Cement revenue stood at

INR13.5b, +14% YoY (v/s est. of INR14.5b). This was led by lower volume growth of

11% YoY to 3.81mt (-1.7% QoQ) v/s estimate of 4.1mt (19.9% YoY), while

realizations fell 3% QoQ (+3.2% YoY) to INR3,540/ton (in-line).

Freight cost push and lower fixed cost absorption dent profitability:

EBITDA grew

12.7% YoY (-10% QoQ) to INR3b (v/s est. of INR3.3b), translating into margin of

19.7% (-1.3pp QoQ, -0.8pp YoY). Cement EBITDA/ton stood at INR715 (-INR101

QoQ, flat YoY) v/s estimate of INR759, led by ~2% higher cost on account of

increased freight cost (overloading restrictions in Rajasthan) and lesser absorption

of fixed cost (lower volume). Lower depreciation and prior period tax reversal

boost PAT at INR945m, -20% YoY (v/s est. of INR561m).

Strong quarter for merchant power:

Merchant power revenue was up 40% YoY

(1% QoQ) to INR1.9b led by 20% YoY (flat QoQ) volume growth to 491units and

QoQ flat realizations of INR3.92/unit (+16% YoY). EBITDA stood at ~INR309m,

translating into EBITDA/unit at INR0.63 (v/s INR0.4 in 1QFY15, INR0.6 in 2QFY14).

Cut FY16E/17E EPS by ~6%:

We cut FY16E/17E EPS by ~6% to factor (1) lower

cement volume growth of 13% in FY15E (v/s earlier 18%), (2) lower realization

growth of INR300/ton YoY in FY16E (v/s earlier est. of INR400/ton) and (3) higher

power volume and realizations. We raise FY15E EPS by 24% to factor for the lower

depreciation. This translates into FY15E/16E/17E cement EBITDA/ton of

INR1,006/1,232/1,519.

Valuation and view:

The stock trades at 15.1x/10x EV/EBITDA on FY16E/17E

and EV of USD230/ton FY17E (adjusting for merchant power assets of ~400mw).

Maintain

Buy

with an SOTP-based target price of INR12,272 (EV at USD260/ton

and implied 11.3x FY17E EV/EBITDA).

321.0 555.8

1,808 2,323

Estimate change

TP change

Rating change

6%

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Sandipan Pal

(Sandipan.Pal@MotilalOswal.com); +91 22 3982 5436

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.