06 February 2015

3QFY15 Result Update | Sector: Capital Goods

AIA Engineering

BSE SENSEX

28718

Shares O/s (cr)

52-W H/L Range (INR)

1/6/12m Rel. Perf. (%)

Market Cap. (INR cr)

Market Cap. (US$ m)

NIFTY

8661

9.4

1229 / 520

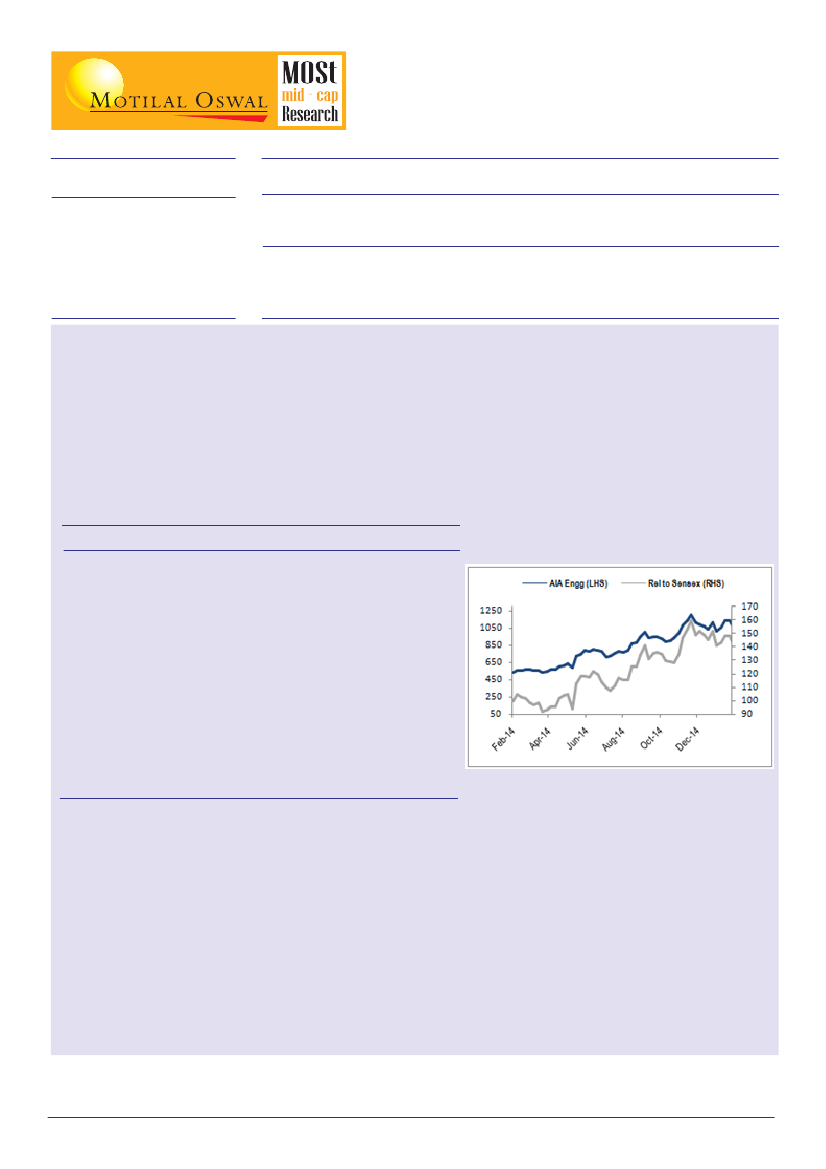

-5 /27 /63

10128

1644

CMP: INR1074

YEAR

END

SALES APAT

(INRCr) (INRCr)

325

442

504

A.EPS

(INR)

34.5

46.8

53.5

EPS

Gr.(%)

54%

36%

14%

PE

TP: INR1500

P/BV EV/EBITDA

(X)

6.0

5.0

4.1

(X)

19.8

14.5

12.5

Div yld

(%)

0.6

0.7

0.7

ROE

(%)

21.0

23.8

22.4

(X)

31.2

22.9

4.1

Buy

ROCE

(%)

25.0

27.6

26.7

FY14A 2,080

FY15E

FY16E

2,219

2,456

Result Highlights

AIA Engineering results were above our estimates.

3Q Revenues were lower by 2% on account of deferment of 12% of the production got deferred for shipment. Volumes

will be accumulated and shipped together for one large client leading to a similar deferment every quarter.

A sharp drop in raw material cost due to lower commodity prices has aided margin improvement

Other income is up sharply adding to the growth at the operating level.

The company has a net cash balance sheet (INR725cr) and proposes to use part of the cash balance to add further

capacity (INR500-550cr) over next 2 years. The greenfiled project has work started and is expected to be commissioned

in phases with 1st phase of 80-90K likely ot be commisioned in 1Q/2QFY16.

QEDec-13

526.2

406.0

120.2

13

9.3

0.5

-31.1

92.2

25.8

66.4

22.9

28.0

QESep-14

572.4

424.6

147.8

20

21.8

1.1

0.0

145.0

36.8

108.2

25.8

25.4

QEDec-14

514.3

362.1

152.2

23

18.1

0.9

0.0

156.5

41.5

115.0

29.6

26.5

% y/y

-2%

-11%

27%

82%

95%

101%

N.A.

70%

61%

73%

% q/q

-10%

-15%

3%

N.A.

-17%

-16%

N.A.

8%

13%

6%

INR Cr.

Revenue

Expenditure

EBITDA

Other Income

Depreciation

Interest

EO Items

Profit before tax

Tax

RPAT

EBIDTA (%)

Tax rate (%)

Valuation and view

Our rationale for positive view on AIA Engineering is:

AIA Engineering Limited (AIA) operates in the Industrial consumables space and manufactures mill internal products used by

cement, mining and utility industries.

The mill internals industry for mining and cement is estimated at 3 million tonnes globally with a value of $5Billion. At 2.6 Lakh tonne

of capacity, AIA still has scope to improve its share of its customers’ needs.

We estimate AIA's overall volume growth during FY14-FY16E to be 11% with mining volumes rising 18%.

We expect AIA to move now in line with earnings growth of 20% CAGR over FY14-FY17E and recommend investors

to Accumulate for a revised target of INR1500 - 25xFY17E EPS.

A commodity price meltdown would impact customer earnings and is a risk for AIA Engineering as mining is a key

focus area. The company remains confident that the current commodity price fall will not impact its revenue prospects.

Ravi Shenoy

(ravi.shenoy@MotilalOswal.com); Tel: +91 22 30896865