3 February 2015

3QFY15 Results Update | Sector:

Automobiles

TVS Motor Company

BSE SENSEX

29,000

Bloomberg

Equity Shares (m)

M.Cap. (INR b) / (USD b)

52-Week Range (INR)

1, 6, 12 Rel. Per (%)

Avg Val (INRm)/Vol ‘000

Free float (%)

S&P CNX

8,757

TVSL IN

475.1

135.9/2.2

322/77

3/74/216

614/3,270

42.6

CMP: INR286

n

TP: INR326 (+14%)

Buy

EBITDA margin flat at 6%; PAT restricted by lower other income

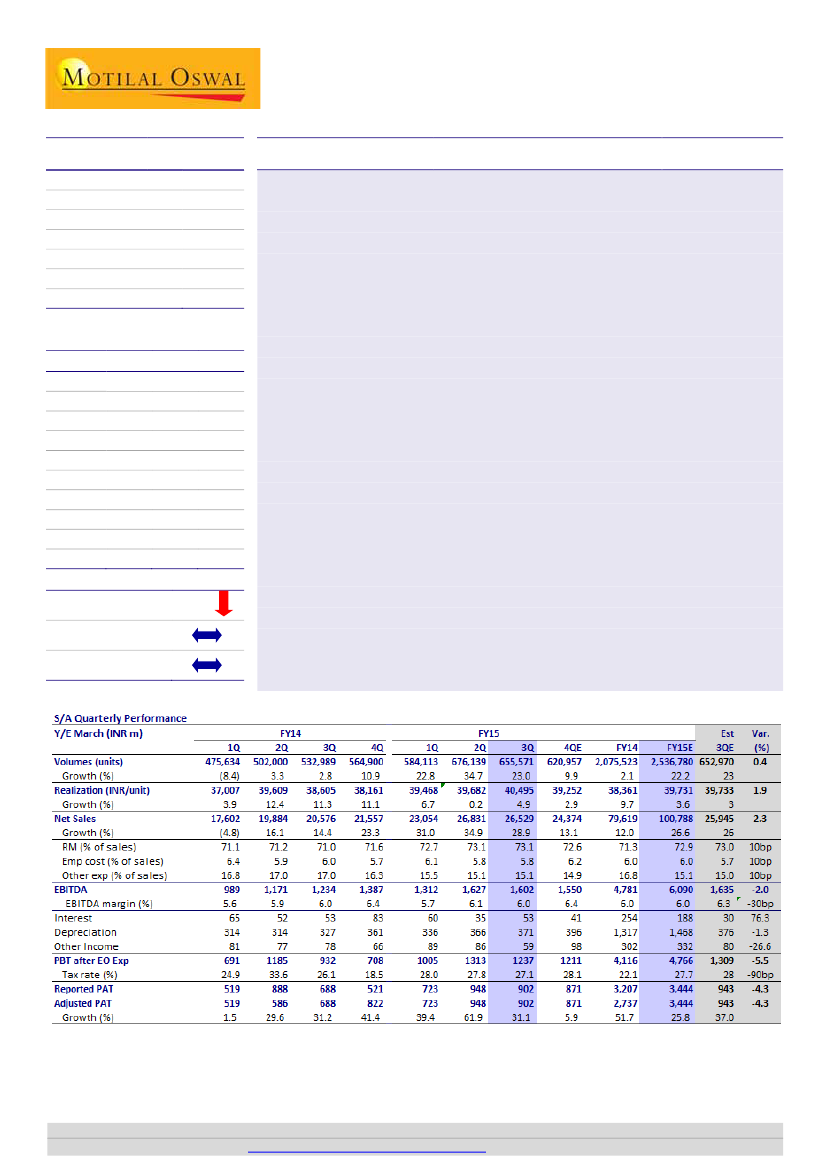

EBITDA margin flat, adj. PAT grows ~31% YoY:

TVSL 3QFY15 performance was

in line with estimates, with EBITDA at ~INR1.6b. Net sales grew 38.9% YoY (-

1.1% QoQ) to INR26.5b (est. INR25.9b) driven by volume growth of 23% YoY (-

3% QoQ) to 655,571 units (est. 653,000 units). Realizations rose by 4.9% YoY

(2% QoQ) to ~INR40,495 (v/s est. ~INR39,733), driven by higher contribution of

Motorcycles and 3Ws. EBITDA margin was flat YoY, down 10bp QoQ to 6% (v/s

est. 6.3%). PAT grew ~31% YoY (-4.9% QoQ) to ~INR902m (v/s est. ~INR943m).

Earnings call highlights:

a) Overall market share in 2Ws at 13.5%, target of

14.5% by 4QFY15, b) blended 0.2% price increase in January 2015 apart from

the excise duty hike, c) 3Q/ 9MFY15 EBITDA margin impacted by 55bp due to

provision for VAT on stock transfers, d) inventory at 28-30 days, e) rural sales to

catch up post harvesting season, f) two new motorcycle launches postponed by

3/6 month to 1Q/2QFY16 to ensure adequate supplies for recent launches, g)

capacity expansion by 5,000 units in 3Ws to 15,000 units in next six months, h)

target of 18% market share in scooters (current 14%) and 20% market share in

domestic 3Ws (in addressed segment) from current 11%, i) Excise duty increase

to boost EBITDA margins by ~0.3%, due to excise exempt plant, and j) maintains

target of EBITDA breakeven in FY16 for Indonesia business.

Valuation and view:

We lower FY15E/16E EPS by 10.9%/8.3% to

~INR7.2/INR13.3 for a) volume cut in exports and b) delay in new product

launches to 1Q/2QFY16. TVSL trades at 21.5x/15.3x FY16E/17E EPS. We value

TVSL at ~17.5x FY17E EPS (~10% premium to peers BJAUT/HMCL for very strong

EPS CAGR of 60%). Maintain

Buy

with a target price of INR326 (17.5x S/A FY17E

EPS).

Financials & Valuation (INR Billion)

Y/E Mar

Net Sales

EBITDA

Adj PAT

EPS (INR)

Gr.(%)

BV/Sh.(INR)

RoE (%)

RoCE (%)

P/E (x)

P/BV (x)

2015E

100.8

6.1

3.4

7.2

32.1

34.9

22.4

25.3

39.4

8.2

2016E

132.9

10.2

6.3

13.3

83.2

45.6

33.0

39.2

21.5

6.3

2017E

158.7

13.9

8.8

18.6

40.3

61.3

34.9

43.5

15.3

4.7

n

n

Estimate change

TP change

Rating change

11/8%

Jinesh Gandhi

(Jinesh@MotilalOswal.com); +91 22 3982 5416

Investors are advised to refer through disclosures made at the end of the Research Report.

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.