3 February 2015

3QFY15 Results Update | Sector:

Automobiles

Hero MotoCorp

BSE SENSEX

29,000

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INRm)/Vol ‘000

Free float (%)

Financials & Valuation (INR b)

Y/E MAR

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr. (%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015E

277.0

34.8

25.9

129.8

38.6

327.2

427.

60.5

21.7

8.6

2016E

318.5

44.2

34.2

171.2

31.9

402.0

47

67.5

16.4

7.0

2017E

368.2

51.7

40.2

201.4

17.6

494.9

44.9

64.6

14.0

5.7

S&P CNX

8,757

HMCL IN

199.7

561.6/9.1

3,272/1,907

-13/-6/0

1,342/500

60.1

CMP: INR2,812

TP: INR3,222 (+15%)

Buy

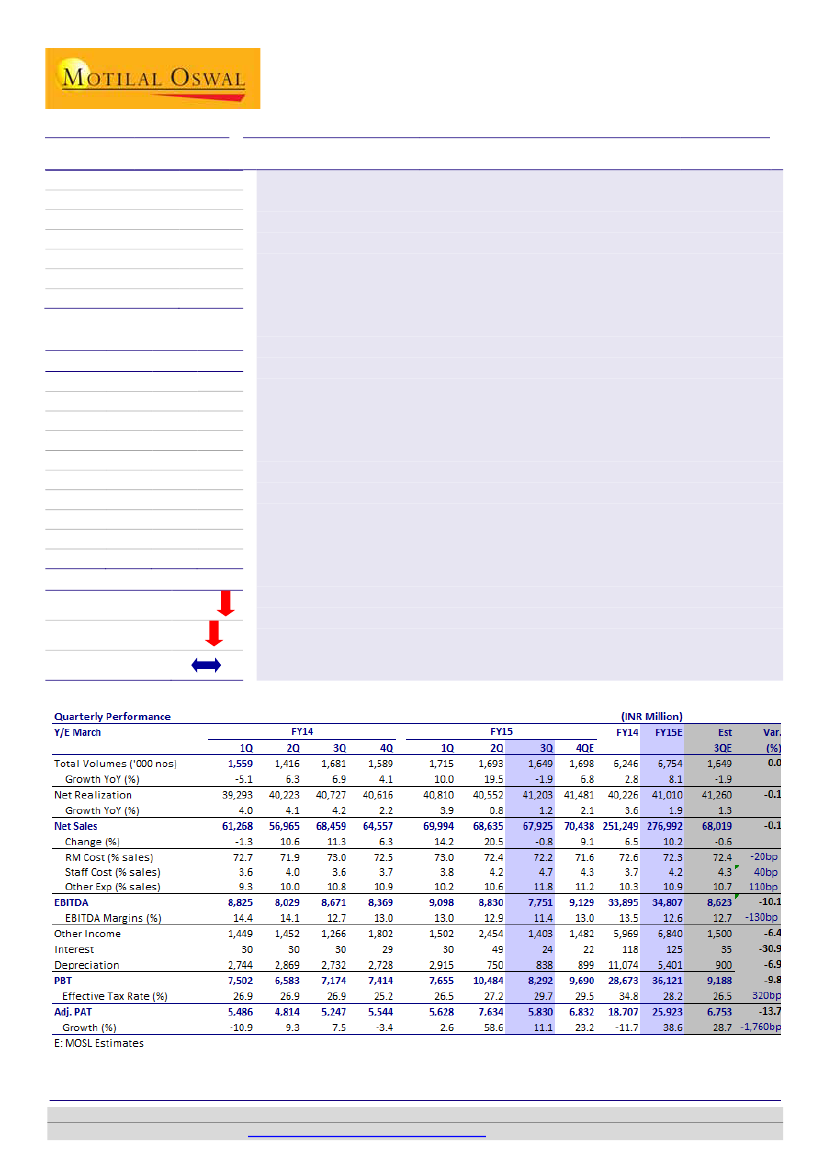

EBITDA margin of 11.4% impacted by higher publicity cost

HMCL’s 3QFY15 operating performance was disappointing, impacted by higher

publicity expenses. Impending demand recovery coincides with several new

product launches (two scooter launches in FY16) and new capacities (~2.1m by

1QFY17). Export focus would necessitate higher marketing investment in these

markets, thus impacting margins in the medium term. Cost cutting initiatives

provide option value as its efforts so far are more than negated by cost push.

Deliverance on successful new products and margins would be a key catalyst for

stock’s performance.

n

Net sales de-grew 0.8% YoY to INR67.9b (est. INR68b) on a volume growth of

-1.9% YoY (-2.6% QoQ), while realizations grew 1.2% YoY (1.6% QoQ).

n

Adj. EBITDA margin at 11.4% (v/s est. 12.7%) declined 130bp YoY (down 150bp

QoQ), impacted by one-time publicity expense of ~INR600m (~90bp) due to

bunching up of sponsorships of several events (PGA event in Orlando, Indian

Football League, World Cup Hockey etc). Staff cost was higher at ~30% YoY

(11% QoQ) to ~INR3.2b (v/s est. ~INR2.9b) due to commissioning of Neemrana

plant and Global Parts Centre.

n

Tax rate at ~29.7% (v/s est. 26.5%) was high due to higher tax on debt

investments. PAT grew by 11.1% YoY to INR5.8b (est. INR6.7b).

n

Valuation and view:

We cut the EPS estimates by 6.6%/3.1%/4.5% for

FY15E/16E/17E to INR129.8/171.2/201.4 respectively to factor in for a) higher

marketing spend especially for exports business and b) higher tax rates.. The

stock trades at 16.4x/14x FY16E/17E EPS. Maintain

Buy

with a target price of

INR3,222 (16x FY17E, in-line with LPA).

Estimate change

TP change

Rating change

7/3/5%

5%

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.