Sector Update | 4 February 2015

Technology

CTSH 4QCY14: Outlook of 14.5% CY15 CC organic growth

Could mean low-teens growth outlook by NASSCOM for FY16

4QCY14 organic revenue ahead of guidance:

CTSH’s 4QCY14 revenue grew 6.2%

QoQ to USD2.74b. This included ~USD81m from integration of TriZetto acquisition.

Excluding the same, organic revenue grew 4.2% QoQ in constant currency and 3.1%

after 110bp impact from cross currency, bettering the guidance of 1.1-2.3% QoQ.

Full year revenues grew 16.1% to USD10.26b. Excluding TriZetto, organic revenue

growth was 15.1%.

CY15 guidance of 14.5% CC organic revenue growth:

CTSH guided for CY15 revenue

growth of ‘at least’ 19%. However, adjusting for mid-single digit growth of the

acquired entity TriZetto, organic growth guidance translates to ~12.5%. This embeds

~2pp adverse impact from depreciation of global currencies. That implies organic

constant currency revenue growth guidance for CY15 of at least ~14.5%.

Flat-to-modestly-up IT budgets:

CTSH not seeing budgets declining on an overall

basis. Client budgets are flat-to-marginally up overall – in line with Gartner’s

prediction of ~2.5% increase. However, there is a clear shift within budgets.

Pressure on organizations is to get more done despite the modest increases by

driving efficiencies and effectiveness. The savings are increasingly getting invested

towards running different.

Europe macro concern is an opportunity:

The concern around macro situation in

Europe is catalyzing the environment for traditional outsourcing. Window for

outsourcing is very active right now, and the structural shift towards traditional and

multi-service large deals continues.

Low-teens growth outlook for FY16 by NASSCOM?

For FY15, NASSCOM had guided

for 13-15% growth at the beginning of the year, which was 2pp below CTSH’s

organic growth guidance of at least 16%. The gap has come down over the years.

Sticking to the trend of last couple of years would hint at low-teens FY16 CC growth

outlook for Indian IT by NASSCOM. While that does not make a case for significant

upsides, differences in execution / valuation continue to drive our bottom-up

approach to stock preferences. We prefer HCLT, INFO and TECHM in tier-I IT.

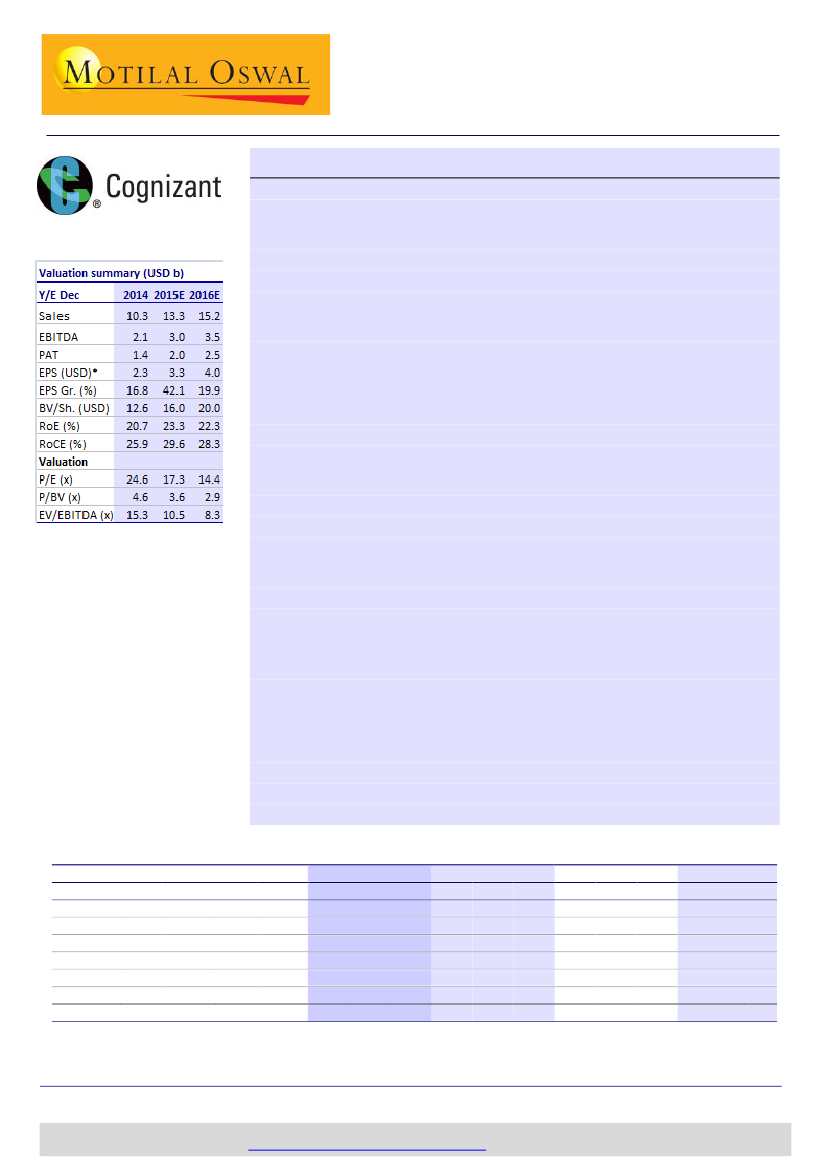

Exhibit 1: Comparative Valuation

Company

TCS

Infosys

Wipro

HCL Tech

TechM

Cognizant

Tier-I Agg

Mkt cap Rating TP (INR) Upside

EPS (INR)

P/E (x)

RoE (%)

(USD b)

(%)

FY15E FY16E FY17E FY15E FY16E FY17E FY15E FY16E

79.6 Neutral 2650

5.4

108.4 125.8 147.2 23.2

20.0

17.1

35.2

34.0

39.6

Buy

2500

16.7

108.7 120.1 137.8 19.7

17.8

15.5

26.2

24.8

24.6 Neutral

640

3.6

35.0

37.8

42.6

17.7

16.3

14.5

24.8

24.3

21.7

Buy

2150

13.1

105.5 117.0 132.5 18.0

16.2

14.3

33.3

30.7

10.8

Buy

3200

12.1

132.3 168.2 199.9 21.6

17.0

14.3

27.4

27.2

33.7 Not Rated

2.3

3.3

4.0

23.5

16.5

13.8

20.7

23.3

209.9

20.6

17.3 14.9

27.9

27.4

FY17E

32.7

24.6

23.1

29.2

26.3

22.3

26.4

Source: Company, MOSL

FY15-17E CAGR (%)

USD rev. EPS

13.7

16.5

12.3

12.6

11.4

10.3

14.4

12.0

21.2

22.9

21.8

30.5

Ashish Chopra

(Ashish.Chopra@MotilalOswal.com); +91 22 3982 5424

Siddharth Vora

(Siddharth.Vora@MotilalOswal.com); +91 22 3982 5585

4 February 2015

Investors are advised to refer through disclosures made at the end of the Research Report.

1

Motilal Oswal research is available on

www.motilaloswal.com/Institutional-Equities,

Bloomberg, Thomson Reuters, Factset and S&P Capital.